Answered step by step

Verified Expert Solution

Question

1 Approved Answer

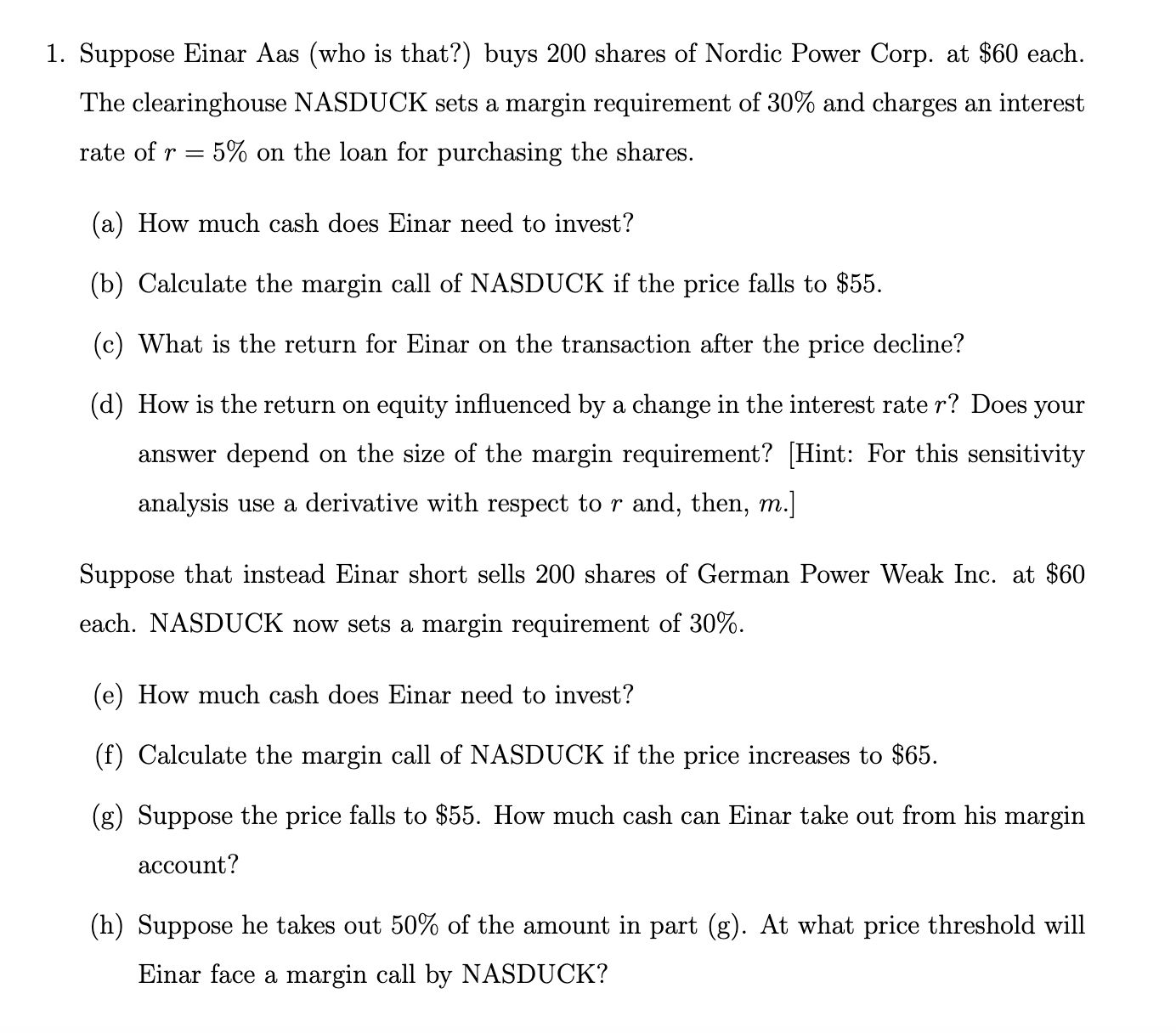

Suppose Einar Aas ( who is that? ) buys 2 0 0 shares of Nordic Power Corp. at $ 6 0 each. The clearinghouse NASDUCK

Suppose Einar Aas who is that? buys shares of Nordic Power Corp. at $ each.

The clearinghouse NASDUCK sets a margin requirement of and charges an interest

rate of on the loan for purchasing the shares.

a How much cash does Einar need to invest?

b Calculate the margin call of NASDUCK if the price falls to $

c What is the return for Einar on the transaction after the price decline?

d How is the return on equity influenced by a change in the interest rate Does your

answer depend on the size of the margin requirement? Hint: For this sensitivity

analysis use a derivative with respect to and, then,

Suppose that instead Einar short sells shares of German Power Weak Inc. at $

each. NASDUCK now sets a margin requirement of

e How much cash does Einar need to invest?

f Calculate the margin call of NASDUCK if the price increases to $

g Suppose the price falls to $ How much cash can Einar take out from his margin

account?

h Suppose he takes out of the amount in part g At what price threshold will

Einar face a margin call by NASDUCK?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started