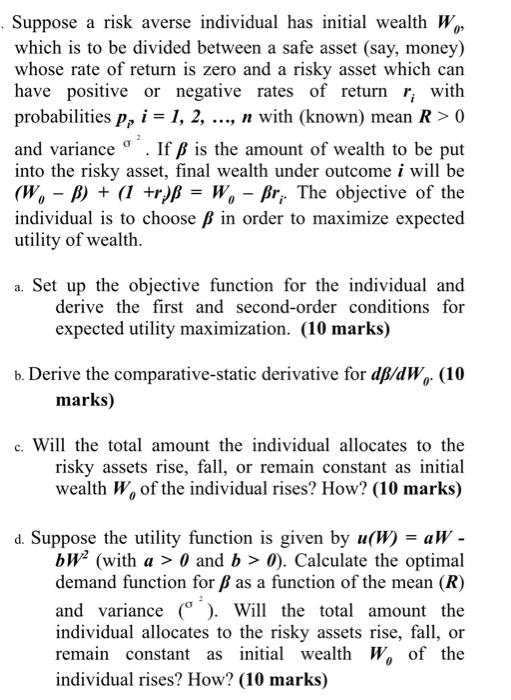

Suppose a risk averse individual has initial wealth W0, which is to be divided between a safe asset (say, money) whose rate of return is zero and a risky asset which can have positive or negative rates of return ri with probabilities ppi=1,2,,n with (known) mean R>0 and variance 2. If is the amount of wealth to be put into the risky asset, final wealth under outcome i will be (W0)+(1+ri)=W0ri. The objective of the individual is to choose in order to maximize expected utility of wealth. a. Set up the objective function for the individual and derive the first and second-order conditions for expected utility maximization. (10 marks) b. Derive the comparative-static derivative for d/dW0. (10 marks) c. Will the total amount the individual allocates to the risky assets rise, fall, or remain constant as initial wealth W of the individual rises? How? (10 marks) d. Suppose the utility function is given by u(W)=aW bW2 (with a>0 and b>0 ). Calculate the optimal demand function for as a function of the mean (R) and variance (2). Will the total amount the individual allocates to the risky assets rise, fall, or remain constant as initial wealth W of the individual rises? How? (10 marks) Suppose a risk averse individual has initial wealth W0, which is to be divided between a safe asset (say, money) whose rate of return is zero and a risky asset which can have positive or negative rates of return ri with probabilities ppi=1,2,,n with (known) mean R>0 and variance 2. If is the amount of wealth to be put into the risky asset, final wealth under outcome i will be (W0)+(1+ri)=W0ri. The objective of the individual is to choose in order to maximize expected utility of wealth. a. Set up the objective function for the individual and derive the first and second-order conditions for expected utility maximization. (10 marks) b. Derive the comparative-static derivative for d/dW0. (10 marks) c. Will the total amount the individual allocates to the risky assets rise, fall, or remain constant as initial wealth W of the individual rises? How? (10 marks) d. Suppose the utility function is given by u(W)=aW bW2 (with a>0 and b>0 ). Calculate the optimal demand function for as a function of the mean (R) and variance (2). Will the total amount the individual allocates to the risky assets rise, fall, or remain constant as initial wealth W of the individual rises? How? (10 marks)