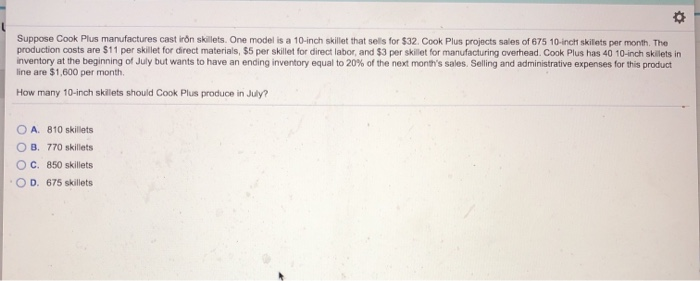

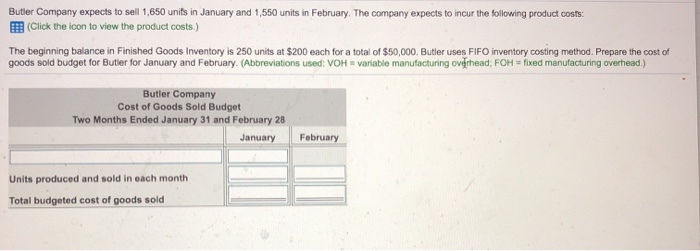

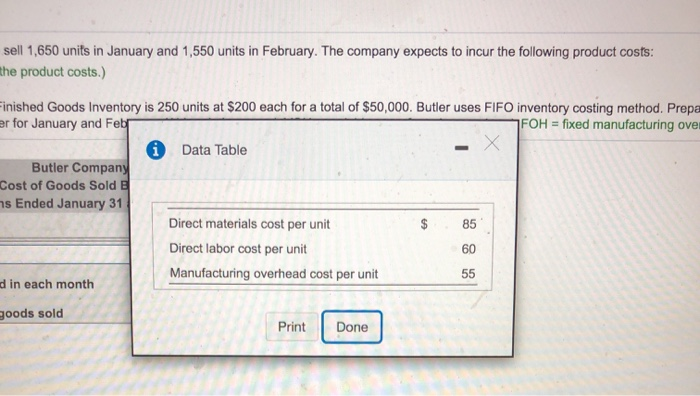

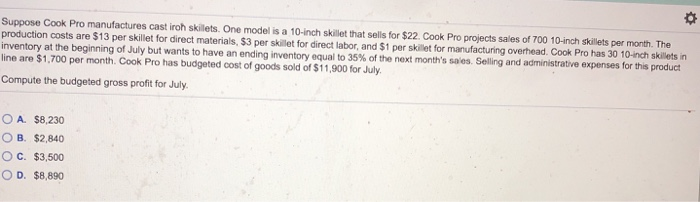

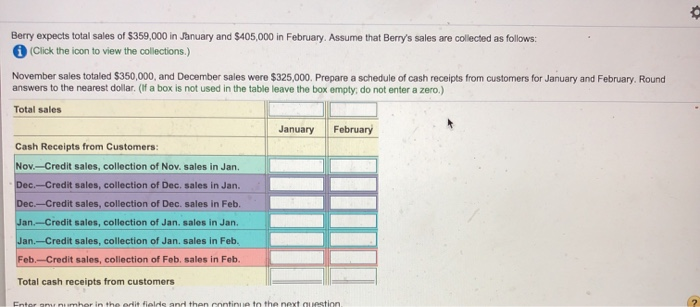

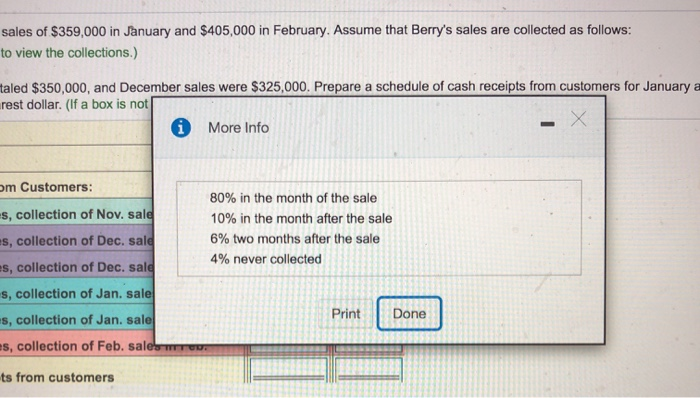

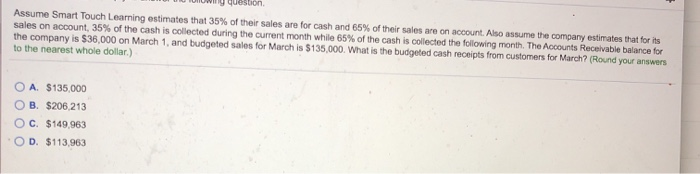

Suppose Cook Plus manufactures cast iron skillets. One model is a 10-inch skillet that sells for $32. Cook Plus projects sales of 675 10-inch skilets per month. The production costs are $11 per skillet for direct materials, 55 per skillet for direct labor, and $3 per skillet for manufacturing overhead. Cook Plus has 40 10-inch skilets in inventory at the beginning of July but wants to have an ending inventory equal to 20% of the next month's sales. Selling and administrative expenses for this product ne are $1.600 per month How many 10-inch skillets should Cook Plus produce in July? O A. 810 skillets OB. 770 skillets OC. 850 skillets OD 675 skillets Butler Company expects to sell 1,650 units in January and 1,550 units in February. The company expects to incur the following product costs: (Click the icon to view the product costs.) The beginning balance in Finished Goods Inventory is 250 units at $200 each for a total of $50,000. Butler uses FIFO inventory costing method. Prepare the cost of goods sold budget for Butler for January and February. (Abbreviations used: VOH = variable manufacturing overhead; FOH = fixed manufacturing overhead.) Butler Company Cost of Goods Sold Budget Two Months Ended January 31 and February 28 January February Units produced and sold in each month Total budgeted cost of goods sold sell 1,650 units in January and 1,550 units in February. The company expects to incur the following product costs: the product costs.) Finished Goods Inventory is 250 units at $200 each for a total of $50,000. Butler uses FIFO inventory costing method. Prepa er for January and Feb FOH = fixed manufacturing over 0 Data Table Butler Company Cost of Goods Sold E as Ended January 31 Direct materials cost per unit Direct labor cost per unit Manufacturing overhead cost per unit d in each month goods sold Print | Done Suppose Cook Pro manufactures cast iroh skilets. One model is a 10-inch skillet that sells for $22. Cook Pro projects sales of 700 10-inch skillets per month. The production costs are $13 per skillet for direct materials, $3 per skillet for direct