Answered step by step

Verified Expert Solution

Question

1 Approved Answer

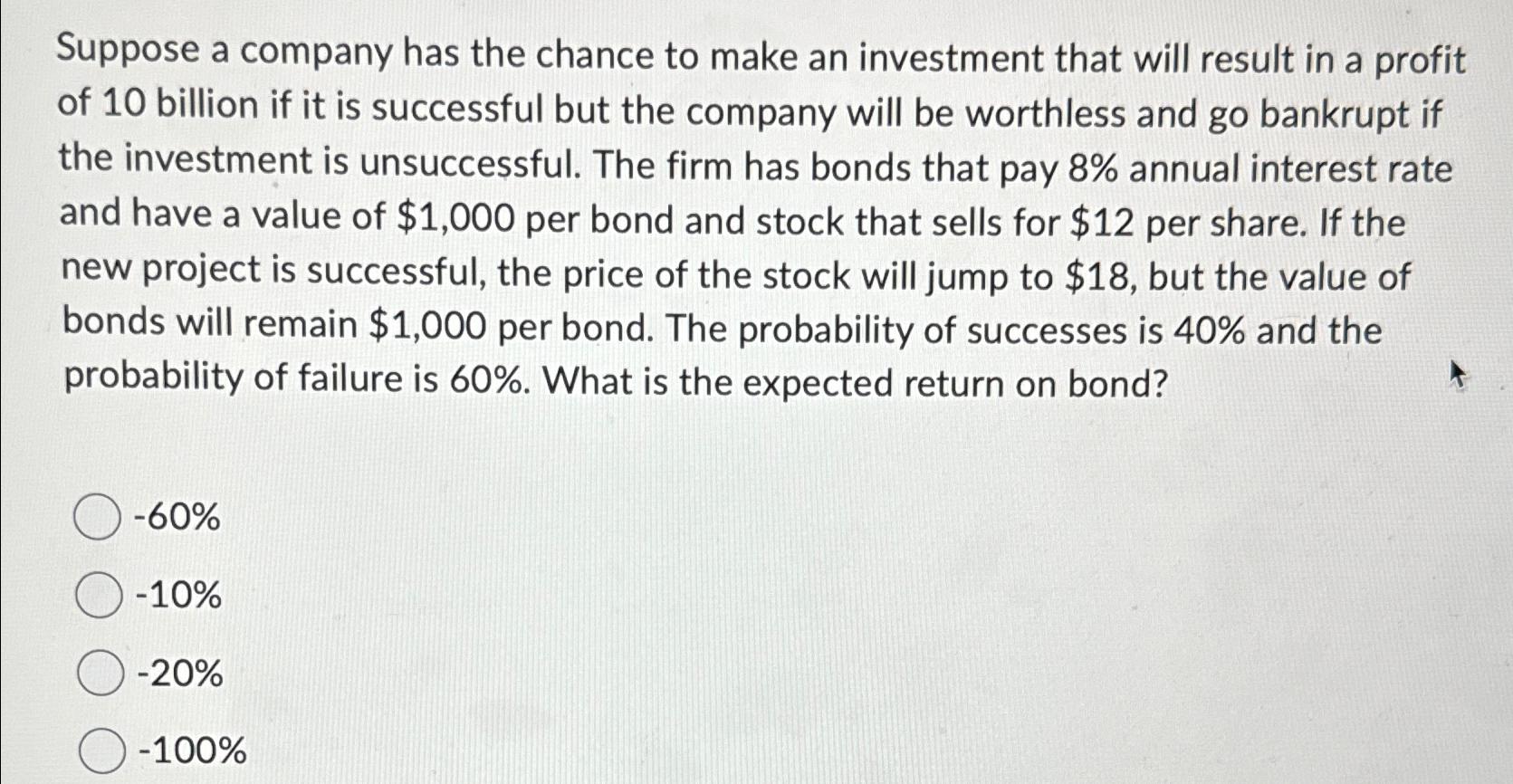

Suppose a company has the chance to make an investment that will result in a profit of 1 0 billion if it is successful but

Suppose a company has the chance to make an investment that will result in a profit of billion if it is successful but the company will be worthless and go bankrupt if the investment is unsuccessful. The firm has bonds that pay annual interest rate and have a value of $ per bond and stock that sells for $ per share. If the new project is successful, the price of the stock will jump to $ but the value of bonds will remain $ per bond. The probability of successes is and the probability of failure is What is the expected return on bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started