Answered step by step

Verified Expert Solution

Question

1 Approved Answer

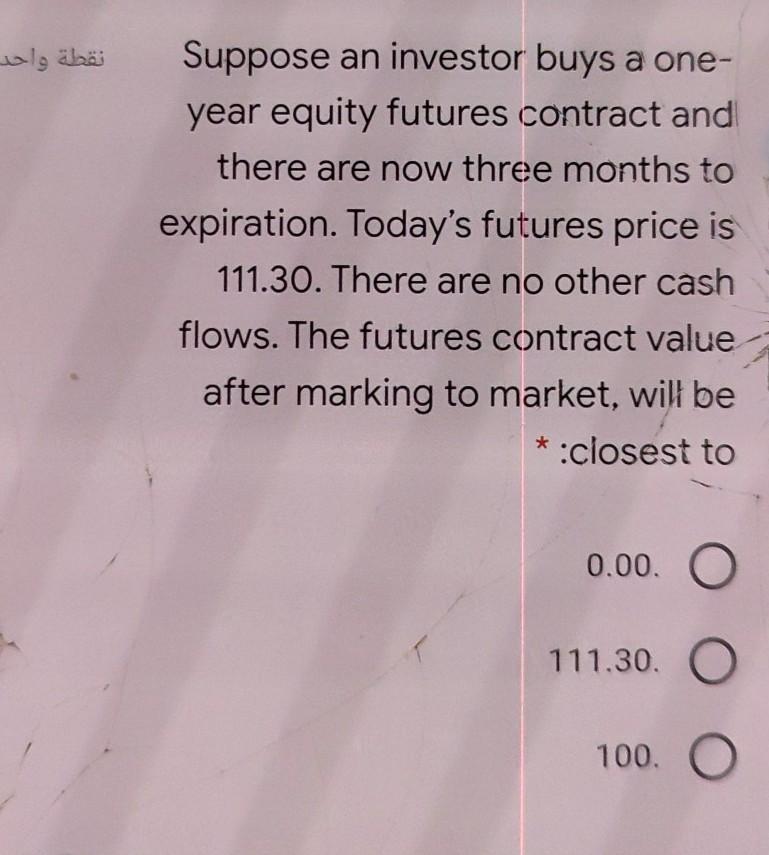

Suppose an investor buys a one- year equity futures contract and there are now three months to expiration. Today's futures price is 111.30. There are

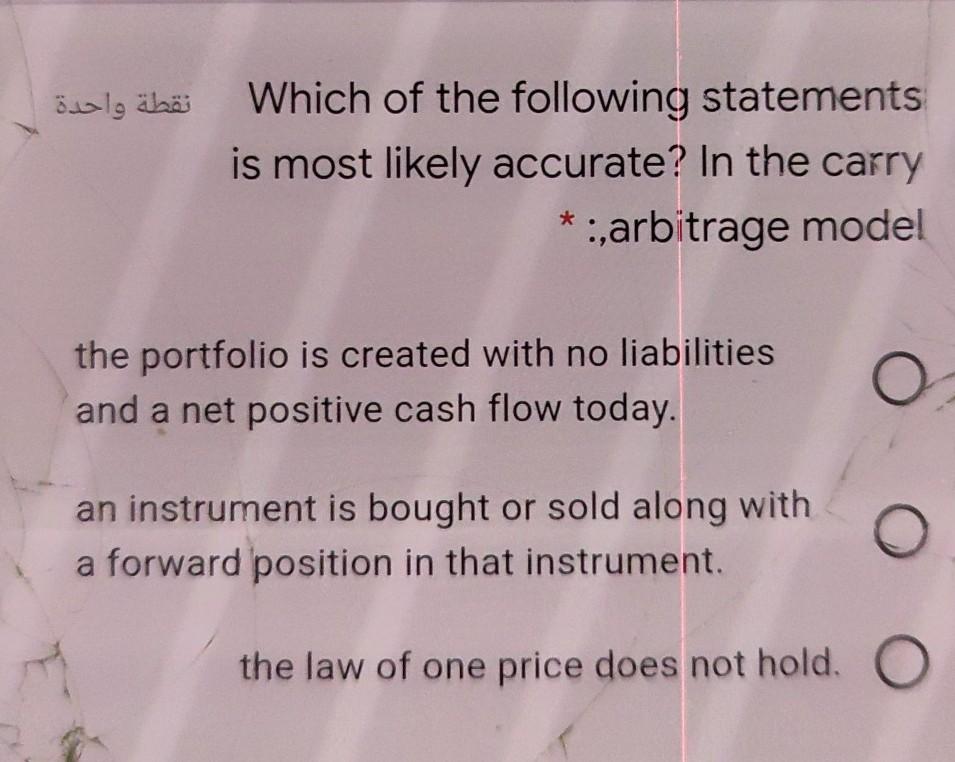

Suppose an investor buys a one- year equity futures contract and there are now three months to expiration. Today's futures price is 111.30. There are no other cash flows. The futures contract value after marking to market, will be *:closest to 0.00. 111.30 100. Which of the following statements is most likely accurate? In the carry *:,arbitrage model the portfolio is created with no liabilities and a net positive cash flow today. an instrument is bought or sold along with a forward position in that instrument. the law of one price does not hold. O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started