Question

Suppose all stocks in Juanitas portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is ______(Andalusian Limited (AL)

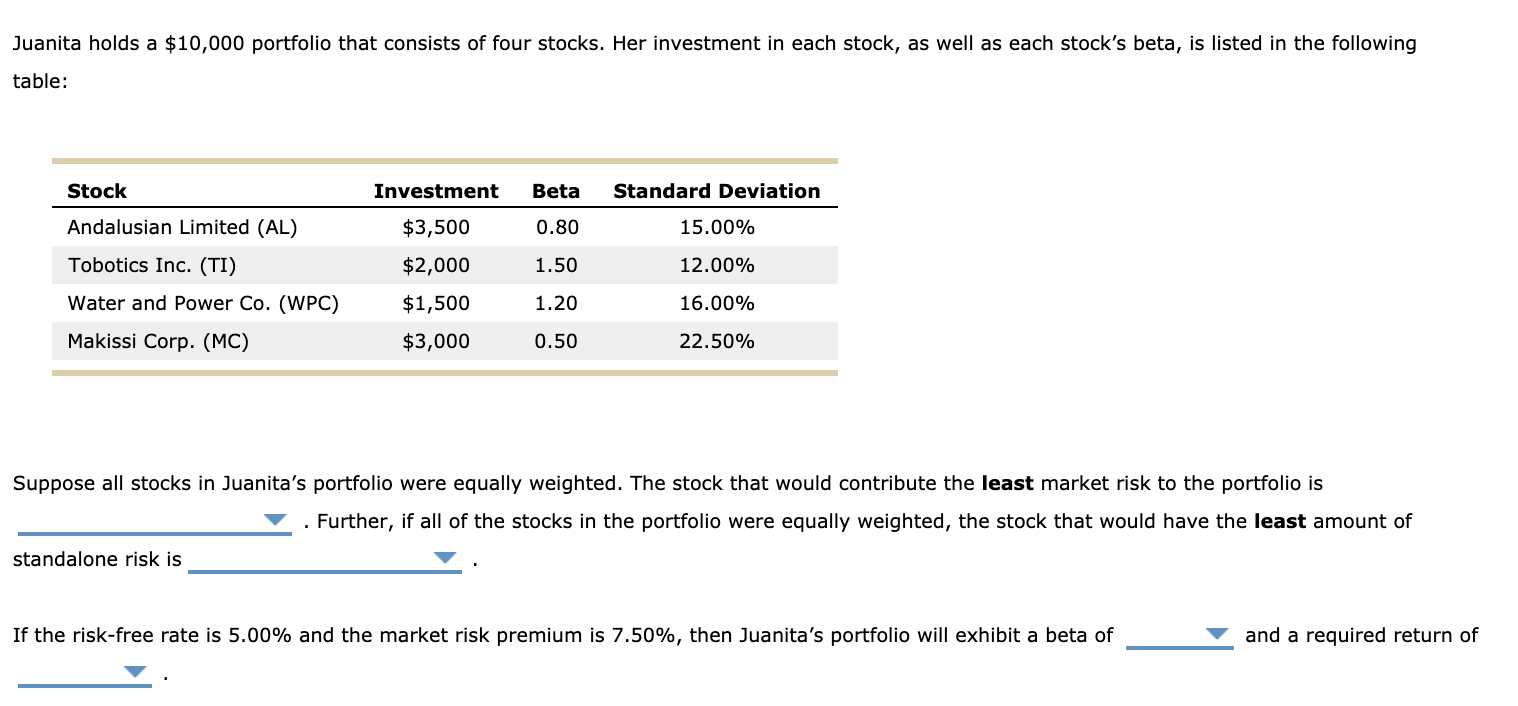

Suppose all stocks in Juanitas portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is ______(Andalusian Limited (AL) or Tobotics Inc. (TI) or Water & Power Co (WPC) or Makissi Corp. (MC). )

Suppose all stocks in Juanitas portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is ______(Andalusian Limited (AL) or Tobotics Inc. (TI) or Water & Power Co (WPC) or Makissi Corp. (MC). )

Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the least amount of standalone risk is______(Andalusian Limited (AL) or Tobotics Inc. (TI) or Water & Power Co (WPC) or Makissi Corp. (MC). )

If the risk-free rate is 5.00% and the market risk premium is 7.50%, then Juanitas portfolio will exhibit a beta of(___){A 0.610 ;B 0.774 ;C 0.910 ;D 1.365 }. and a required return of (____)

{A 7.95% ;B 9.23% ;C 11.83% ;D 17.05% }

Juanita holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Investment Standard Deviation Beta 0.80 $3,500 15.00% 1.50 12.00% Andalusian Limited (AL) Tobotics Inc. (TI) Water and Power Co. (WPC) Makissi Corp. (MC) $2,000 $1,500 $3,000 16.00% 1.20 0.50 22.50% Suppose all stocks in Juanita's portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is . Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the least amount of standalone risk is If the risk-free rate is 5.00% and the market risk premium is 7.50%, then Juanita's portfolio will exhibit a beta of and a required return ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started