Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a representative bank like the one we studied in class. On the asset side of their T-account, the bank has loans for $100,

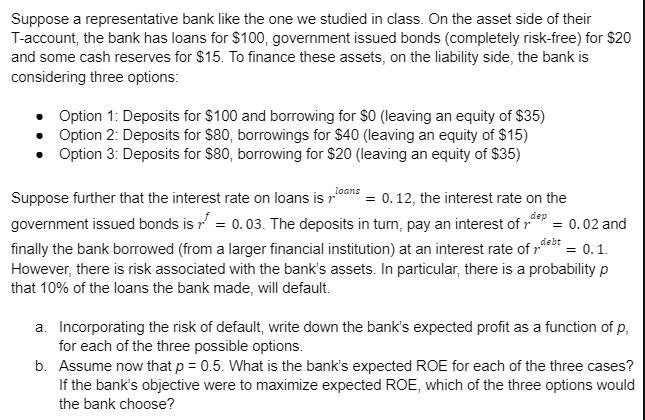

Suppose a representative bank like the one we studied in class. On the asset side of their T-account, the bank has loans for $100, government issued bonds (completely risk-free) for $20 and some cash reserves for $15. To finance these assets, on the liability side, the bank is considering three options: Option 1: Deposits for $100 and borrowing for $0 (leaving an equity of $35) Option 2: Deposits for $80, borrowings for $40 (leaving an equity of $15) Option 3: Deposits for $80, borrowing for $20 (leaving an equity of $35) loans Suppose further that the interest rate on loans is = 0.12, the interest rate on the government issued bonds is = 0.03. The deposits in turn, pay an interest of dep = 0.02 and debt finally the bank borrowed (from a larger financial institution) at an interest rate of 1. = 0.1. However, there is risk associated with the bank's assets. In particular, there is a probability p that 10% of the loans the bank made, will default. a. Incorporating the risk of default, write down the bank's expected profit as a function of p, for each of the three possible options. b. Assume now that p = 0.5. What is the bank's expected ROE for each of the three cases? If the bank's objective were to maximize expected ROE, which of the three options would the bank choose?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a To incorporate the risk of default we need to calculate the expected profit for each option taking ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started