Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose Bigriver com sells 1,000 books on account for $16 each (cost of these books is $9,600) on October 10 to The Reading Hour. Several

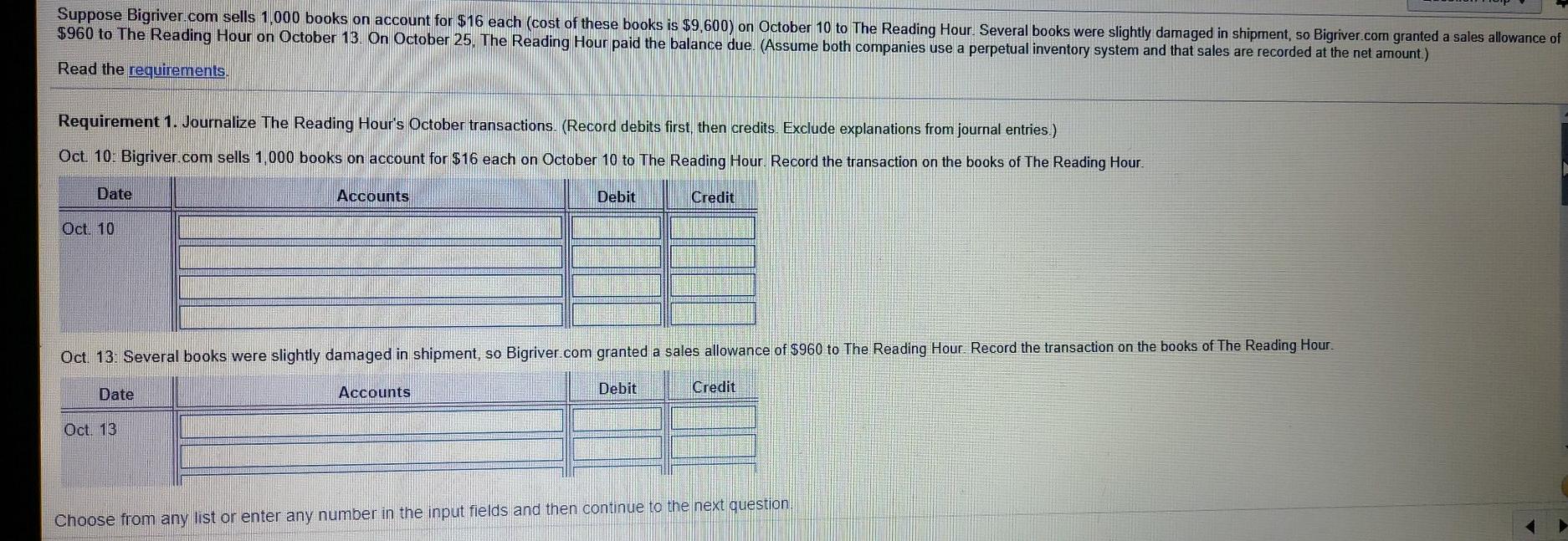

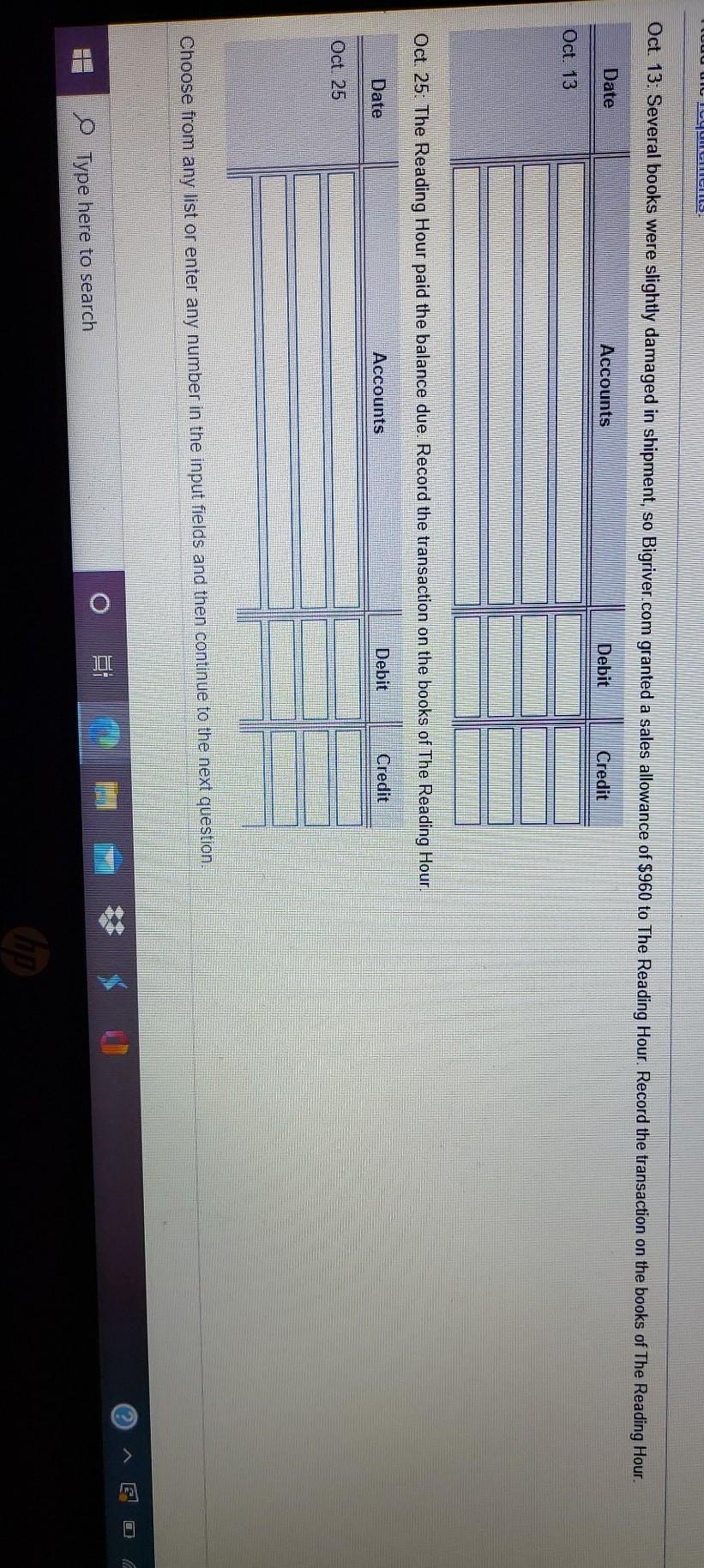

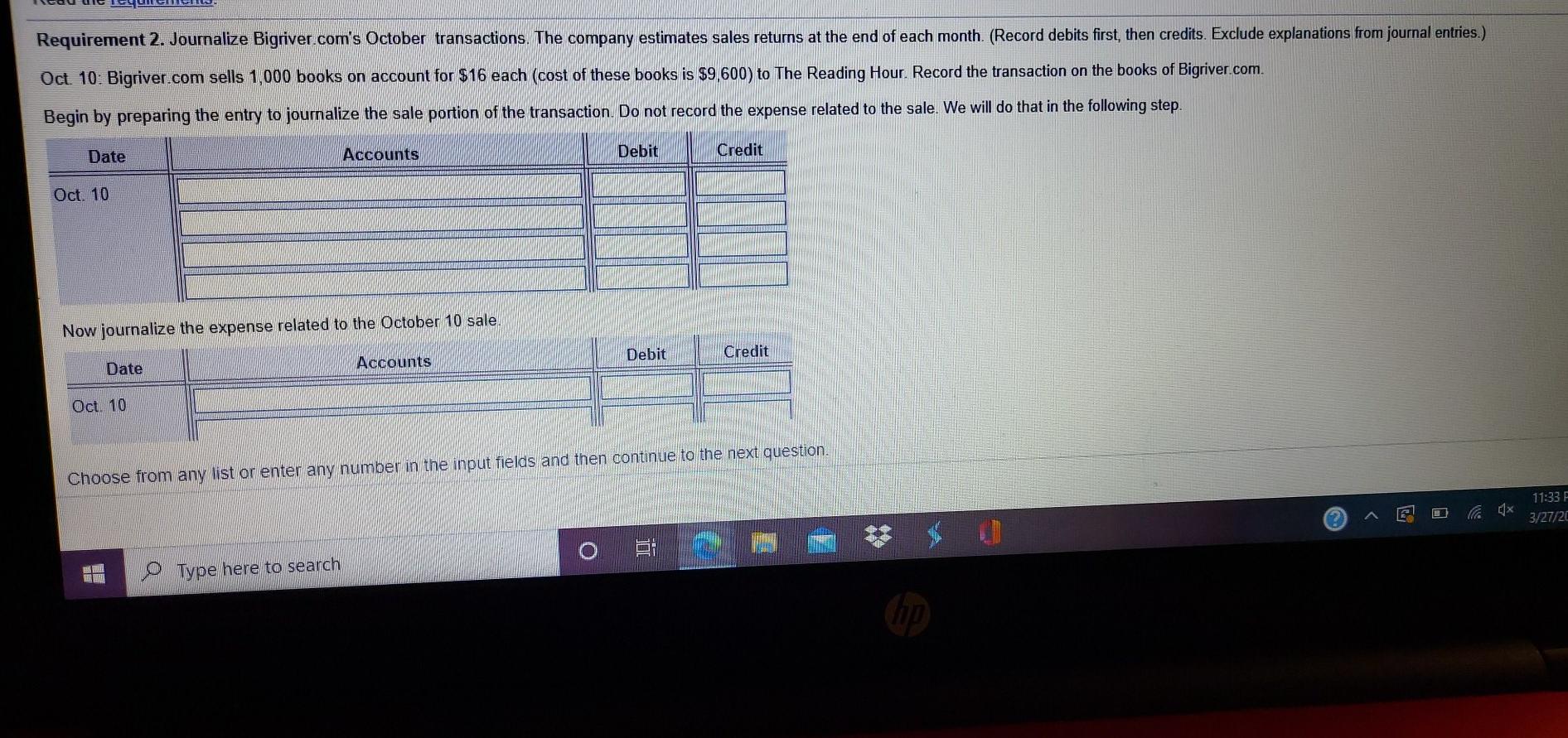

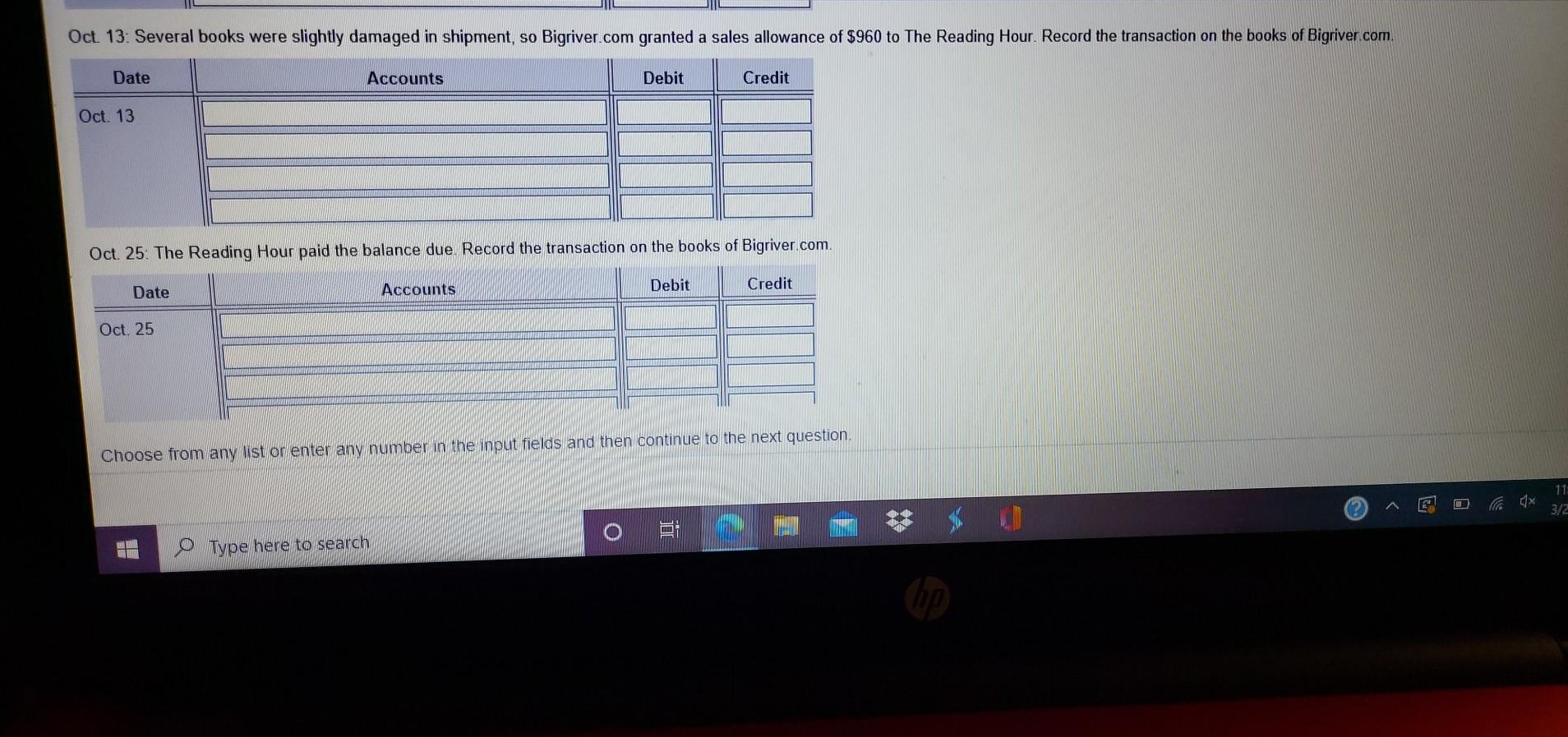

Suppose Bigriver com sells 1,000 books on account for $16 each (cost of these books is $9,600) on October 10 to The Reading Hour. Several books were slightly damaged in shipment, so Bigriver.com granted a sales allowance of $960 to The Reading Hour on October 13. On October 25, The Reading Hour paid the balance due. