Answered step by step

Verified Expert Solution

Question

1 Approved Answer

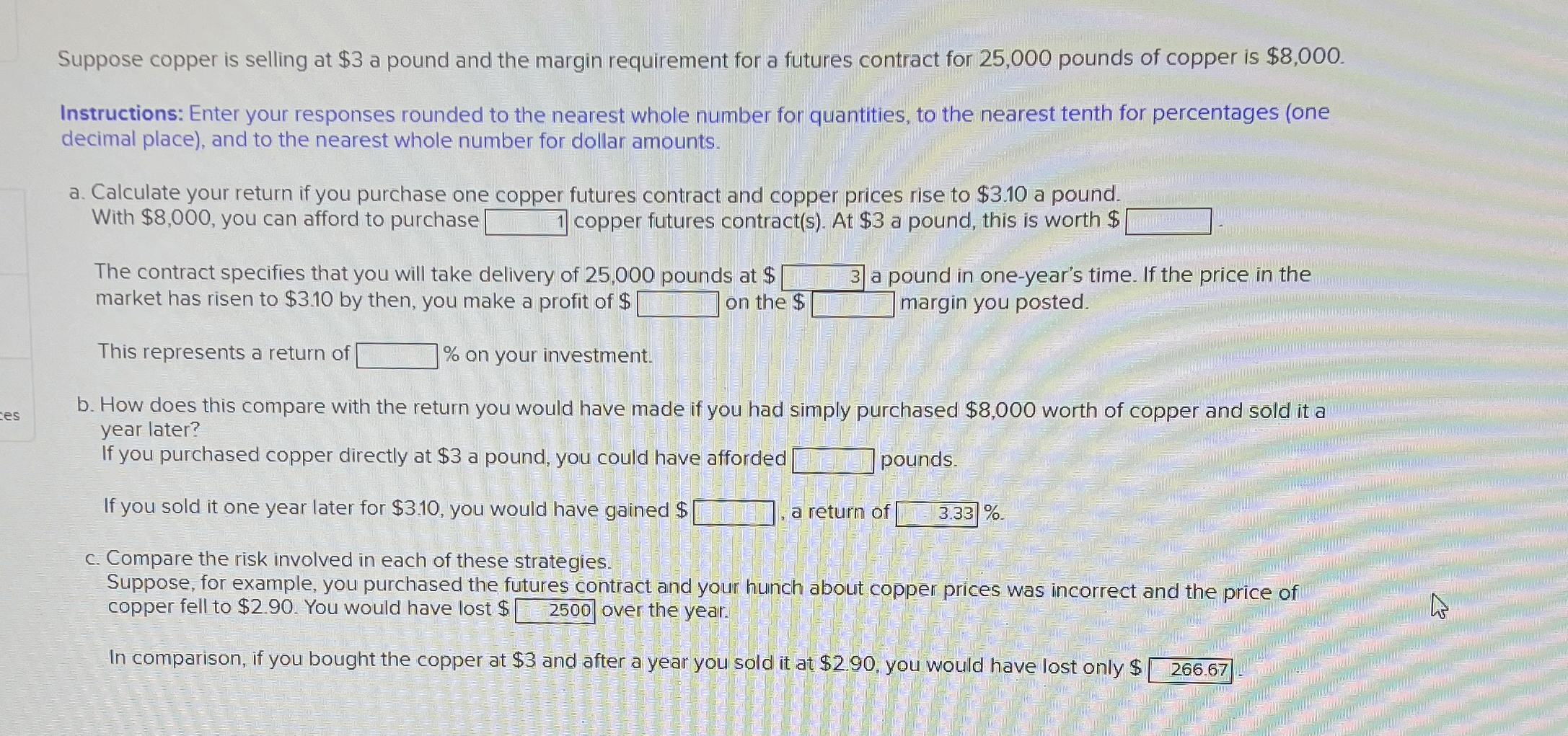

Suppose copper is selling at $ 3 a pound and the margin requirement for a futures contract for 2 5 , 0 0 0 pounds

Suppose copper is selling at $ a pound and the margin requirement for a futures contract for pounds of copper is $

Instructions: Enter your responses rounded to the nearest whole number for quantities, to the nearest tenth for percentages one

decimal place and to the nearest whole number for dollar amounts.

a Calculate your return if you purchase one copper futures contract and copper prices rise to $ a pound.

With $ you can afford to purchase

copper futures contracts At $ a pound, this is worth $

The contract specifies that you will take delivery of pounds at $

market has risen to $ by then, you make a profit of $

on the $

a pound in oneyear's time. If the price in the

margin you posted.

This represents a return of

on your investment.

b How does this compare with the return you would have made if you had simply purchased $ worth of copper and sold it a

year later?

If you purchased copper directly at $ a pound, you could have afforded

pounds.

If you sold it one year later for $ you would have gained $

a return of

c Compare the risk involved in each of these strategies.

Suppose, for example, you purchased the futures contract and your hunch about copper prices was incorrect and the price of

copper fell to $ You would have lost $

over the year.

In comparison, if you bought the copper at $ and after a year you sold it at $ you would have lost only $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started