Answered step by step

Verified Expert Solution

Question

1 Approved Answer

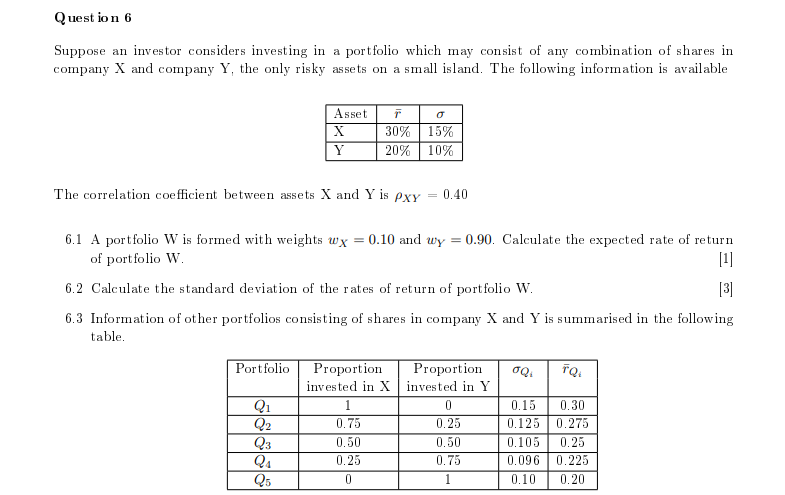

Suppose an investor considers investing in a portfolio which may consist of any combination of shares in company X and company Y, the only risky

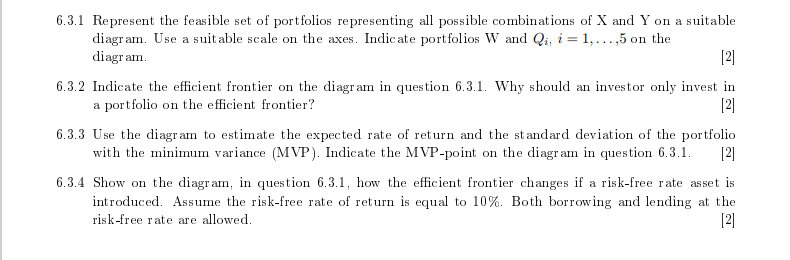

Suppose an investor considers investing in a portfolio which may consist of any combination of shares in company X and company Y, the only risky assets on a small island. The following information is available The correlation coefficient between assets X and Y is XY=0.40 6.1 A portfolio W is formed with weights wX=0.10 and wY=0.90. Calculate the expected rate of return of portfolio W. 6.2 Calculate the standard deviation of the rates of return of portfolio W. 6.3 Information of other portfolios consisting of shares in company X and Y is summarised in the following table. 6.3.1 Represent the feasible set of portfolios representing all possible combinations of X and Y on a suitable diagram. Use a suitable scale on the axes. Indicate portfolios W and Qi,i=1,,5 on the diagram. 6.3.2 Indicate the efficient frontier on the diagram in question 6.3.1. Why should an investor only invest in a portfolio on the efficient frontier? 6.3.3 Use the diagram to estimate the expected rate of return and the standard deviation of the portfolio with the minimum variance (MVP). Indicate the MVP-point on the diagram in question 6.3.1. 6.3.4 Show on the diagram, in question 6.3.1, how the efficient frontier changes if a risk-free rate asset is introduced. Assume the risk-free rate of return is equal to 10%. Both borrowing and lending at the risk-free r ate are allowed

Suppose an investor considers investing in a portfolio which may consist of any combination of shares in company X and company Y, the only risky assets on a small island. The following information is available The correlation coefficient between assets X and Y is XY=0.40 6.1 A portfolio W is formed with weights wX=0.10 and wY=0.90. Calculate the expected rate of return of portfolio W. 6.2 Calculate the standard deviation of the rates of return of portfolio W. 6.3 Information of other portfolios consisting of shares in company X and Y is summarised in the following table. 6.3.1 Represent the feasible set of portfolios representing all possible combinations of X and Y on a suitable diagram. Use a suitable scale on the axes. Indicate portfolios W and Qi,i=1,,5 on the diagram. 6.3.2 Indicate the efficient frontier on the diagram in question 6.3.1. Why should an investor only invest in a portfolio on the efficient frontier? 6.3.3 Use the diagram to estimate the expected rate of return and the standard deviation of the portfolio with the minimum variance (MVP). Indicate the MVP-point on the diagram in question 6.3.1. 6.3.4 Show on the diagram, in question 6.3.1, how the efficient frontier changes if a risk-free rate asset is introduced. Assume the risk-free rate of return is equal to 10%. Both borrowing and lending at the risk-free r ate are allowed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started