Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose biofuels were available in infinite supply at a price of $30 per unit of oil-equivalent. Inverse demand for oil in a competitive market

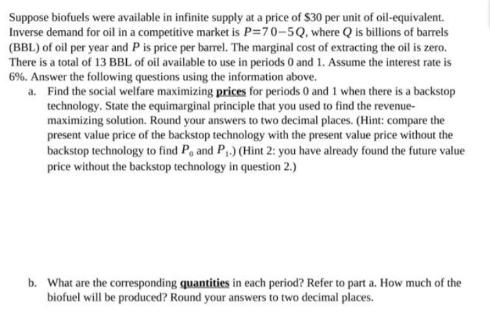

Suppose biofuels were available in infinite supply at a price of $30 per unit of oil-equivalent. Inverse demand for oil in a competitive market is P=70-5Q, where Q is billions of barrels (BBL) of oil per year and P is price per barrel. The marginal cost of extracting the oil is zero. There is a total of 13 BBL of oil available to use in periods 0 and 1. Assume the interest rate is 6%. Answer the following questions using the information above. a. Find the social welfare maximizing prices for periods 0 and 1 when there is a backstop technology, State the equimarginal principle that you used to find the revenue- maximizing solution. Round your answers to two decimal places. (Hint: compare the present value price of the backstop technology with the present value price without the backstop technology to find P, and P.) (Hint 2: you have already found the future value price without the backstop technology in question 2.) b. What are the corresponding quantities in each period? Refer to part a. How much of the biofuel will be produced? Round your answers to two decimal places.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations a Equimarginal principle Set ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started