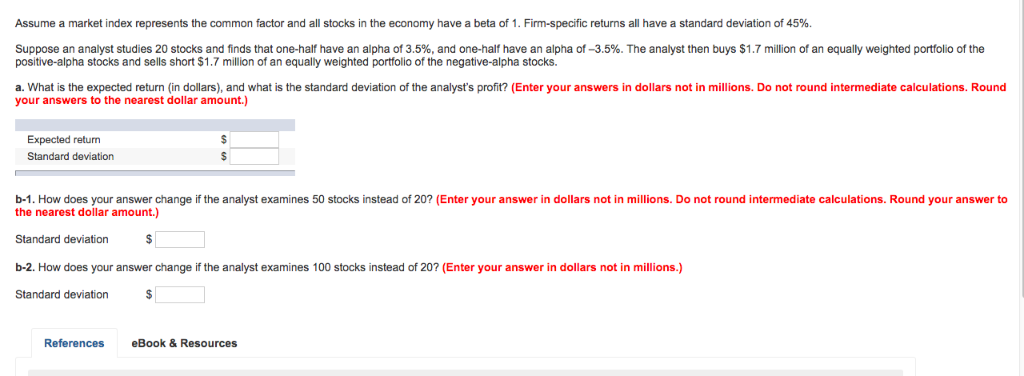

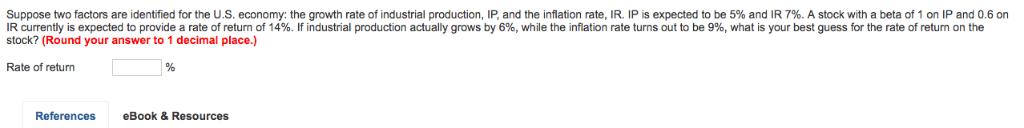

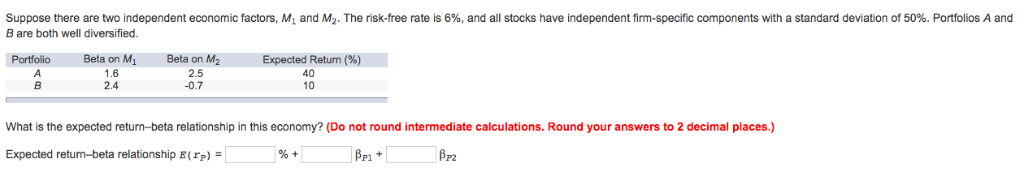

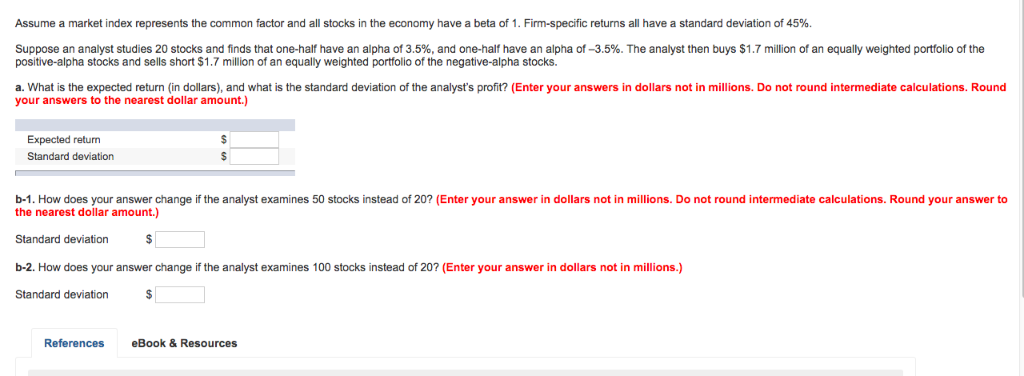

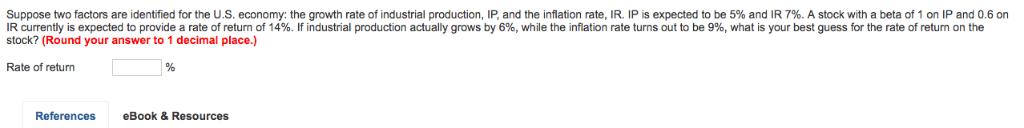

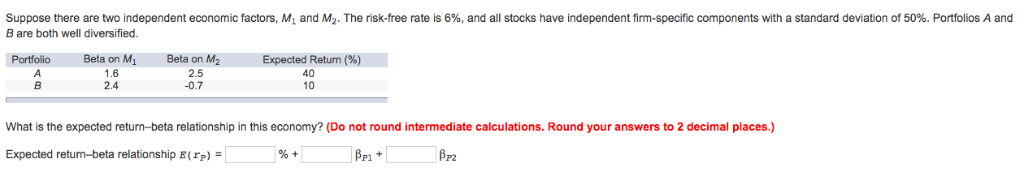

Suppose an analyst studies 20 stocks and finds that one-half have an alpha of 3.5%, and one-half have an alpha of-3.5%. The analyst then buys $1.7 million of an equally weighted portfolio of the positive-alpha stocks and sells short $1.7 million of an equally weighted portfolio of the negative-alpha stocks a. What is the expected return (in dollars), and what is the standard deviation of the analyst's profit? (Enter your answers in dollars not in millions. Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Expected return Standard deviation b-1. How does your answer change if the analyst examines 50 stocks instead of 20? (Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to the nearest dollar amount.) Standard deviationS b-2. How does your answer change if the analyst examines 100 stocks instead of 20? (Enter your answer in dollars not in millions.) Standard deviation References eBook & Resources Suppose two factors are identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 5% and IR 7%. A stock with a beta of 1 on IP and 0.6 on IR currently is expected to provide a rate of return of 14%. findustrial production actually grows by 6%, while the inflation rate turns out to be 9% what is your best guess for the rate of retum on the stock? (Round your answer to 1 decimal place.) Rate of return References eBook & Resources Suppose there are two independent economic actors, M1 and M2 The risk-free rate is 6%, and all stocks have independent m-specific components with a standard deviation of 50%. Portfolios A and B are both well diversified. Betaon Mi 1.6 24 onM2 2.5 -0.7 Expected Return(%) 40 10 Portfolio What is the expected return-beta relationship in this economy? