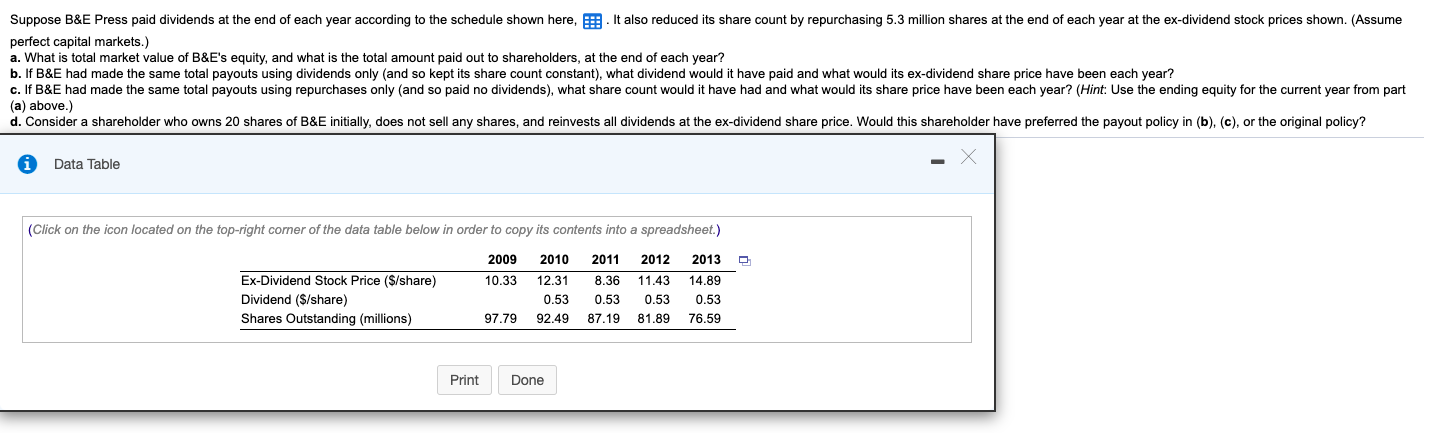

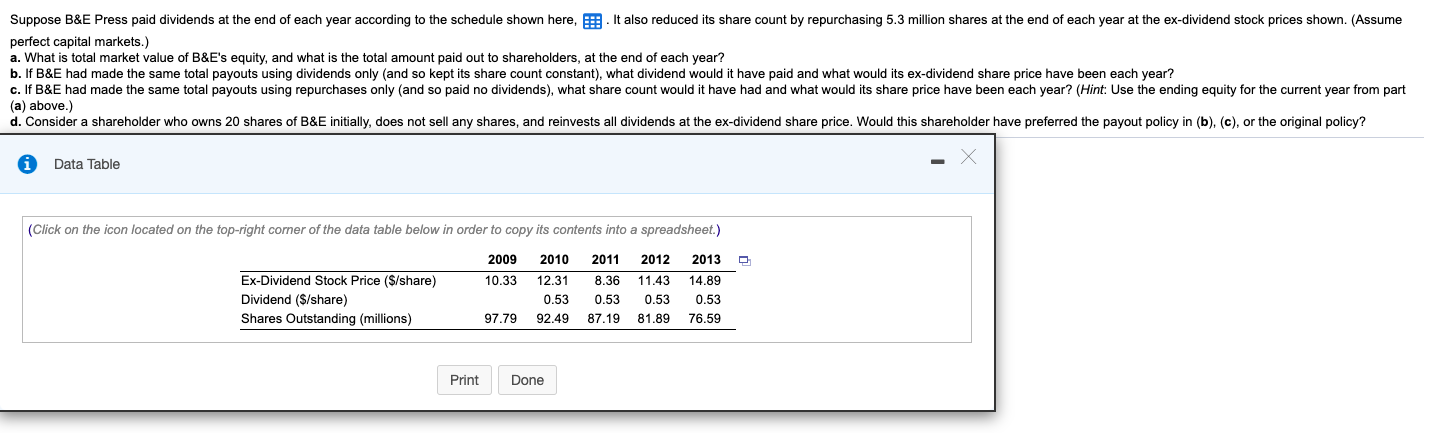

Suppose B&E Press paid dividends at the end of each year according to the schedule shown here, : . It also reduced its share count by repurchasing 5.3 million shares at the end of each year at the ex-dividend stock prices shown. (Assume perfect capital markets.) a. What is total market value of B&E's equity, and what is the total amount paid out to shareholders, at the end of each year? b. If B&E had made the same total payouts using dividends only (and so kept its share count constant), what dividend would it have paid and what would its ex-dividend share price have been each year? c. If B&E had made the same total payouts using repurchases only (and so paid no dividends), what share count would it have had and what would its share price have been each year? (Hint: Use the ending equity for the current year from part (a) above.) d. Consider a shareholder who owns 20 shares of B&E initially, does not sell any shares, and reinvests all dividends at the ex-dividend share price. Would this shareholder have preferred the payout policy in (b), (c), or the original policy? Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 2009 10.33 Ex-Dividend Stock Price ($/share) Dividend ($/share) Shares Outstanding (millions) 2010 12.31 0.53 92.49 2011 8.36 0.53 87.19 2012 11.43 0.53 81.89 2013 14.89 0.53 76.59 97.79 Print Done Suppose B&E Press paid dividends at the end of each year according to the schedule shown here, : . It also reduced its share count by repurchasing 5.3 million shares at the end of each year at the ex-dividend stock prices shown. (Assume perfect capital markets.) a. What is total market value of B&E's equity, and what is the total amount paid out to shareholders, at the end of each year? b. If B&E had made the same total payouts using dividends only (and so kept its share count constant), what dividend would it have paid and what would its ex-dividend share price have been each year? c. If B&E had made the same total payouts using repurchases only (and so paid no dividends), what share count would it have had and what would its share price have been each year? (Hint: Use the ending equity for the current year from part (a) above.) d. Consider a shareholder who owns 20 shares of B&E initially, does not sell any shares, and reinvests all dividends at the ex-dividend share price. Would this shareholder have preferred the payout policy in (b), (c), or the original policy? Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 2009 10.33 Ex-Dividend Stock Price ($/share) Dividend ($/share) Shares Outstanding (millions) 2010 12.31 0.53 92.49 2011 8.36 0.53 87.19 2012 11.43 0.53 81.89 2013 14.89 0.53 76.59 97.79 Print Done