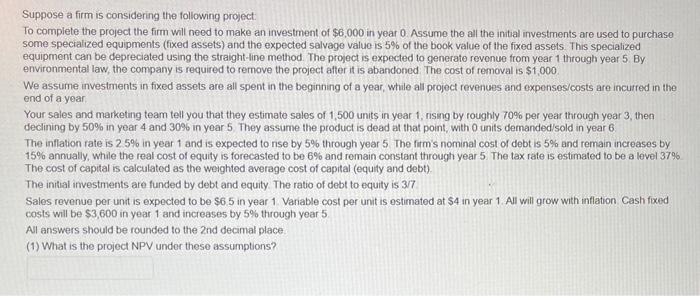

Suppose a firm is considering the following project: To complete the project the firm will need to make an investment of $6,000 in year 0 . Assume the all the inital investments are used to purchase some specialized equipments (fixed assets) and the expected salvage value is 5% of the book value of the fixed assets. This specialized equipment can be depreciated using the straight-line method. The project is expected to generate revenue from year 1 through year 5 . By environmental law, the company is required to remove the project after it is abandoned The cost of removal is $1,000 We assume investments in fixed assets are all spent in the beginning of a year, while all project revenues and expensos/costs are incurred in the end of a year Your sales and marketing team tell you that they estimate sales of 1,500 units in year 1 , rising by roughly 70% per year through year 3 , then decining by 50% in year 4 and 30% in year 5 . They assume the product is dead at that point, with 0 units demanded/sold in year 6. The inflation rate is 2.5% in year 1 and is expected to nse by 5% through year 5 . The firm's nominal cost of debt is 5% and remain increases by 15% annually, while the real cost of equity is forecasted to be 6% and remain constant through year 5 The tax rate is estimated to be a level 37% The cost of capital is calculated as the weighted average cost of capital (equity and debt). The initial investments are funded by debt and equity. The ratio of debt to equity is 3/7 Sales revenue per unt is expected to be $6.5 in year 1 Variable cost per unit is estimated at $4 in year 1 . All will grow with inflation Cash fixed costs will be $3,600 in year 1 and increases by 5% through year 5 All answers should be rounded to the 2 nd decimal place. (1) What is the project NPV under these assumptions? Suppose a firm is considering the following project: To complete the project the firm will need to make an investment of $6,000 in year 0 . Assume the all the inital investments are used to purchase some specialized equipments (fixed assets) and the expected salvage value is 5% of the book value of the fixed assets. This specialized equipment can be depreciated using the straight-line method. The project is expected to generate revenue from year 1 through year 5 . By environmental law, the company is required to remove the project after it is abandoned The cost of removal is $1,000 We assume investments in fixed assets are all spent in the beginning of a year, while all project revenues and expensos/costs are incurred in the end of a year Your sales and marketing team tell you that they estimate sales of 1,500 units in year 1 , rising by roughly 70% per year through year 3 , then decining by 50% in year 4 and 30% in year 5 . They assume the product is dead at that point, with 0 units demanded/sold in year 6. The inflation rate is 2.5% in year 1 and is expected to nse by 5% through year 5 . The firm's nominal cost of debt is 5% and remain increases by 15% annually, while the real cost of equity is forecasted to be 6% and remain constant through year 5 The tax rate is estimated to be a level 37% The cost of capital is calculated as the weighted average cost of capital (equity and debt). The initial investments are funded by debt and equity. The ratio of debt to equity is 3/7 Sales revenue per unt is expected to be $6.5 in year 1 Variable cost per unit is estimated at $4 in year 1 . All will grow with inflation Cash fixed costs will be $3,600 in year 1 and increases by 5% through year 5 All answers should be rounded to the 2 nd decimal place. (1) What is the project NPV under these assumptions