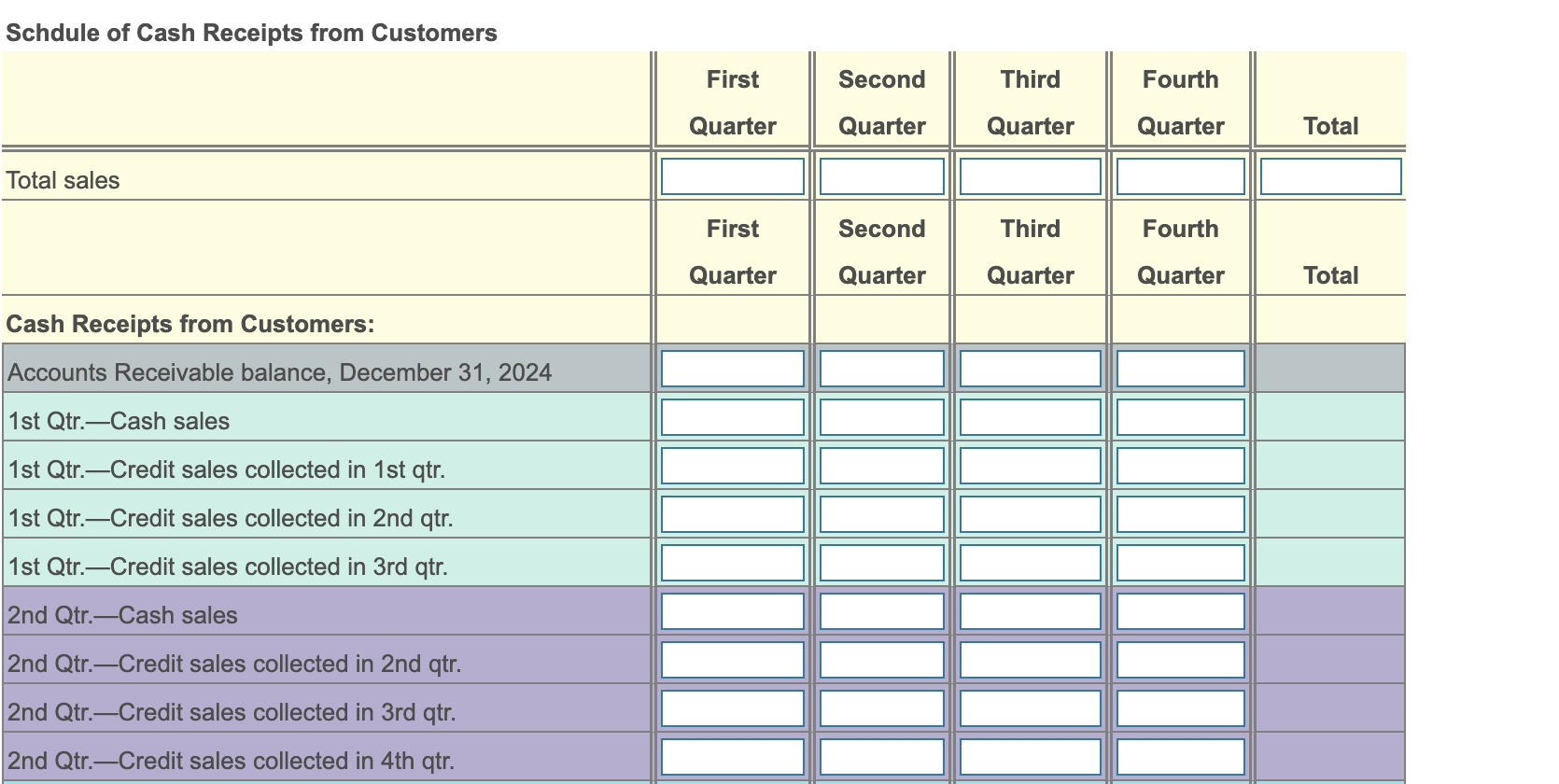

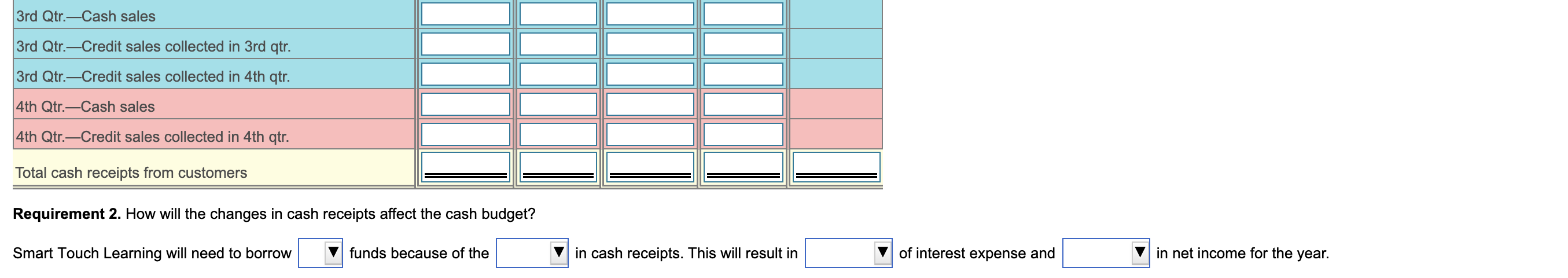

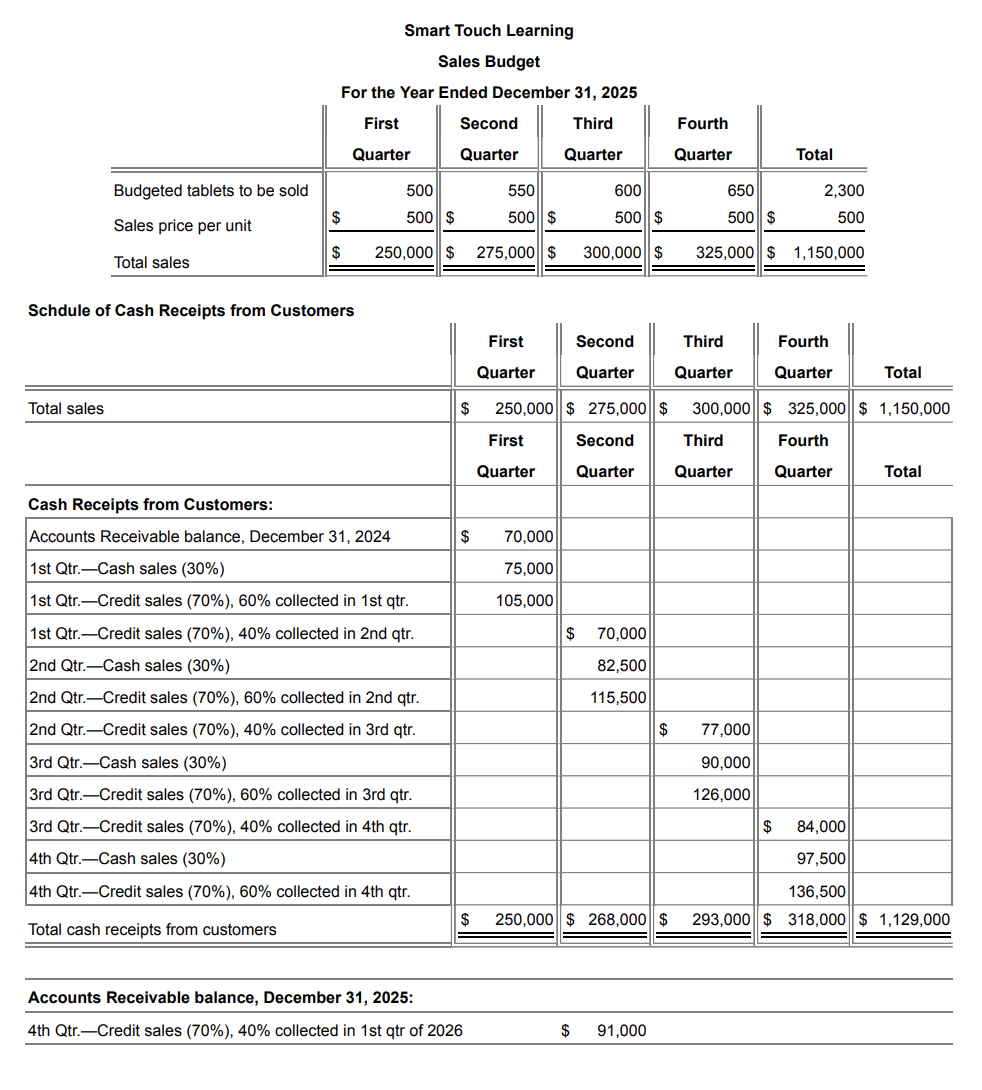

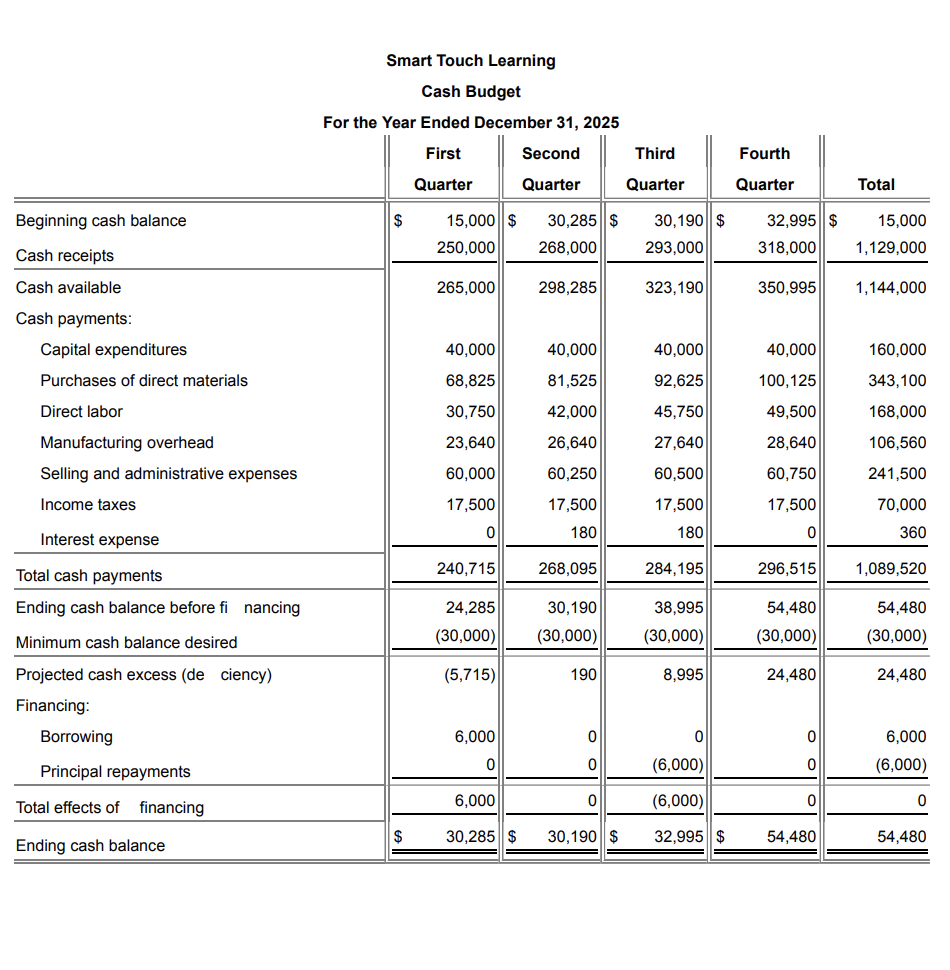

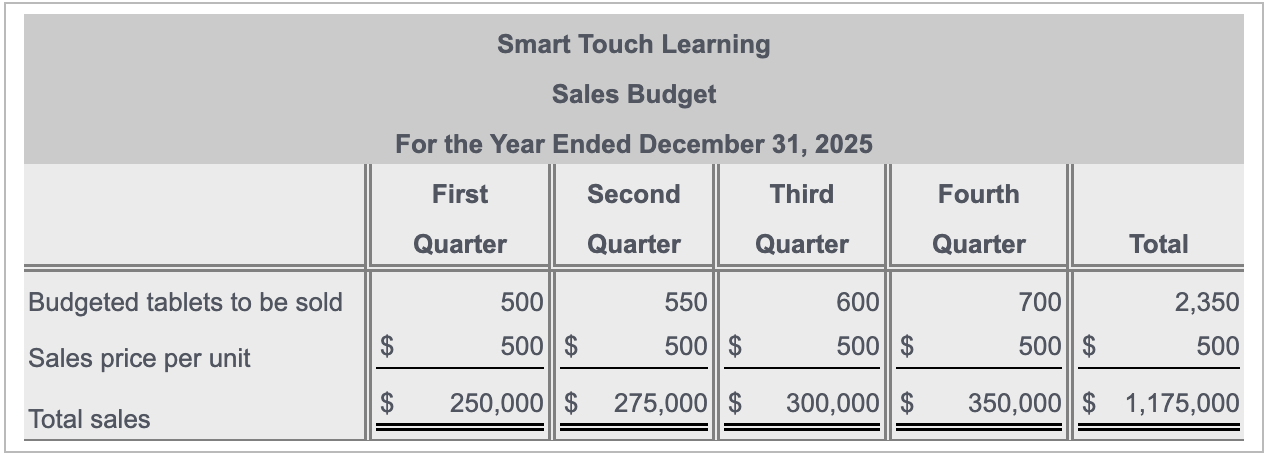

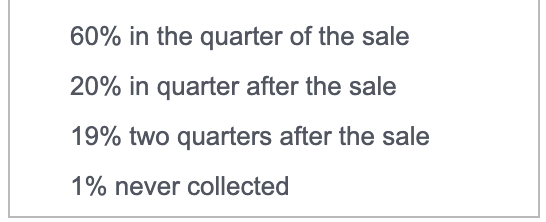

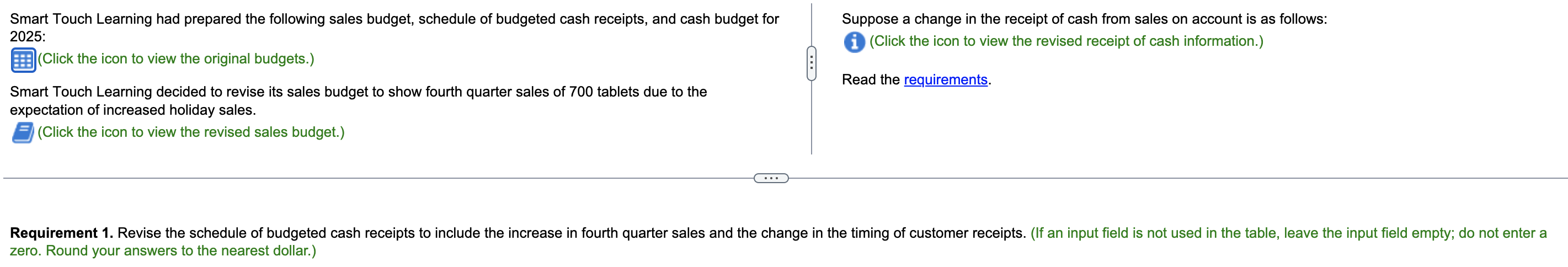

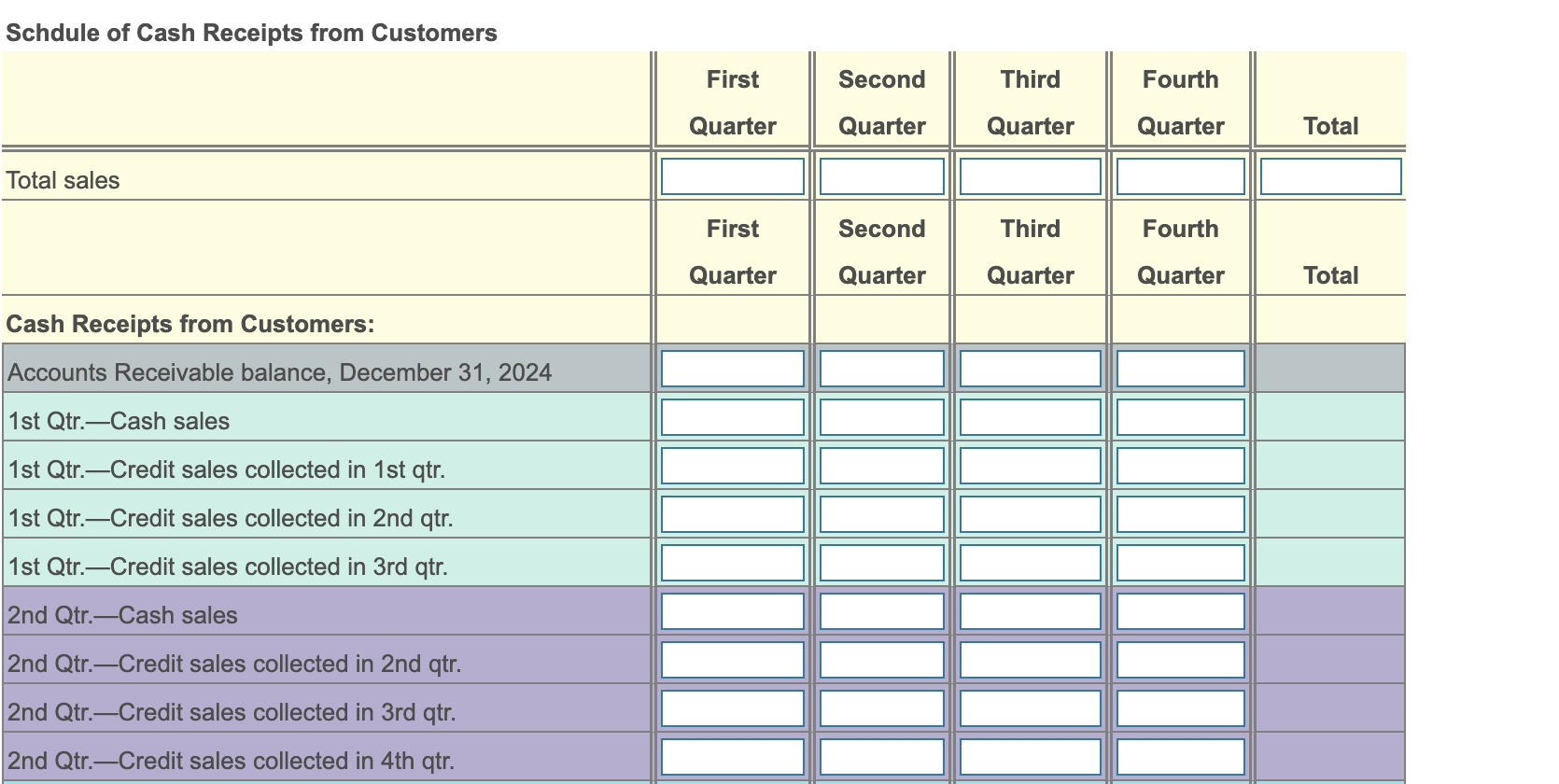

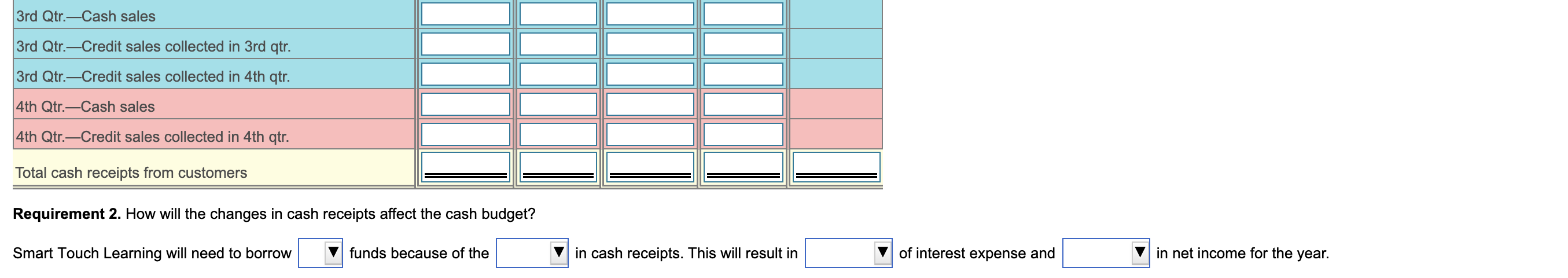

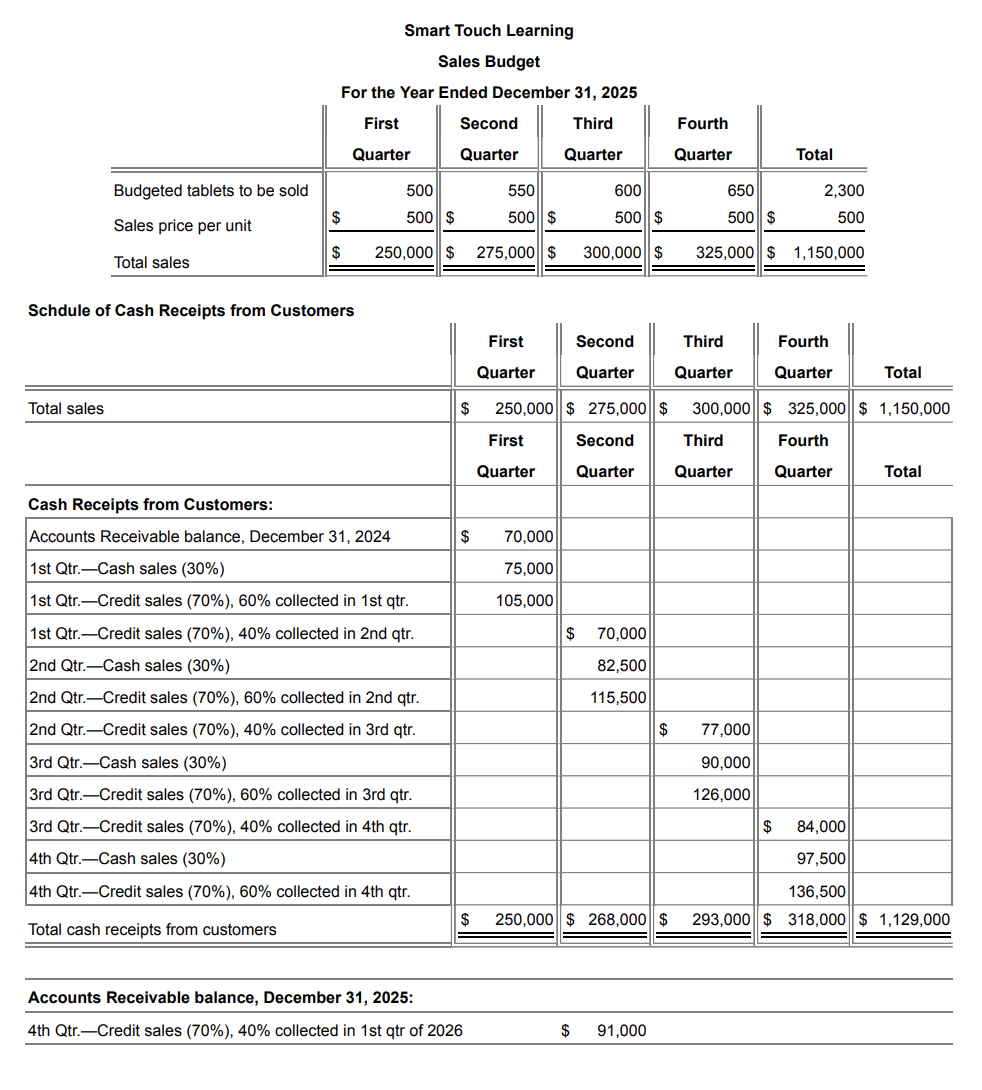

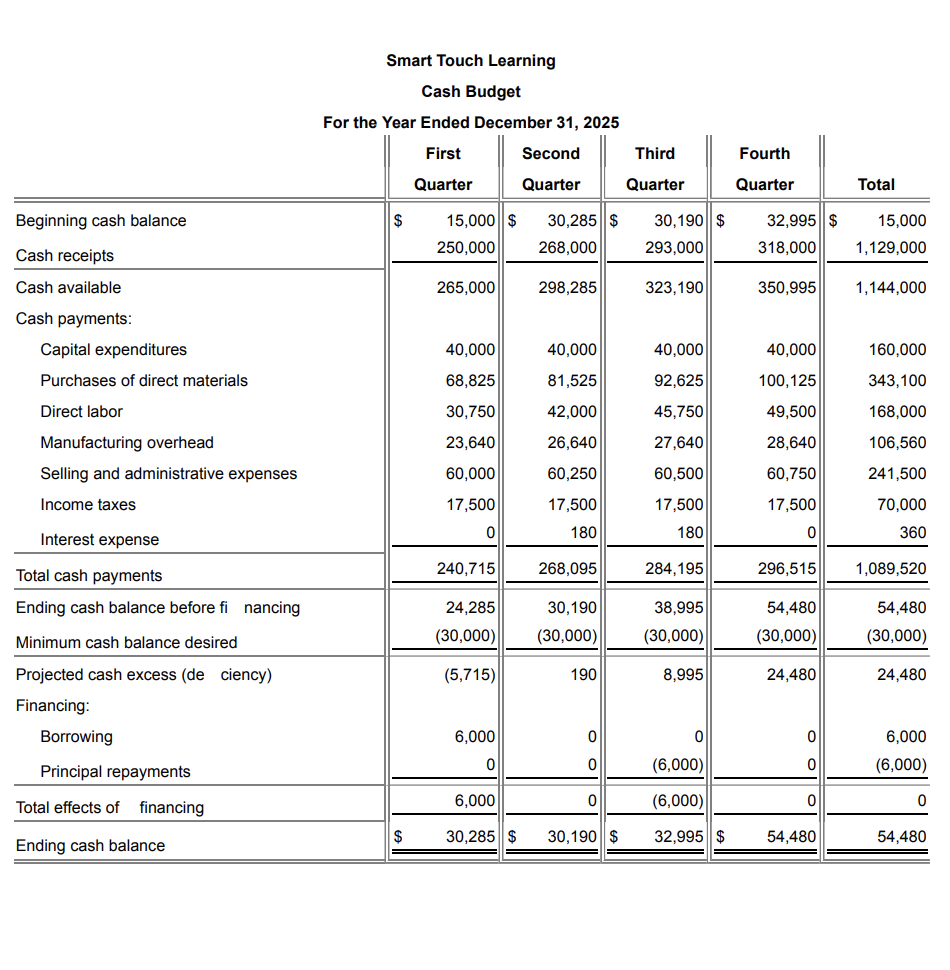

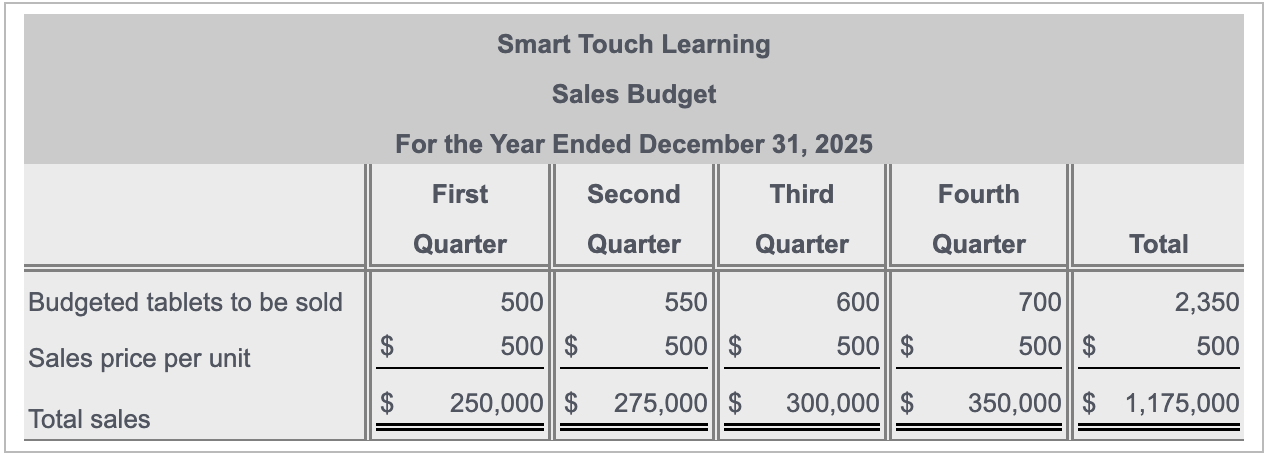

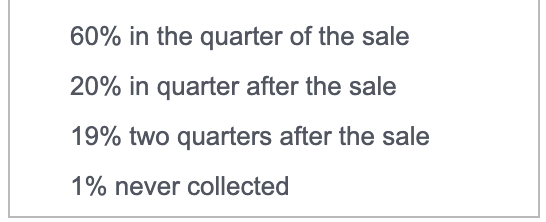

