Answered step by step

Verified Expert Solution

Question

1 Approved Answer

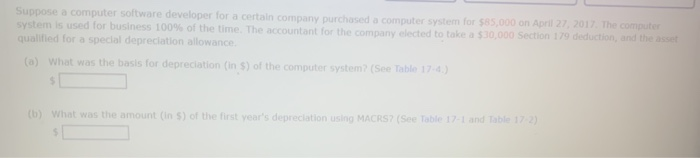

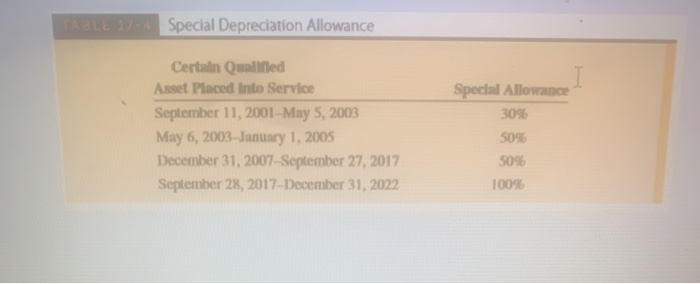

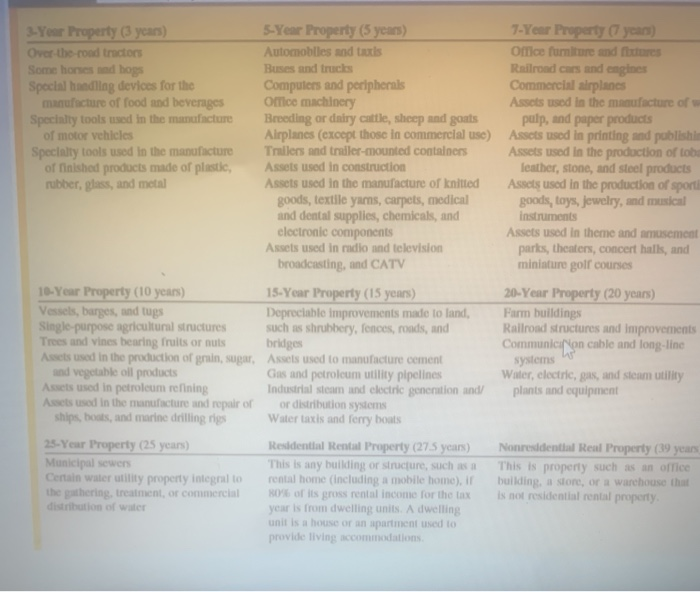

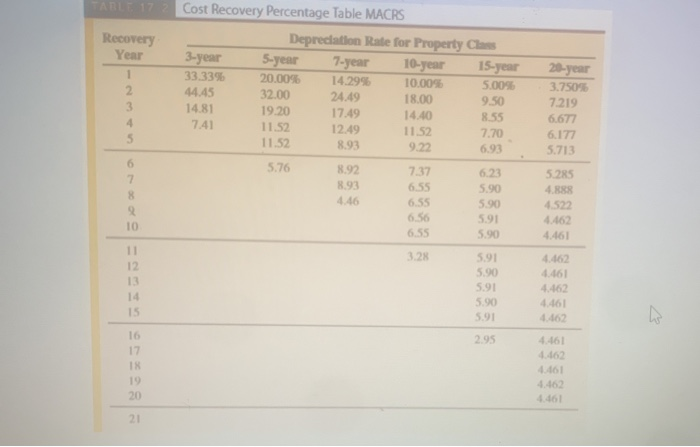

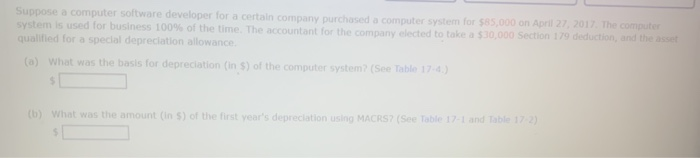

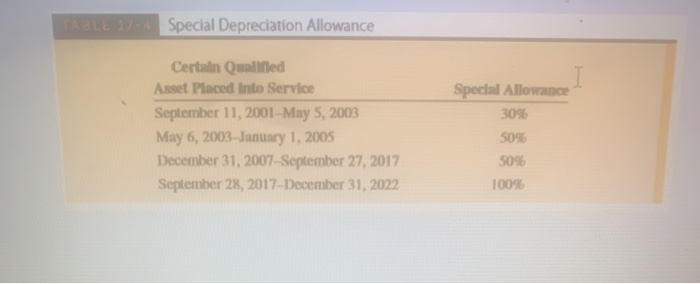

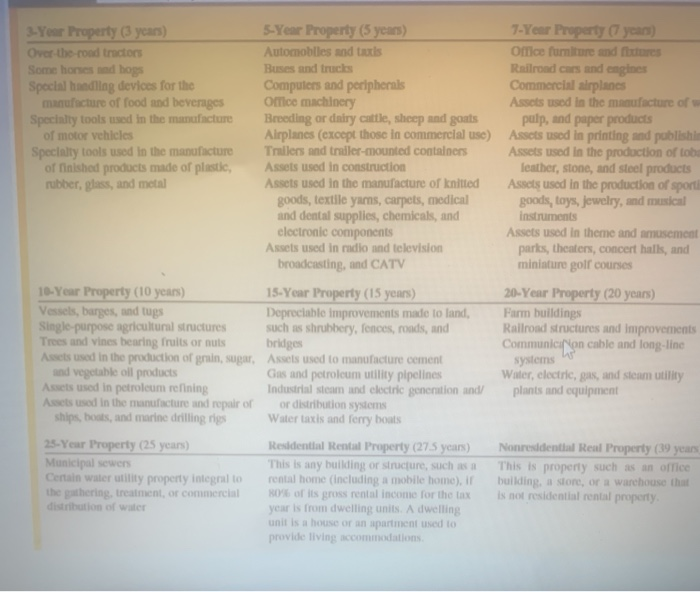

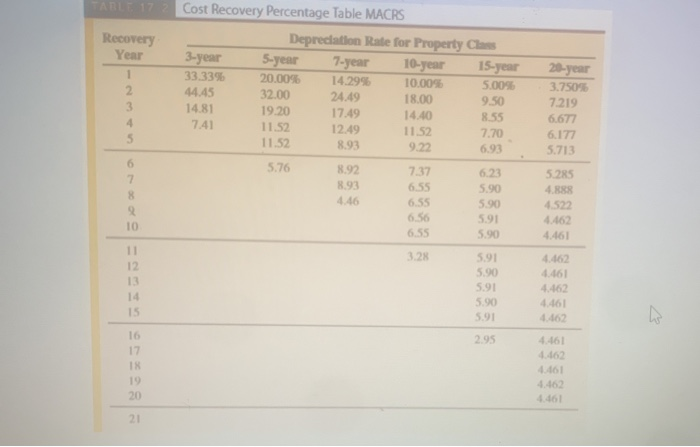

Suppose a computer software developer for a certain company purchased a computer system for $85,000 on April 27, 2017. The computer system is used for

Suppose a computer software developer for a certain company purchased a computer system for $85,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $10,000 Section 179 deduction and the qualified for a special depreciation allowance (a) What was the basis for depreciation (In S) of the computer system (See Table 17 d) (6) What was the amount (ins) of the first year's depreciation using MACRS? (See Table 17-1 and table 12) ABLE 11-Special Depreciation Allowance Certain Qualified Asset Placed Into Service September 11, 2001-May 5, 2003 May 6, 2003-January 1, 2005 December 31, 2007 September 27, 2017 September 28, 2017December 31, 2022 Special Allowance 30% 5056 509 100% 3-Year Property (3 years) 5-Year Property (5 years) 7-Year Property (years) Over the road tractors Automobiles and taxis Once furniture and futures Some hones and hops Buses and trucks Railroad cars and engines Special edilng devices for the Computers and peripherals Commercial sirplanes manufacture of food and beverages Orice machinery Assets used in the manufacture of Specialty tools used in the manufacture Breeding or dairy cattle, sheep and goats pulp, and paper products of motor vehicles Airplanes (except those in commercial use) Assets used in printing and publishi Specialty tools used in the manufacture Trailers and trailer-mounted containers Assets used in the production of toba of finished products made of plastic, Assets used in construction leather, stone, and steel products rubber, glass, and metal Assets used in the manufacture of knitted Assets used in the production of sport goods, textile