Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose Congress is considering raising the top federal marginal tax rate from 35% to 40%. Senator Jones believes the elasticity of taxable income is large.

Suppose Congress is considering raising the top federal marginal tax rate from 35% to 40%. Senator Jones believes the elasticity of taxable income is large. Senator Smith believes the elasticity of taxable income is small. (Both believe the elasticity is positive.) The Congressional Budget Office estimates the effects of the tax proposal using each Senator’s assumptions.

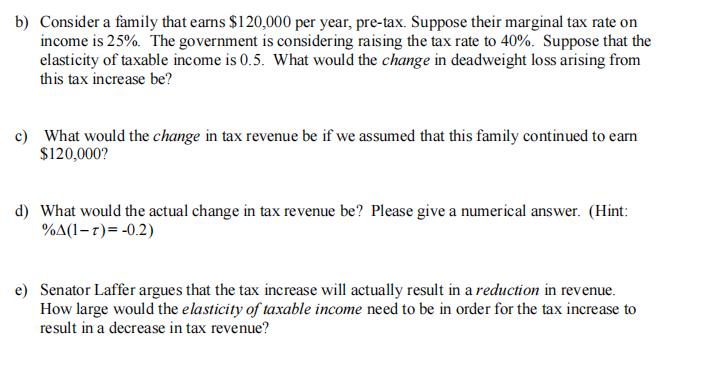

b) Consider a family that earns $120,000 per year, pre-tax. Suppose their marginal tax rate on income is 25%. The government is considering raising the tax rate to 40%. Suppose that the elasticity of taxable income is 0.5. What would the change in deadweight loss arising from this tax increase be? c) What would the change in tax revenue be if we assumed that this family continued to earn $120,000? d) What would the actual change in tax revenue be? Please give a numerical answer. (Hint: %A(1-7)= -0.2) e) Senator Laffer argues that the tax increase will actually result in a reduction in revenue. How large would the elasticity of taxable income need to be in order for the tax increase to result in a decrease in tax revenue?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution According to Senator Jones the elasticity of taxable income is larger which means that du...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started