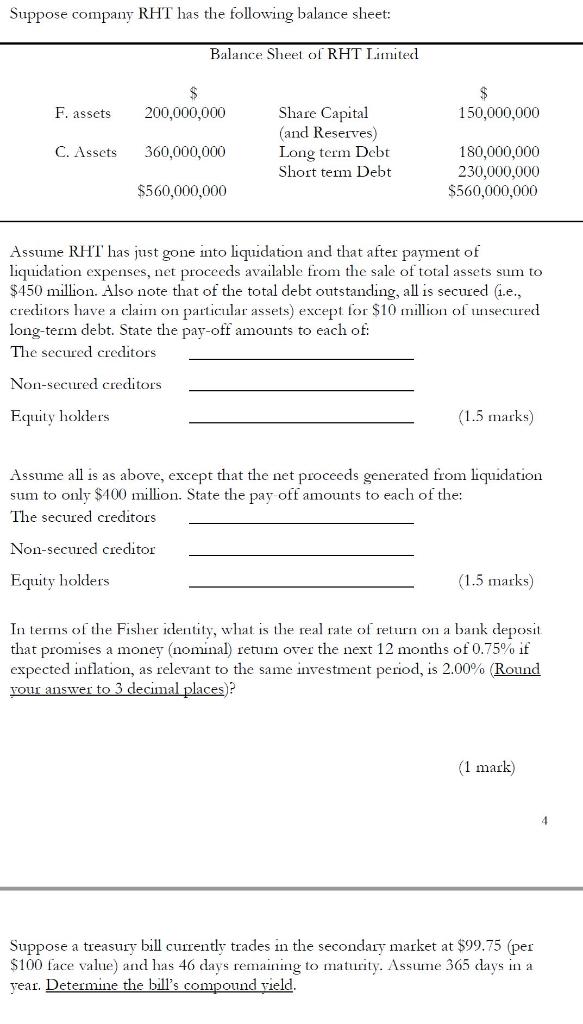

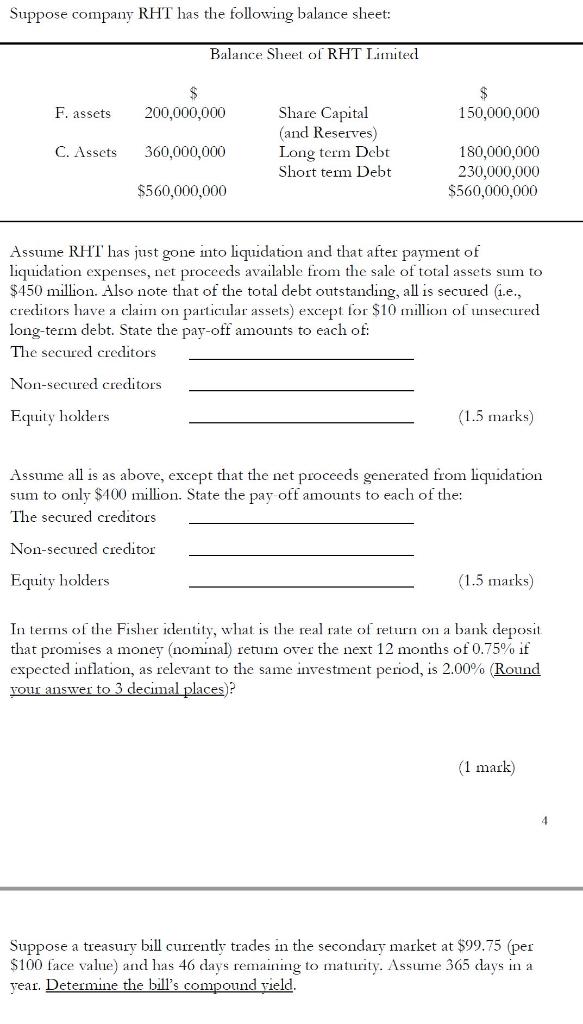

Suppose company RHT has the following balance sheet: Balance Sheet of RHT Limited F. assets 200,000,000 $ 150,000,000 Share Capital (and Reserves) Long term Debt Short term Debt C. Assets 360,000,000 180,000,000 230,000,000 $560,000,000 $560,000,000 Assume RHT has just gone into liquidation and that after payment of liquidation expenses, net proceeds available from the sale of total assets sum to $450 million. Also note that of the total debt outstanding, all is secured (1.e., creditors have a claim on particular assets) except for $10 million of unsecured long-term debt. State the pay-off amounts to each of: The secured creditors Non-secured creditors Equity holders (1.5 marks) Assume all is as above, except that the net proceeds generated from liquidation sum to only $400 million. State the pay off amounts to each of the The secured creditors Non-secured creditor Equity holders (1.5 marks) In terms of the Fisher identity, what is the real rate of return on a bank deposit that promises a money (nominal) retum over the next 12 months of 0.75% if expected inflation, as relevant to the same investment period, is 2.00% Round your answer to 3 decimal places)? (1 mark) 4 Suppose a treasury bill currently trades in the secondary market at $99.75 (per $100 face value) and has 46 days remaining to maturity. Assine 365 days in a year. Determine the bill's compound vield. Suppose company RHT has the following balance sheet: Balance Sheet of RHT Limited F. assets 200,000,000 $ 150,000,000 Share Capital (and Reserves) Long term Debt Short term Debt C. Assets 360,000,000 180,000,000 230,000,000 $560,000,000 $560,000,000 Assume RHT has just gone into liquidation and that after payment of liquidation expenses, net proceeds available from the sale of total assets sum to $450 million. Also note that of the total debt outstanding, all is secured (1.e., creditors have a claim on particular assets) except for $10 million of unsecured long-term debt. State the pay-off amounts to each of: The secured creditors Non-secured creditors Equity holders (1.5 marks) Assume all is as above, except that the net proceeds generated from liquidation sum to only $400 million. State the pay off amounts to each of the The secured creditors Non-secured creditor Equity holders (1.5 marks) In terms of the Fisher identity, what is the real rate of return on a bank deposit that promises a money (nominal) retum over the next 12 months of 0.75% if expected inflation, as relevant to the same investment period, is 2.00% Round your answer to 3 decimal places)? (1 mark) 4 Suppose a treasury bill currently trades in the secondary market at $99.75 (per $100 face value) and has 46 days remaining to maturity. Assine 365 days in a year. Determine the bill's compound vield