Answered step by step

Verified Expert Solution

Question

1 Approved Answer

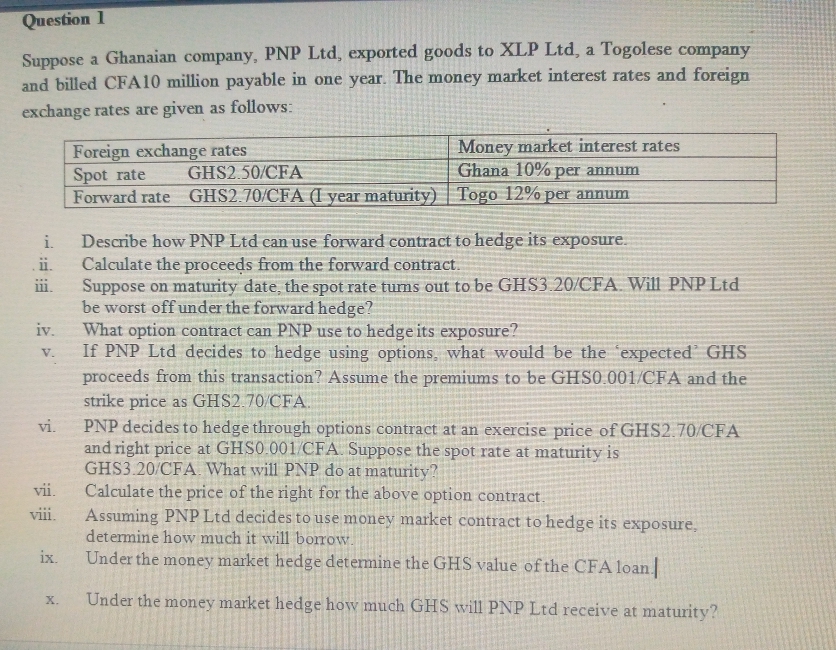

Suppose a Ghanaian company, PNP Ltd, exported goods to XLP Ltd, a Togolese company and billed CFA10 million payable in one year. The money market

Suppose a Ghanaian company, PNP Ltd, exported goods to XLP Ltd, a Togolese company and billed CFA10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows: i. Describe how PNP Ltd can use forward contract to hedge its exposure. ii. Calculate the proceeds from the forward contract. iii. Suppose on maturity date, the spot rate tums out to be GHS3.20/CFA. Will PNP Ltd be worst off under the forward hedge? iv. What option contract can PNP use to hedge its exposure? v. If PNP Ltd decides to hedge using options, what would be the 'expected' GHS proceeds from this transaction? Assume the premiums to be GHS0.001/CFA and the strike price as GHS2.70/CFA. vi. PNP decides to hedge through options contract at an exercise price of GHS2.70/CFA and right price at GHSO O01/CFA. Suppose the spot rate at maturity is GHS3.20/CFA. What will PNP do at maturity? vii. Calculate the price of the right for the above option contract. viii. Assuming PNP Ltd decides to use money market contract to hedge its exposure, determine how much it will borrow. ix. Under the money market hedge determine the GHS value of the CFA loan. x. Under the money market hedge horv much GHS will PNP Ltd receive at maturity

Suppose a Ghanaian company, PNP Ltd, exported goods to XLP Ltd, a Togolese company and billed CFA10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows: i. Describe how PNP Ltd can use forward contract to hedge its exposure. ii. Calculate the proceeds from the forward contract. iii. Suppose on maturity date, the spot rate tums out to be GHS3.20/CFA. Will PNP Ltd be worst off under the forward hedge? iv. What option contract can PNP use to hedge its exposure? v. If PNP Ltd decides to hedge using options, what would be the 'expected' GHS proceeds from this transaction? Assume the premiums to be GHS0.001/CFA and the strike price as GHS2.70/CFA. vi. PNP decides to hedge through options contract at an exercise price of GHS2.70/CFA and right price at GHSO O01/CFA. Suppose the spot rate at maturity is GHS3.20/CFA. What will PNP do at maturity? vii. Calculate the price of the right for the above option contract. viii. Assuming PNP Ltd decides to use money market contract to hedge its exposure, determine how much it will borrow. ix. Under the money market hedge determine the GHS value of the CFA loan. x. Under the money market hedge horv much GHS will PNP Ltd receive at maturity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started