Suppose a change in the receipt of cash from sales on account is as follows: (Click the icon to view the revised receipt of cash information.) In Smart Touch Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2025: B Click the icon to view the original budgets.) Smart Touch Learning decided to revise its sales budget to show fourth quarter sales of 700 tablets due to the expectation of increased holiday sales. (Click the icon to view the revised sales budget.) Read the requirements. Requirement 1. Revise the schedule of budgeted cash receipts to include the increase in fourth quarter sales and the change in the timing of customer receipts. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Round your answers to the nearest dollar.) Schdule of Cash Receipts from Customers First Second Third Fourth Quarter Quarter Quarter Quarter Total Total sales First Second Third Fourth Quarter Quarter Quarter Quarter Total Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 1st Qtr.Cash sales 1st Qtr. Credit sales collected in 1st qtr. 1st Qtr.Credit sales collected in 2nd qtr. 1st Qtr.Credit sales collected in 3rd qtr. 2nd Qtr.Cash sales 2nd Qtr.Credit sales collected in 2nd qtr. 2nd Qtr.Credit sales collected in 3rd qtr. 2nd Qtr.Credit sales collected in 4th qtr. 3rd Qtr.Cash sales 3rd Qtr.Credit sales collected in 3rd qtr. 3rd Qtr.Credit sales collected in 4th qtr. 