Answered step by step

Verified Expert Solution

Question

1 Approved Answer

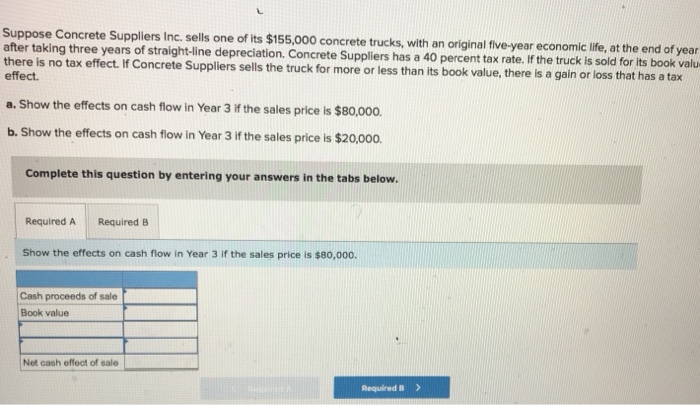

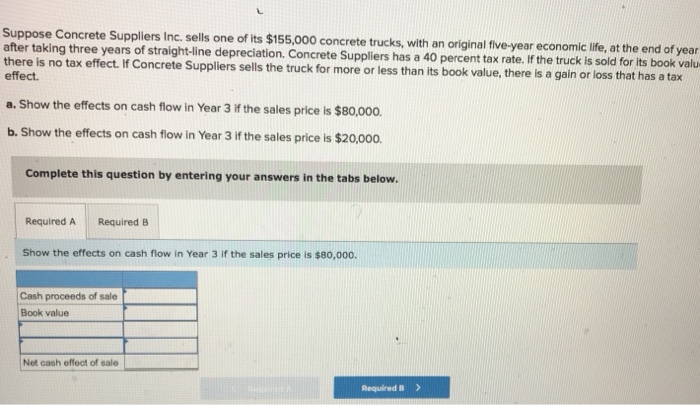

Suppose Concrete Suppl after taking three years of straight-line depreciation. Concrete Suppliers has a 40 percent tax rate. If the truck is sold for its

Suppose Concrete Suppl after taking three years of straight-line depreciation. Concrete Suppliers has a 40 percent tax rate. If the truck is sold for its book valu there is no tax effect. If Concrete Sup effect. ers Inc. sells one of its $155,000 concrete trucks, with an original five-year economic life, at the end of year pliers sells the truck for more or less than its book value, there is a gain or loss that has a tax a. Show the effects on cash flow in Year 3 if the sales price is $80.000. b. Show the effects on cash flow in Year 3 if the sales price is $20,000. Complete this question by entering your answers in the tabs below Required ARequired B Show the effects on cash flow in Year 3 if the sales price is $80,000 Cash proceeds of sale Book value Net cash offect of sale Required B>

Suppose Concrete Suppl after taking three years of straight-line depreciation. Concrete Suppliers has a 40 percent tax rate. If the truck is sold for its book valu there is no tax effect. If Concrete Sup effect. ers Inc. sells one of its $155,000 concrete trucks, with an original five-year economic life, at the end of year pliers sells the truck for more or less than its book value, there is a gain or loss that has a tax a. Show the effects on cash flow in Year 3 if the sales price is $80.000. b. Show the effects on cash flow in Year 3 if the sales price is $20,000. Complete this question by entering your answers in the tabs below Required ARequired B Show the effects on cash flow in Year 3 if the sales price is $80,000 Cash proceeds of sale Book value Net cash offect of sale Required B>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started