Answered step by step

Verified Expert Solution

Question

1 Approved Answer

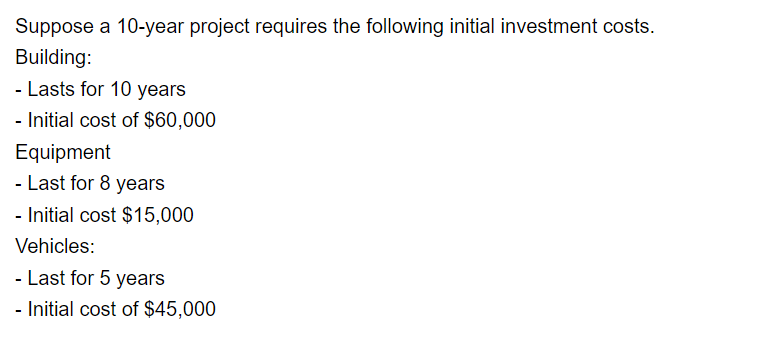

Suppose a 10 -year project requires the following initial investment costs. Building: - Lasts for 10 years - Initial cost of $60,000 Equipment - Last

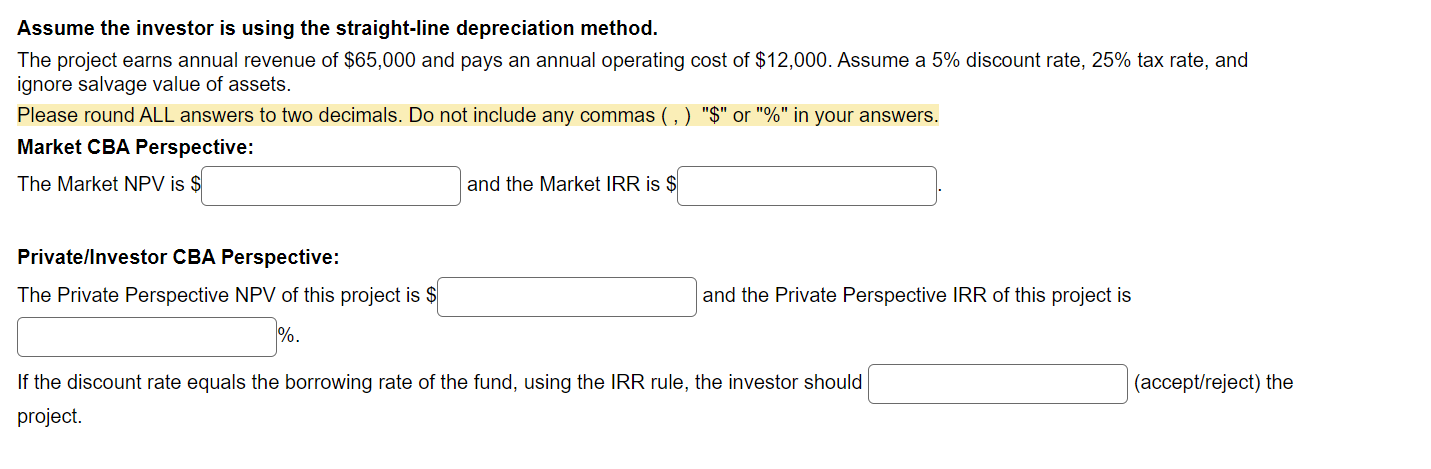

Suppose a 10 -year project requires the following initial investment costs. Building: - Lasts for 10 years - Initial cost of $60,000 Equipment - Last for 8 years - Initial cost $15,000 Vehicles: - Last for 5 years - Initial cost of $45,000 Assume the investor is using the straight-line depreciation method. The project earns annual revenue of $65,000 and pays an annual operating cost of $12,000. Assume a 5% discount rate, 25% tax rate, and ignore salvage value of assets. Please round ALL answers to two decimals. Do not include any commas (, ) "\$" or "\%" in your answers. Market CBA Perspective: The Market NPV is $ and the Market IRR is \$ Private/lnvestor CBA Perspective: The Private Perspective NPV of this project is $ and the Private Perspective IRR of this project is %. If the discount rate equals the borrowing rate of the fund, using the IRR rule, the investor should (accept/reject) the project

Suppose a 10 -year project requires the following initial investment costs. Building: - Lasts for 10 years - Initial cost of $60,000 Equipment - Last for 8 years - Initial cost $15,000 Vehicles: - Last for 5 years - Initial cost of $45,000 Assume the investor is using the straight-line depreciation method. The project earns annual revenue of $65,000 and pays an annual operating cost of $12,000. Assume a 5% discount rate, 25% tax rate, and ignore salvage value of assets. Please round ALL answers to two decimals. Do not include any commas (, ) "\$" or "\%" in your answers. Market CBA Perspective: The Market NPV is $ and the Market IRR is \$ Private/lnvestor CBA Perspective: The Private Perspective NPV of this project is $ and the Private Perspective IRR of this project is %. If the discount rate equals the borrowing rate of the fund, using the IRR rule, the investor should (accept/reject) the project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started