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements Requirement 1. Journalize The Reading Hour's October transactions. (Record debits first, then credits. Exclude explanations from journal entries.) Oct. 10. Bigriver.com sells 1,000 books on account for $16 each on October 10 to The Reading Hour. Record the transaction on the books of The Reading Hour. Date Accounts Debit Credit Oct 10 Oct. 13. Several books were slightly damaged in shipment, so Bigriver.com granted a sales allowance of $960 to The Reading Hour. Record the transaction on the books of The Reading Hour. Date Accounts Debit Cred Oct. 13 Choose from any list or enter any number in the input fields and then continue to the next question LLLLLLLL Oct. 13. Several books were slightly damaged in shipment, so Bigriver com granted a sales allowance of $960 to The Reading Hour. Record the transaction on the books of The Reading Hour. Date Accounts Debit Credit Oct. 13 Oct 25: The Reading Hour paid the balance due. Record the transaction on the books of The Reading Hour. Date Accounts Debit Credit Oct 25 Choose from any list or enter any number in the input fields and then continue to the next question. E O Type here to search Requirement 2. Journalize Bigriver.com's October transactions. The company estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries.) Oct. 10: Bigriver.com sells 1,000 books on account for $16 each (cost of these books is $9,600) to The Reading Hour. Record the transaction on the books of Bigriver.com Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Oct. 10 Now journalize the expense related to the October 10 sale. Debit Credit Date Accounts Oct 10 Choose from any list or enter any number in the input fields and then continue to the next question. 11:33 F 3/27/20 ? o Type here to search Oct 13: Several books were slightly damaged in shipment, so Bigriver.com granted a sales allowance of $960 to The Reading Hour. Record the transaction on the books of Bigriver.com Date Accounts Debit Credit Oct. 13 Oct 25: The Reading Hour paid the balance due. Record the transaction on the books of Bigriver.com Accounts Debit Date Credit Oct. 25 Choose from any ist or enter any number in the input fields and then continue to the next question. 11: 3/2 2 S O o Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started