Answered step by step

Verified Expert Solution

Question

1 Approved Answer

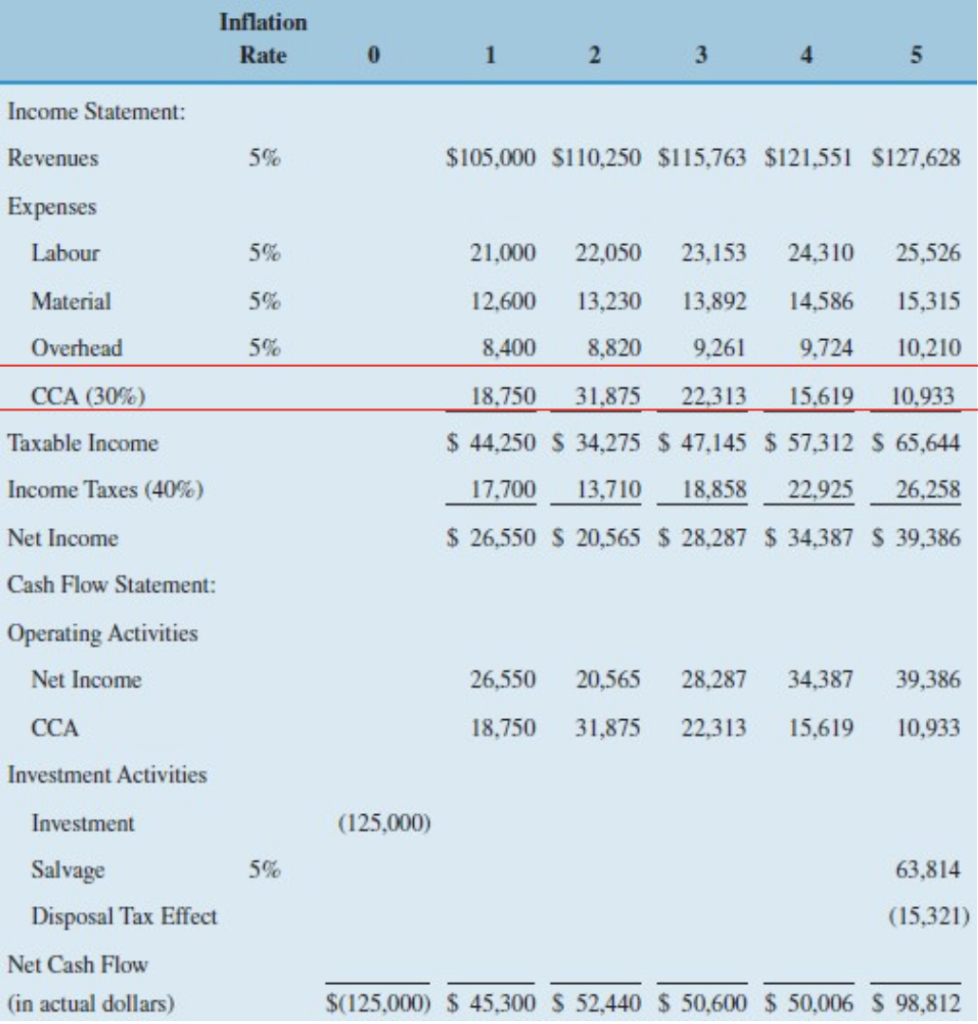

Suppose Example 14.8 from the slides was only a 3-year project. Using the net cash flows derived from the Cash Flow Statement, find the IRR

Suppose Example 14.8 from the slides was only a 3-year project. Using the net cash flows derived from the Cash Flow Statement, find the IRR for the project.