yarns, carpets, medical goods, toys, jewelry, and musical and dental supplies, chemicals, and Instruments electronic components Assets used in theme and amusement Assets used in radio and television parks, theaters, concert halls, and broadcasting, and CATV miniature golf courses 10-Year Property (10 years) 15-Year Property (15 years) 20-Year Property (20 years) Vessels, barges, and tugs Depreciable improvements made to land, Farm buildings Single-purpose agricultural structures such as shrubbery, fences, roads, and Railroad structures and improvements Trees and vines bearing fruits or nuts bridges Communicaron cable and long-ling Assets used in the production of grain, sugar. Assets used to manufacture cement systems and vegetable oil products Gas and petroleum utility pipelines Water, electric, gas, and steam utility Assets used in petroleum relining Industrial steam and electric generation and plants and equipment Assets used in the manufacture and repair or or distribution systems ships, bools, and marine drilling rigs Water taxis and ferry boats 25-Year Property (25 years) Residential Rental Property (27.5 years) Nonresidential Real Property (39 years Municipal sewers This is any building or structure, such as a This is property such as an orice Certain water utility property integral to rental home (including a mobile home), in building, a store, or a warehouse that the gathering, treatment, or commercial 80% of its gross rental income for the tax is not residential rental property. year is from dwelling units. A dwelling unit is a house or an apartment used to provide living accommodations Recovery Year Cost Recovery Percentage Table MACRS Depreciation Rate for Property Class 3-year 5-year 7-year 10-year 15-year 33.3390 20.0096 14.2996 10.000 5.00% 44.45 32.00 24.49 18.00 9.50 14.81 19.20 17.49 14.40 8.55 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 2 3 4 5 20-year 3.750 7.219 6.677 6.177 5.713 5.76 6 7 X 2 10 8.92 8.93 4.46 5.285 4.88 7.37 6.55 6.55 6.50 6.55 6.23 5.90 5.90 5.91 5.90 4.461 3.28 12 13 5.91 5.90 5.91 5.90 5.91 4.462 4161 4.462 15 1.162 16 2.95 12 18 19 20 4.-161 1407 4.46 4.462 4.461 21

