Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a dollar-based company is facing the following euro payments in the future: -10m in year 1,-15m in year 2, and 20m in year

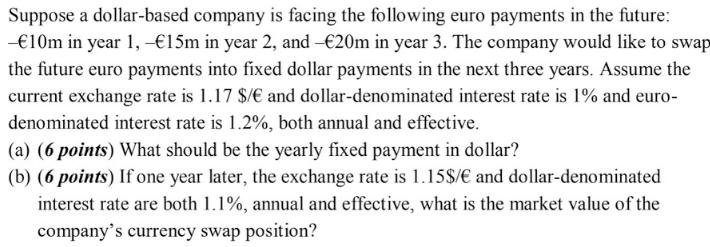

Suppose a dollar-based company is facing the following euro payments in the future: -10m in year 1,-15m in year 2, and 20m in year 3. The company would like to swap the future euro payments into fixed dollar payments in the next three years. Assume the current exchange rate is 1.17 $/ and dollar-denominated interest rate is 1% and euro- denominated interest rate is 1.2%, both annual and effective. (a) (6 points) What should be the yearly fixed payment in dollar? (b) (6 points) If one year later, the exchange rate is 1.15$/ and dollar-denominated interest rate are both 1.1%, annual and effective, what is the market value of the company's currency swap position?

Step by Step Solution

★★★★★

3.46 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the yearly fixed payment in dollars for the currency swap we need to determine the present value of the future euro payments and then con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started