Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a firm has an expected net profit (EBIT) of $1200. The entrepreneur wants to sell the firm and asks an investment bank for

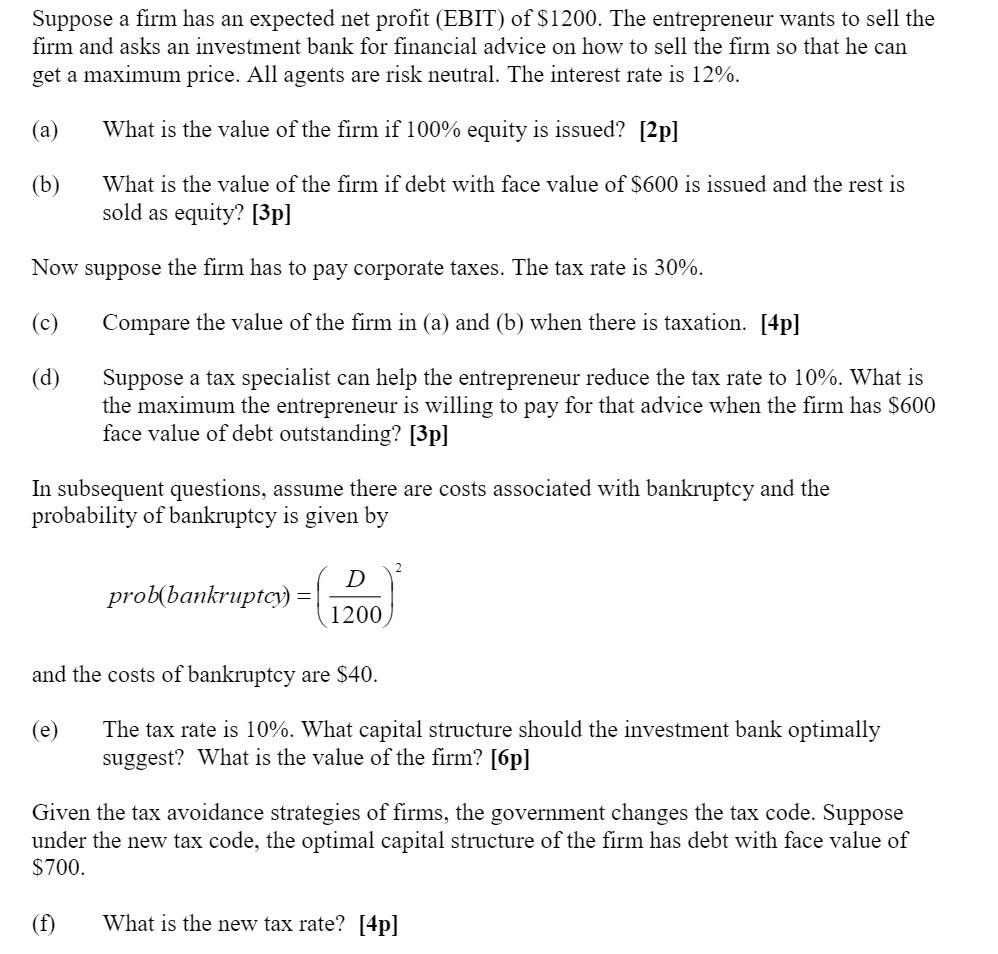

Suppose a firm has an expected net profit (EBIT) of $1200. The entrepreneur wants to sell the firm and asks an investment bank for financial advice on how to sell the firm so that he can get a maximum price. All agents are risk neutral. The interest rate is 12%. (a) What is the value of the firm if 100% equity is issued? [2p] (b) What is the value of the firm if debt with face value of $600 is issued and the rest is sold as equity? [3p] Now suppose the firm has to pay corporate taxes. The tax rate is 30%. (c) (d) Compare the value of the firm in (a) and (b) when there is taxation. [4p] Suppose a tax specialist can help the entrepreneur reduce the tax rate to 10%. What is the maximum the entrepreneur is willing to pay for that advice when the firm has $600 face value of debt outstanding? [3p] In subsequent questions, assume there are costs associated with bankruptcy and the probability of bankruptcy is given by prob(bankruptcy): (f) D 1200 and the costs of bankruptcy are $40. (e) The tax rate is 10%. What capital structure should the investment bank optimally suggest? What is the value of the firm? [6p] Given the tax avoidance strategies of firms, the government changes the tax code. Suppose under the new tax code, the optimal capital structure of the firm has debt with face value of $700. What is the new tax rate? [4p]

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The value of the firm when 100 equity is issued is equal to the expected net profit EBIT divided b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started