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected retum-beta relationship E(rp) Suppose an analyst studies 20 stocks and finds that one-half have an alpha of 3.5%, and one-half have an alpha of-3.5%. The analyst then buys $1.7 million of an equally weighted portfolio of the positive-alpha stocks and sells short $1.7 million of an equally weighted portfolio of the negative-alpha stocks a. What is the expected return (in dollars), and what is the standard deviation of the analyst's profit? (Enter your answers in dollars not in millions. Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Expected return Standard deviation b-1. How does your answer change if the analyst examines 50 stocks instead of 20? (Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to the nearest dollar amount.) Standard deviationS b-2. How does your answer change if the analyst examines 100 stocks instead of 20? (Enter your answer in dollars not in millions.) Standard deviation References eBook & Resources Suppose two factors are identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 5% and IR 7%. A stock with a beta of 1 on IP and 0.6 on IR currently is expected to provide a rate of return of 14%. findustrial production actually grows by 6%, while the inflation rate turns out to be 9% what is your best guess for the rate of retum on the stock? (Round your answer to 1 decimal place.) Rate of return References eBook & Resources Suppose there are two independent economic actors, M1 and M2 The risk-free rate is 6%, and all stocks have independent m-specific components with a standard deviation of 50%. Portfolios A and B are both well diversified. Betaon Mi 1.6 24 onM2 2.5 -0.7 Expected Return(%) 40 10 Portfolio What is the expected return-beta relationship in this economy? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected retum-beta relationship E(rp)