Answered step by step

Verified Expert Solution

Question

1 Approved Answer

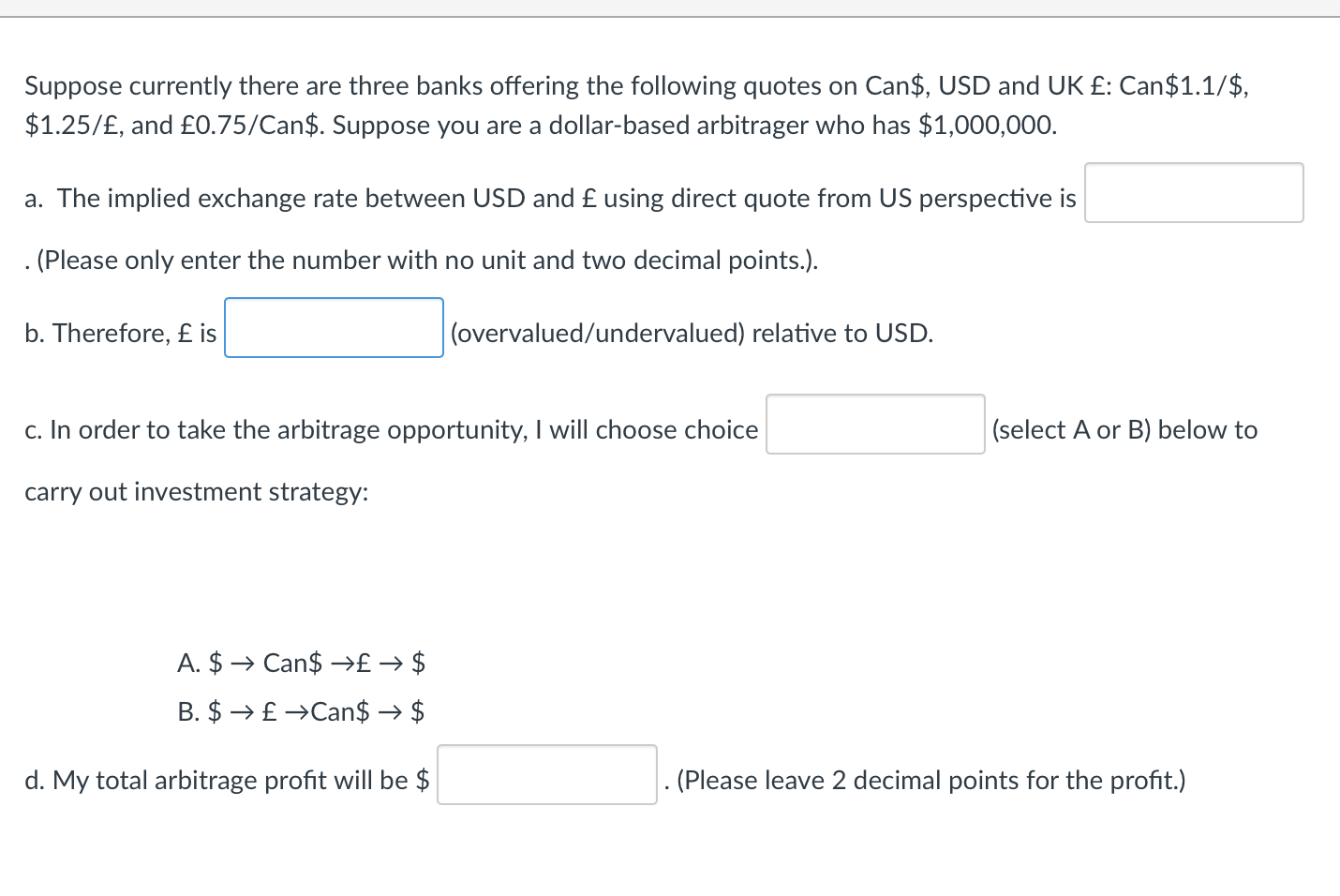

Suppose currently there are three banks offering the following quotes on Can$, USD and UK : Can $1.1/$, $1.25/, and 0.75/ Can $. Suppose you

Suppose currently there are three banks offering the following quotes on Can\$, USD and UK : Can $1.1/$, $1.25/, and 0.75/ Can $. Suppose you are a dollar-based arbitrager who has $1,000,000. a. The implied exchange rate between USD and using direct quote from US perspective is . (Please only enter the number with no unit and two decimal points.). b. Therefore, is (overvalued/undervalued) relative to USD. c. In order to take the arbitrage opportunity, I will choose choice carry out investment strategy: (select A or B) below to (select A or B) below to A. $Can$$ B. $ Can $$ d. My total arbitrage profit will be $ . (Please leave 2 decimal points for the profit.)

Suppose currently there are three banks offering the following quotes on Can\$, USD and UK : Can $1.1/$, $1.25/, and 0.75/ Can $. Suppose you are a dollar-based arbitrager who has $1,000,000. a. The implied exchange rate between USD and using direct quote from US perspective is . (Please only enter the number with no unit and two decimal points.). b. Therefore, is (overvalued/undervalued) relative to USD. c. In order to take the arbitrage opportunity, I will choose choice carry out investment strategy: (select A or B) below to (select A or B) below to A. $Can$$ B. $ Can $$ d. My total arbitrage profit will be $ . (Please leave 2 decimal points for the profit.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started