Answered step by step

Verified Expert Solution

Question

1 Approved Answer

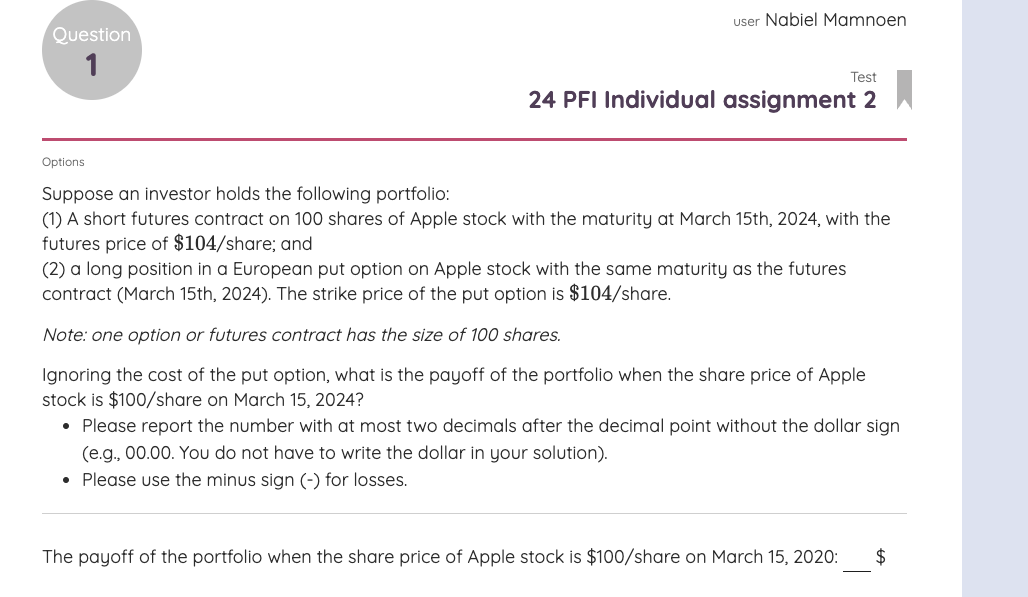

Suppose an investor holds the following portfolio: ( 1 ) A short futures contract on 1 0 0 shares of Apple stock with the maturity

Suppose an investor holds the following portfolio:

A short futures contract on shares of Apple stock with the maturity at March th with the

futures price of $ share; and

a long position in a European put option on Apple stock with the same maturity as the futures

contract March th The strike price of the put option is $ share.

Note: one option or futures contract has the size of shares.

Ignoring the cost of the put option, what is the payoff of the portfolio when the share price of Apple

stock is $ share on March

Please report the number with at most two decimals after the decimal point without the dollar sign

eg You do not have to write the dollar in your solution

Please use the minus sign for losses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started