labor, and $1 per skillet for manufacturing overhead Cook Pro has 30 10-inch skillets in inventory at the beginning of July but wants to have an ending inventory equal to 35% of the next month's sales. Selling and administrative expenses for this product line are $1,700 per month. Cook Pro has budgeted cost of goods sold of $11.900 for July Compute the budgeted gross profit for July O A $8,230 OB. $2,840 OC. $3,500 OD. $8,890 Berry expects total sales of $359,000 in January and $405,000 in February. Assume that Berry's sales are collected as follows: i Click the icon to view the collections.) November sales totaled $350,000, and December sales were $325,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If a box is not used in the table leave the box empty, do not enter a zero) Total sales January February Cash Receipts from Customers: Nov-Credit sales, collection of Nov, sales in Jan. Dec.-Credit sales, collection of Dec. sales in Jan. Dec.-Credit sales, collection of Dec. sales in Feb. Jan.-Credit sales, collection of Jan. sales in Jan. Jan.--Credit sales, collection of Jan. sales in Feb. Feb.-Credit sales, collection of Feb, sales in Feb. Total cash receipts from customers r e han at the new custin sales of $359,000 in January and $405,000 in February. Assume that Berry's sales are collected as follows: to view the collections.) taled $350,000, and December sales were $325,000. Prepare a schedule of cash receipts from customers for January a rest dollar. (If a box is not * More Info 80% in the month of the sale 10% in the month after the sale 6% two months after the sale 4% never collected om Customers: s, collection of Nov. sale s, collection of Dec. sale s, collection of Dec. sale s, collection of Jan. sale s, collection of Jan. sale es, collection of Feb. sales Print Done ts from customers y ques Assume Smart Touch Learning estimates that 35% of their sales are for cash and 65% of their sales are on account. Also assume the company estimates that for its sales on account, 35% of the cash is collected during the current month while 65% of the cash is collected the following month. The Accounts Receivable balance for the company is $36,000 on March 1, and budgeted sales for March is $135,000. What is the budgeted cash receipts from customers for March? (Round your answers to the nearest whole dollar) O A $135,000 O B. $206,213 OC. $149,963 OD. $113,963