Question

Suppose a computer software developer for a certain company purchased a computer system for $65,000 on April 27, 2017. The computer system is used for

Suppose a computer software developer for a certain company purchased a computer system for $65,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $30,000 Section 179 deduction, and the asset qualified for a special depreciation allowance.

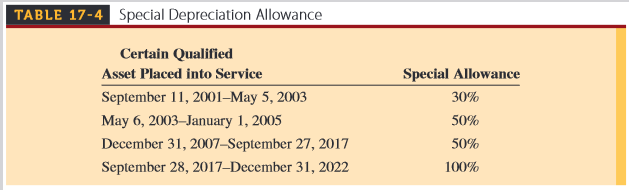

What was the basis for depreciation (in $) of the computer system?(See Table 17-4.)

$_____________

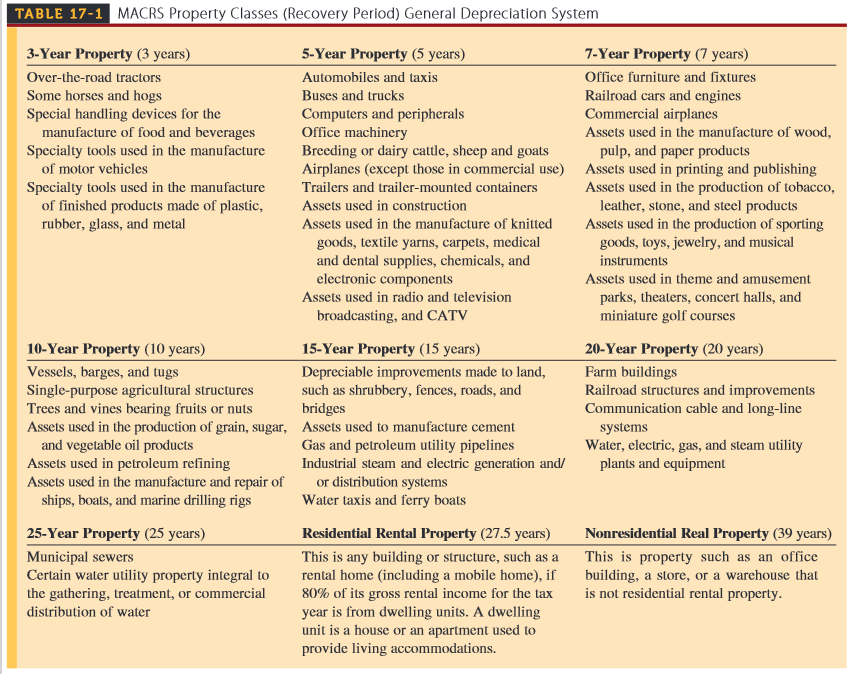

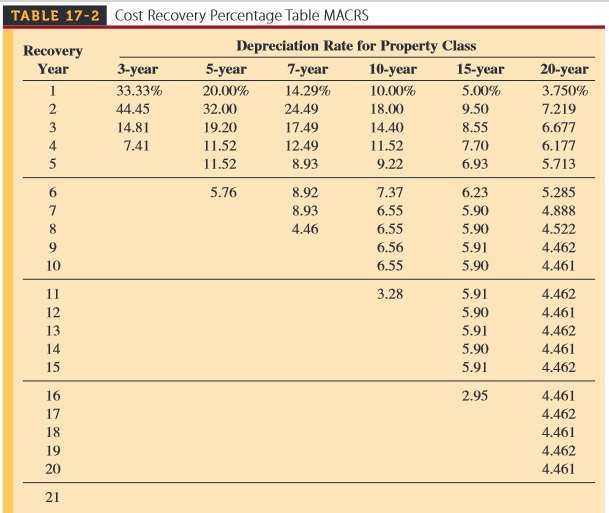

What was the amount (in $) of the first year's depreciation using MACRS? (See Table 17-1 and Table 17-2)

$ ______________________

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(Please keep them in the graph below so it is easy to understand thanks)

Sara Industries purchased a metal-working lathe for $36,000. This item will be used for business 90% of the time. Accountants elected to take a $15,000 section 179 deduction and utilize the special depreciation allowance of 50%.

Prepare a depreciation schedule (in $) using MACRS.

Round all dollar amounts to the nearest cent.

| End of Year | Basis for Depreciation | Recovery Percent | = | MACRS Depreciation Deduction | Accumulated Depreciation | Book Value | |

|---|---|---|---|---|---|---|---|

| $ | |||||||

| 1 | $ | 33.33% | = | $ | $ | $ | |

| 2 | $ | 44.45% | = | $ | $ | $ | |

| 3 | $ | 14.81% | = | $ | $ | $ | |

| 4 | $ | 7.41% | = | $ | $ | $ | |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started