Question

Suppose a firm is issuing bonds. Each bond has a face amount of $1,000, a stated rate of 8%, and a 10-year term. Coupon (interest)

Suppose a firm is issuing bonds. Each bond has a face amount of $1,000, a stated rate of 8%, and a 10-year term. Coupon (interest) payments are made annually. When the bonds are issued, the market rate for similar bonds is 8%.

1. After a year, the bond is selling for $1,015. What is the yield to maturity?

2. After 2 years, the bond is selling for $930. What is the yield to maturity?

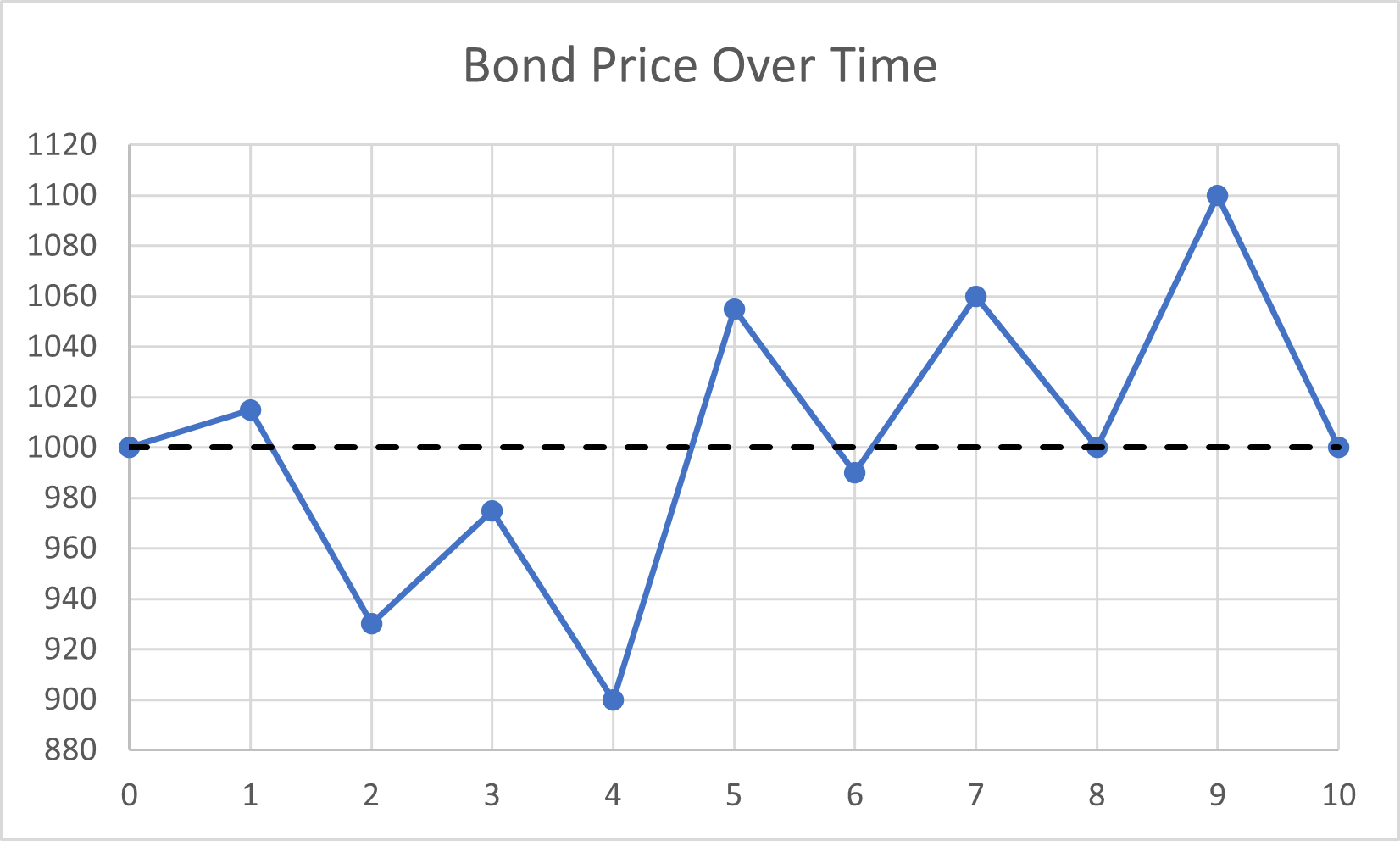

Suppose after the bonds mature, the firm puts together a graph of the bond price over time, as shown below.

3. Based on the graph, was this bond issued at par? Why or why not?

4. Based on the graph, during which years was the bond priced at a premium?

5. Based on the graph, during which years was the bond priced at a discount?

Suppose the firm is considering issuing a new series of bonds with the same terms (face amount of $1,000, a stated rate of 8%, and a 10-year term) but different coupon (interest) payment frequency.

6. What is the bond price when issued if the market rate on similar bonds is 7% and coupon (interest) payments are made annually?

7. What is the bond price when issued if the market rate on similar bonds is 7% and coupon (interest) payments are made semiannually?

8. What is the bond price when issued if the market rate on similar bonds is 7% and coupon (interest) payments are made quarterly?

9. Would you recommend annual, semi-annual, or quarterly coupon (interest) payments for the newly issued bonds? Why? (You may want to consider the difference in capital raised between the three payment options).

10. How would your recommendation from (9.) change if the firm has stable sales versus highly cyclical sales (i.e., sales are high in spring/summer and low in fall/winter)?

Bond Price Over Time Bond Price Over TimeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started