Question

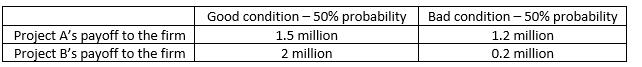

Suppose a firm needs to pay back $1 million to their debtholders next year and they distribute the rest of the payoff to the shareholders.

A. Which project will bondholders choose?

B. Which project will shareholders choose?

C. Which project should the manager choose if they wish to maximize firm value?

Project A's payoff to the firm Project B's payoff to the firm Good condition - 50% probability 1.5 million 2 million Bad condition - 50% probability 1.2 million 0.2 million

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Bondholders typically prefer lower risk as they want to ensure that they receive their repayment I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App