Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a firm is considering the following project, where all of the dollar figures are in thousands of dollars. In year 0, the project requires

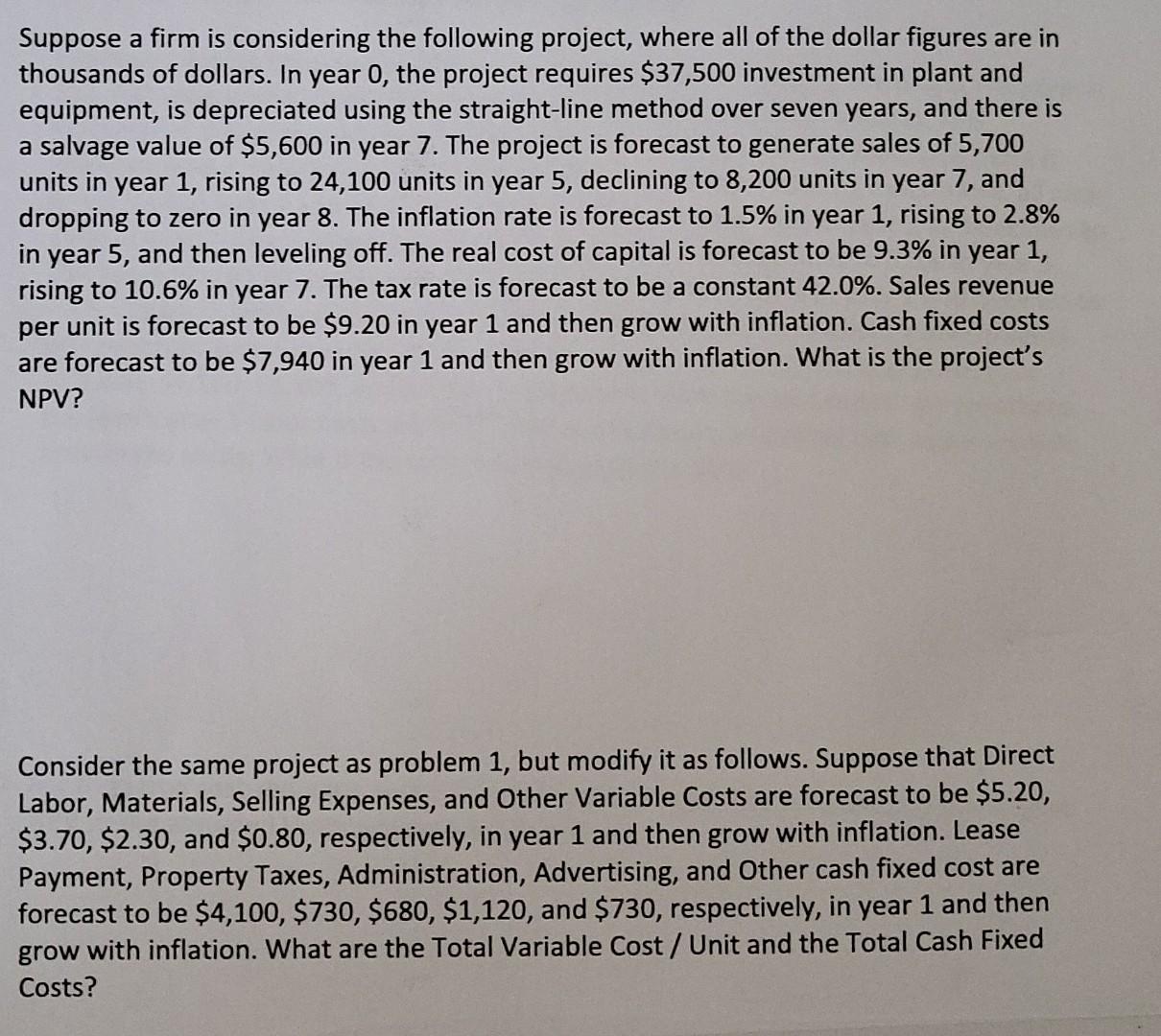

Suppose a firm is considering the following project, where all of the dollar figures are in thousands of dollars. In year 0, the project requires $37,500 investment in plant and equipment, is depreciated using the straight-line method over seven years, and there is a salvage value of $5,600 in year 7. The project is forecast to generate sales of 5,700 units in year 1, rising to 24,100 units in year 5, declining to 8,200 units in year 7, and dropping to zero in year 8. The inflation rate is forecast to 1.5% in year 1, rising to 2.8% in year 5, and then leveling off. The real cost of capital is forecast to be 9.3% in year 1, rising to 10.6% in year 7. The tax rate is forecast to be a constant 42.0%. Sales revenue per unit is forecast to be $9.20 in year 1 and then grow with inflation. Cash fixed costs are forecast to be $7,940 in year 1 and then grow with inflation. What is the project's NPV? Consider the same project as problem 1, but modify it as follows. Suppose that Direct Labor, Materials, Selling Expenses, and Other Variable Costs are forecast to be $5.20, $3.70, $2.30, and $0.80, respectively, in year 1 and then grow with inflation. Lease Payment, Property Taxes, Administration, Advertising, and Other cash fixed cost are forecast to be $4,100, $730, $680, $1,120, and $730, respectively, in year 1 and then grow with inflation. What are the Total Variable Cost/Unit and the Total Cash Fixed Costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started