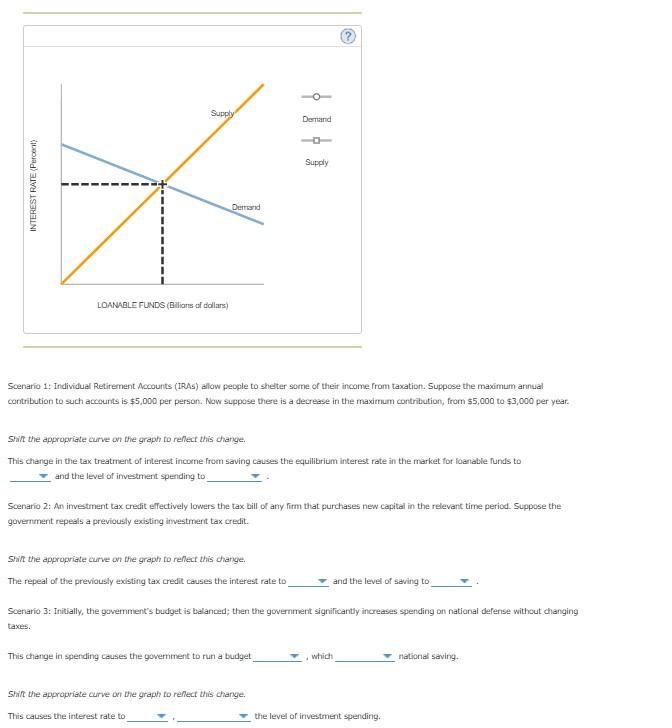

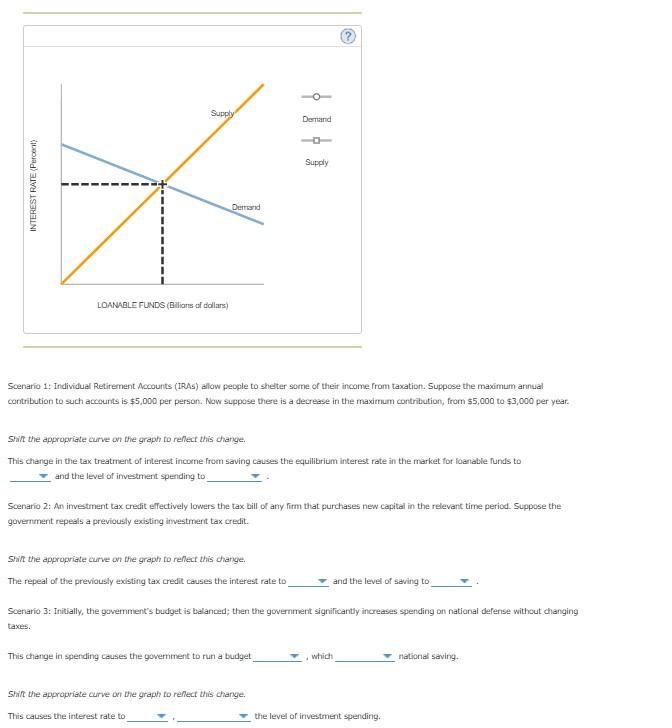

Supply Demand Supply INTEREST RATE (Percent) Demand LOANABLE FUNDS (Bilions of dollars) Scenario 1: Individual Retirement Accounts (TRA) aliow people to shelter some of their income from taxation. Suppose the maximum annual contribution to such accounts is $5,000 per person. Now suppose there is a decrease in the maximum contribution, from $5,000 to $3,000 per year. Start the appropriate curve on the graph to reflect this change. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for foanable funds to and the level of investment spending to Scenario 2: An investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. Suppose the government repeals a previously existing investment tax credit Start the appropriate curve on the graph to reflect this charge.. The repeal of the previously existing tax credit causes the interest rate to and the level of saving to Scenario 3: Initially, the government's budget is balanced, then the government significantly increases spending on national defense without changing taxes. This change in spending causes the government to run a budget which national Saving. Start the appropriate curve on the graph to reflect this change, This causes the interest rate to the level of investment spending. Supply Demand Supply INTEREST RATE (Percent) Demand LOANABLE FUNDS (Bilions of dollars) Scenario 1: Individual Retirement Accounts (TRA) aliow people to shelter some of their income from taxation. Suppose the maximum annual contribution to such accounts is $5,000 per person. Now suppose there is a decrease in the maximum contribution, from $5,000 to $3,000 per year. Start the appropriate curve on the graph to reflect this change. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for foanable funds to and the level of investment spending to Scenario 2: An investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. Suppose the government repeals a previously existing investment tax credit Start the appropriate curve on the graph to reflect this charge.. The repeal of the previously existing tax credit causes the interest rate to and the level of saving to Scenario 3: Initially, the government's budget is balanced, then the government significantly increases spending on national defense without changing taxes. This change in spending causes the government to run a budget which national Saving. Start the appropriate curve on the graph to reflect this change, This causes the interest rate to the level of investment spending