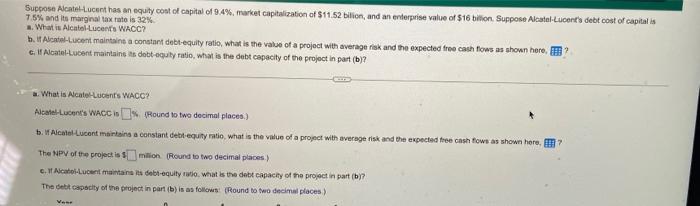

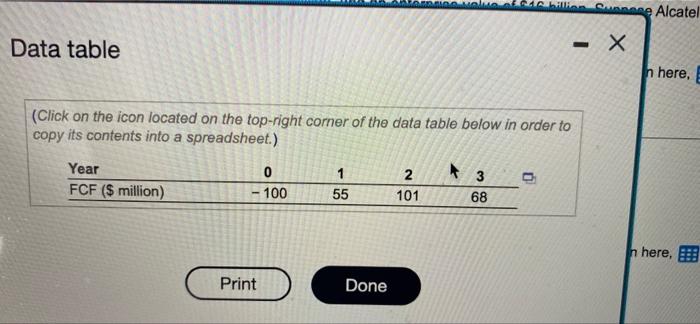

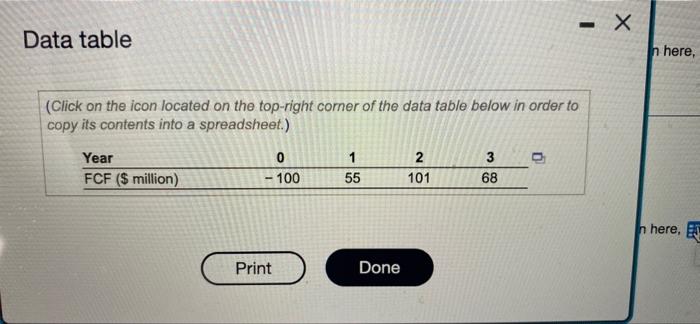

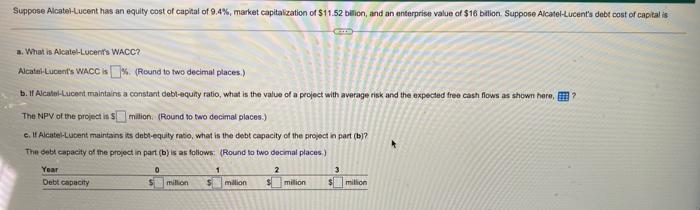

Suppose Alcatel-Lucent has an equity cost of capital of 9.4%, market capitalization of $11.52 billion, and an enterprise value of $16 billion. Suppose Alcatel-Lucent's debt cost of capital is 7.5% and its marginal tax rate is 32% a. What is Alcatel-Lucents WACC? b. if Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is % (Round to two decimal places) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, 7 The NPV of the project is $million (Round to two decimal places) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the project in part (b) is as follows: (Round to two decimal places) Your billion Sunnage Alcatel - X Data table n here, (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year 0 1 2 3 C FCF ($ million) - 100 55 101 68 Print Done n here, Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year 0 1 2 3 FCF ($ million) - 100 55 101 68 Print - X Done n here, n here, E Suppose Alcatel-Lucent has an equity cost of capital of 9.4%, market capitalization of $11.52 billion, and an enterprise value of $16 billion. Suppose Alcatel-Lucent's debt cost of capital is a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is%. (Round to two decimal places.) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here.? The NPV of the project is $ million (Round to two decimal places.) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the project in part (b) is as follows: (Round to two decimal places) Year 0 2 3 1 $ Debt capacity $ million million $ million milion $