4th Qtr.Cash sales 4th Qtr.Credit sales collected in 4th qtr. Total cash receipts from customers Requirement 2. How will the changes in cash receipts affect the cash budget? Smart Touch Learning will need to borrow funds because of the in cash receipts. This will result in of interest expense and in net income for the year. Smart Touch Learning Sales Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Budgeted tablets to be sold 650 500 500 $ 550 500||$ 600 500 $ 2,300 500 $ 500 $ Sales price per unit $ 250,000 $ 275,000||$ 300,000||$ 325,000 $ 1,150,000 Total sales Schdule of Cash Receipts from Customers First Second Third Fourth Quarter Quarter Quarter Quarter Total Total sales $ 250,000 $ 275,000 $ 300,000||$ 325,000||$ 1,150,000 First Second Third Fourth Quarter Quarter Quarter Quarter Total Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 $ 70,000 1st Qtr.-Cash sales (30%) 75,000 105,000 1st Qtr.-Credit sales (70%), 60% collected in 1st qtr. 1st Qtr.Credit sales (70%), 40% collected in 2nd qtr. 2nd Qtr.-Cash sales (30%) $ 70,000 82,500 115,500 $ 77,000 90,000 2nd Qtr.-Credit sales (70%), 60% collected in 2nd qtr. 2nd Qtr.Credit sales (70%), 40% collected in 3rd qtr. 3rd Qtr.Cash sales (30%) 3rd Qtr.-Credit sales (70%), 60% collected in 3rd qtr. 3rd Qtr.