Question

Suppose a student has an hour before their next class starts. They can either read a book, get something to eat, or take a nap.

Suppose a student has an hour before their next class starts. They can either read a book, get something to eat, or take a nap. The opportunity cost of getting something to eat is

a) the cost of what the student eats.

b) the value of reading and sleeping.

c) the loss of value from not reading or sleeping.

d) the net benefit of sleeping for another hour. e) impossible to determine because the most preferred alternative is not known

2. If Inga pays $8 for a coffee:

a) she expects the marginal benefit of that coffee to be exactly $8.

b) she expects the marginal benefit of that coffee to be at least $8.

c) she expects the marginal benefit of that coffee to be less than $8.

d) it’s impossible to know anything about her expectations of its marginal benefit.

e) she is being irrational.

3. Sugar and honey are viewed as substitutes for each other in many cooking applications. If the price of sugar rises, we would expect:

a) the demand for honey to increase

b) the demand for honey to decrease

c) the quantity demanded of honey to decrease

d) the price of honey to decrease e) the supply of honey to increase

4. In 1971, a pocket calculator cost more than $75. In 2010, a calculator of the same quality cost less than $10. Which of the following explanations is most consistent with these facts?

a) An increase in the demand for calculators forced their price down.

b) A change in technology caused the supply curve for calculators to shift to the right, depressing price.

c) As the population grew, fewer expensive calculators were needed, causing their price to fall.

d) Intense competition in the production of calculators caused the supply curve for calculators to shift to the left, depressing price.

e) Growing incomes of consumers reduced the demand for calculators because they are a normal good.

5. If the market for beef cattle was initially in equilibrium, an increase in the price of the feed grains used to fatten cattle would cause:

a) the demand for beef cattle to increase, driving prices upward.

b) the supply of beef cattle to decrease, driving beef prices upward in the long run.

c) the supply of beef to increase, placing downward pressure on beef prices in the long run.

d) both supply and demand to fall, leaving price virtually unchanged.

e) the supply of beef to decrease, which then will cause demand to decrease, which means the effect on the price of beef in uncertain.

6. Suppose there are only two goods: apples and oranges. What happens if the price of each good increases by 15 per cent?

a) The consumer will substitute apples for oranges.

b) The consumer will substitute oranges for apples.

c) There is no substitution effect because relative prices have remained constant.

d) Demand for both goods increases.

e) Demand for both goods decreases.

7. If a country is an importer of a particular good, this means that the world price is:

a) Above what the domestic equilibrium price is.

b) Below what the equilibrium price is.

c) Equal to the domestic equilibrium price.

d) Not known for certainty without more information.

e) Irrelevant to the question of international trade.

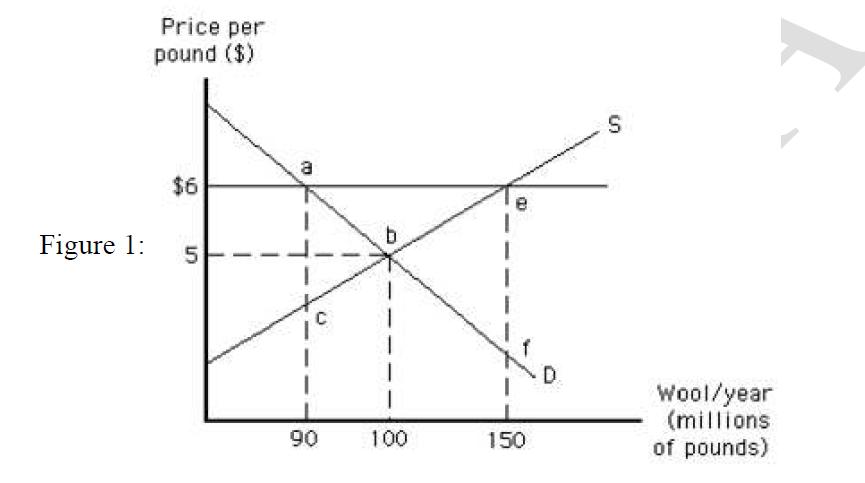

8. Refer to Figure 1 above. If an effective price floor is introduced as shown, what will be the increase in consumer expenditure on wool?

a) $500 million

b) $6 million

c) $40 million

d) $400 million

e) $90 million

9. If a 5 per cent increase in price leads to an 8 per cent decrease in quantity demanded, demand is:

a) perfectly elastic

b) elastic

c) unit elastic

d) inelastic

e) perfectly inelastic

10. When demand is price elastic, total revenue will:

a) directly related to the quantity demanded

b) inversely related to the quantity demanded

c) directly related to the price

d) directly related to price and inversely related to quantity demanded

e) not related to either price or to quantity demanded

Figure 1: Price per pound ($) $6 5 CO 90 b 100 150 S Wool/year (millions of pounds)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 e impossible to determine because the most preferred alternative is not known Explanation Opportunity cost is also known as the next best alternative According to the student the next best alternati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started