Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose an individual can invest in a stock, a bond, or a risk-free asset. Further suppose that these asset's payoffs are determined from throwing

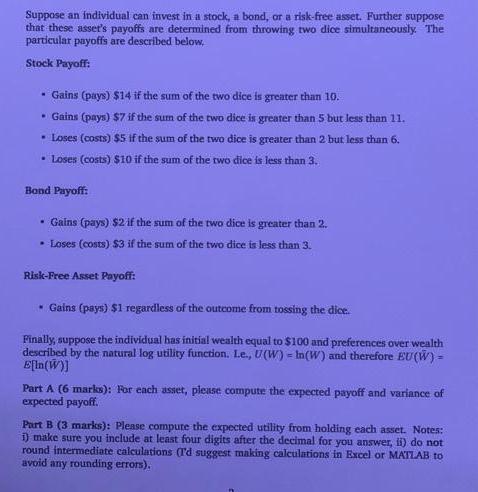

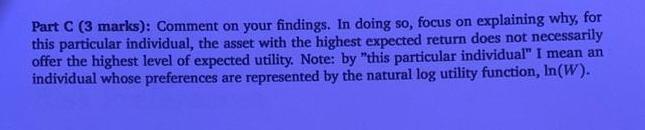

Suppose an individual can invest in a stock, a bond, or a risk-free asset. Further suppose that these asset's payoffs are determined from throwing two dice simultaneously. The particular payoffs are described below. Stock Payoff: Gains (pays) $14 if the sum of the two dice is greater than 10. Gains (pays) $7 if the sum of the two dice is greater than 5 but less than 11. Loses (costs) $5 if the sum of the two dice is greater than 2 but less than 6. - Loses (costs) $10 if the sum of the two dice is less than 3. Bond Payoff: Gains (pays) $2 if the sum of the two dice is greater than 2. Loses (costs) $3 if the sum of the two dice is less than 3. Risk-Free Asset Payoff: Gains (pays) $1 regardless of the outcome from tossing the dice. Finally, suppose the individual has initial wealth equal to $100 and preferences over wealth described by the natural log utility function. Le., U(W) - In(W) and therefore EU(W) = E[In(W)] Part A (6 marks): For each asset, please compute the expected payoff and variance of expected payoff. Part B (3 marks): Please compute the expected utility from holding each asset. Notes: i) make sure you include at least four digits after the decimal for you answer, ii) do not round intermediate calculations (I'd suggest making calculations in Excel or MATLAB to avoid any rounding errors). Part C (3 marks): Comment on your findings. In doing so, focus on explaining why, for this particular individual, the asset with the highest expected return does not necessarily offer the highest level of expected utility. Note: by "this particular individual" I mean an individual whose preferences are represented by the natural log utility function, In (W).

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part A Stock Expected payoff Psum 10 14 Psum 5 and sum 11 7 Psum 2 and sum 6 5 Psum 3 10 36 089 Variance of expected payoff EX 2 089 08922 00073 Bond Expected payoff Psum 2 2 Psum 3 3 36 006 Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started