Suppose a computer software developer for a certain company purchased a computer system for $85,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $10,000 Section 179 deduction and the qualified for a special depreciation allowance (a) What was the basis for depreciation (In S) of the computer system (See Table 17 d) (6) What was the amount (ins) of the first year's depreciation using MACRS? (See Table 17-1 and table 12) ABLE 11-Special Depreciation Allowance Certain Qualified Asset Placed Into Service September 11, 2001-May 5, 2003 May 6, 2003-January 1, 2005 December 31, 2007 September 27, 2017 September 28, 2017December 31, 2022 Special Allowance 30% 5056 509 100% 3-Year Property (3 years) 5-Year Property (5 years) 7-Year Property (years) Over the road tractors Automobiles and taxis Once furniture and futures Some hones and hops Buses and trucks Railroad cars and engines Special edilng devices for the Computers and peripherals Commercial sirplanes manufacture of food and beverages Orice machinery Assets used in the manufacture of Specialty tools used in the manufacture Breeding or dairy cattle, sheep and goats pulp, and paper products of motor vehicles Airplanes (except those in commercial use) Assets used in printing and publishi Specialty tools used in the manufacture Trailers and trailer-mounted containers Assets used in the production of toba of finished products made of plastic, Assets used in construction leather, stone, and steel products rubber, glass, and metal Assets used in the manufacture of knitted Assets used in the production of sport goods, textile yarns, carpets, medical goods, toys, jewelry, and musical and dental supplies, chemicals, and Instruments electronic components Assets used in theme and amusement Assets used in radio and television parks, theaters, concert halls, and broadcasting, and CATV miniature golf courses 10-Year Property (10 years) 15-Year Property (15 years) 20-Year Property (20 years) Vessels, barges, and tugs Depreciable improvements made to land, Farm buildings Single-purpose agricultural structures such as shrubbery, fences, roads, and Railroad structures and improvements Trees and vines bearing fruits or nuts bridges Communicaron cable and long-ling Assets used in the production of grain, sugar. Assets used to manufacture cement systems and vegetable oil products Gas and petroleum utility pipelines Water, electric, gas, and steam utility Assets used in petroleum relining Industrial steam and electric generation and plants and equipment Assets used in the manufacture and repair or or distribution systems ships, bools, and marine drilling rigs Water taxis and ferry boats 25-Year Property (25 years) Residential Rental Property (27.5 years) Nonresidential Real Property (39 years Municipal sewers This is any building or structure, such as a This is property such as an orice Certain water utility property integral to rental home (including a mobile home), in building, a store, or a warehouse that the gathering, treatment, or commercial 80% of its gross rental income for the tax is not residential rental property. year is from dwelling units. A dwelling unit is a house or an apartment used to provide living accommodations Recovery Year Cost Recovery Percentage Table MACRS Depreciation Rate for Property Class 3-year 5-year 7-year 10-year 15-year 33.3390 20.0096 14.2996 10.000 5.00% 44.45 32.00 24.49 18.00 9.50 14.81 19.20 17.49 14.40 8.55 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 2 3 4 5 20-year 3.750 7.219 6.677 6.177 5.713 5.76 6 7 X 2 10 8.92 8.93 4.46 5.285 4.88 7.37 6.55 6.55 6.50 6.55 6.23 5.90 5.90 5.91 5.90 4.461 3.28 12 13 5.91 5.90 5.91 5.90 5.91 4.462 4161 4.462 15 1.162 16 2.95 12 18 19 20 4.-161 1407 4.46 4.462 4.461 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started