-Credit sales (70%), 40% collected in 4th qtr. 4th Qtr.-Cash sales (30%) 126.000 $ 84,000 97,500 4th Qtr.Credit sales (70%), 60% collected in 4th qtr. 136,500 293,000 $ 318,000 $ 1,129,000 $ 250,000 $ 268,000 $ Total cash receipts from customers Accounts Receivable balance, December 31, 2025: 4th Qtr.Credit sales (70%), 40% collected in 1st qtr of 2026 $ 91,000 Smart Touch Learning Cash Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Beginning cash balance $ 30.190||$ 15,000 || $ 250,000 30,285 || $ 268,000 32,995 || $ 318,000 15,000 1,129,000 Cash receipts 293,000 Cash available 265,000 298,285 323,190 350,995 1,144,000 Cash payments: Capital expenditures Purchases of direct materials 40,000 40,000 40,000 40,000 160,000 68,825 81,525 92,625 100,125 343,100 Direct labor 30,750 42,000 45,750 49,500 168,000 23,640 26,640 27,640 28,640 106,560 Manufacturing overhead Selling and administrative expenses Income taxes 60,000 60,250 60,500 60,750 241,500 17,500 17,500 70,000 17,500 180 17,500 180 0 0 Interest expense 360 Total cash payments 240,715 268,095 284,195 296,515 1,089,520 Ending cash balance before financing 54,480 24,285 (30,000) 30,190 (30,000) 38,995 (30,000) 54,480 (30,000) Minimum cash balance desired (30,000) (5,715) 190 8,995 24,480 24,480 Projected cash excess (de ciency) Financing: Borrowing 6,000 0 oa 0 oloo 6,000 (6,000) Principal repayments (6,000) ooo 0 Total effects of financing 6,000 (6,000) 0 $ 30,285$ Ending cash balance 30,190$ 54,480 32,995$ 54,480 Smart Touch Learning Sales Budget For the Year Ended December 31, 2025 First Second Third Quarter Quarter Quarter Fourth Quarter Total Budgeted tablets to be sold 500 550 600 700 2,350 $ 500 || $ 500 || $ 500||$ 500|| $ 500 Sales price per unit $ 250,000||$ 275,000||$ 300,000||$ 350,000|| $ 1,175,000 Total sales 60% in the quarter of the sale 20% in quarter after the sale 19% two quarters after the sale 1% never collected