Question

Suppose a new customer adds $100 to his account at Midwestern Mutual Bank, which the owners of the bank then use to make $100 worth

Suppose a new customer adds $100 to his account at Midwestern Mutual Bank, which the owners of the bank then use to make $100 worth of new loans. This would increase the loans account and (increase/decrease) the (capital / debt / deposits / loans / reserves) account.

This would also bring the leverage ratio from its initial value of (1.86/ 1.95/ 3.96/ 5.35) to a new value of (1.86/ 1.95/ 3.96/ 5.35).

Which of the following do bankers take into account when determining how to allocate their assets? Check all that apply.

___ The total value of liabilities

___ The size of the monetary base

___ The return on each asset

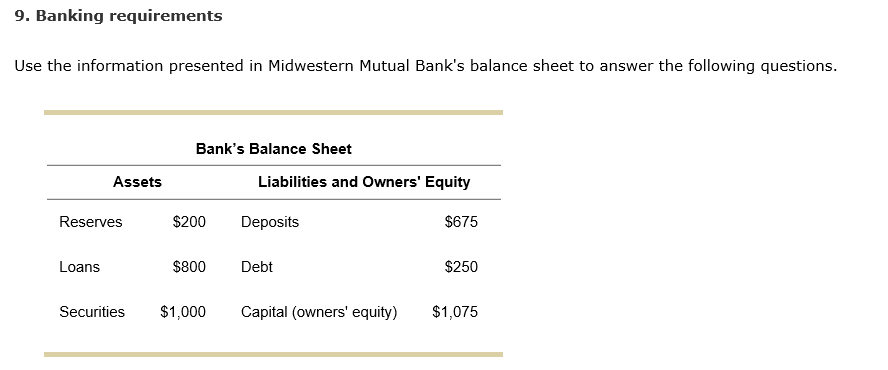

9. Banking requirements Use the information presented in Midwestern Mutual Bank's balance sheet to answer the following questions. Bank's Balance Sheet Assets Liabilities and Owners' Equity Reserves$200 Deposits 200 Deposits $675 Loans $800 Debt $250 Securities $1,000 Capital (owners' equity) $1,075Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started