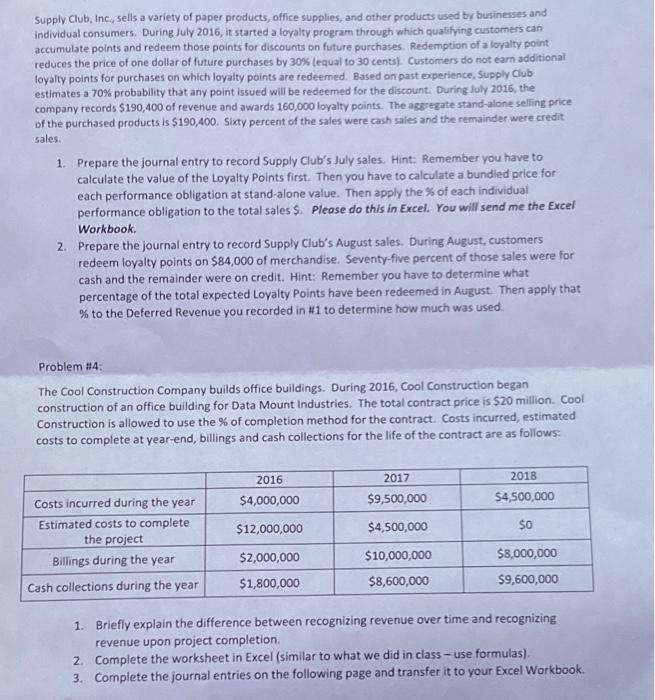

Supply Club, Inc, sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During fuly 2016 , it started a lovalty program through which quatifying customers can accumulate points and redeem those points for discounts on future purchases. Redemption of a loralty point reduces the price of one dollar of future purchases by 300 (equal to 30 cents). Customers do not earn additional. loyalty points for purchases on which loyalty points are redeemed. Based on past experience, Supply Club estimates a 70% probability that any point issued will be redeemed for the discount During fufy 2016 , the company records $190,400 of revenue and awards 160,000 loyalty points. The apgregate stand-alone selling price of the purchased products is $190,400. Sicty percent of the sales were cash sales and the remainder were credit sales. 1. Prepare the journal entry to record Supply Club's July sales. Hint: Remember you have to calculate the value of the Loyalty Points first. Then you have to calculate a bundled price for each performance obligation at stand-alone value. Then apply the % of each individual performance obligation to the total sales $. Please do this in Excel. You will send me the Excel Workbook. 2. Prepare the journal entry to record Supply Club's August sales. During August, customers redeem loyalty points on $84,000 of merchandise. Seventy-five percent of those sales were for cash and the remainder were on credit. Hint: Remember you have to determine what percentage of the total expected Loyalty Points have been redeemed in August. Then apply that % to the Deferred Revenue you recorded in \#1 to determine how much was used. Problem \#4: The Cool Construction Company builds office buildings. During 2016, Cool Construction began construction of an office building for Data Mount Industries. The total contract price is $20 million. Cool Construction is allowed to use the % of completion method for the contract. Costs incurred, estimated costs to complete at year-end, billings and cash collections for the life of the contract are as follows: 1. Briefly explain the difference between recognizing revenue over time and recognizing revenue upon project completion. 2. Complete the worksheet in Excel (similar to what we did in class - use formulas). 3. Complete the journal entries on the following page and transfer it to your Excel Workbook