Question 2 options:

| 21-22% | |

| 22-23% | |

| 23-24% | |

| 24-25% | |

| None of the above |

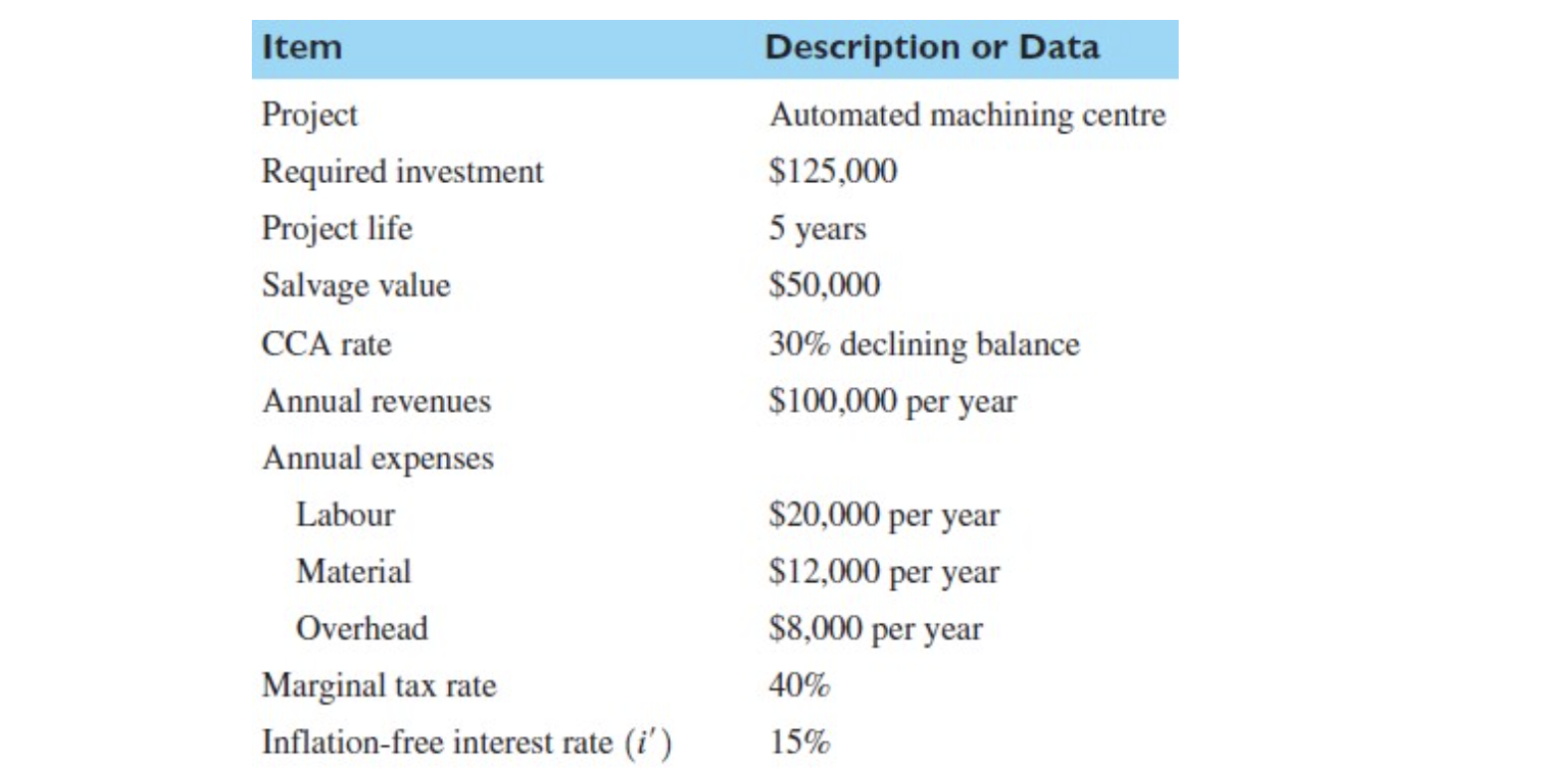

Item Description or Data Automated machining centre $125,000 5 years $50,000 30% declining balance $100,000 per year Project Required investment Project life Salvage value CCA rate Annual revenues Annual expenses Labour Material Overhead Marginal tax rate Inflation-free interest rate (i') $20,000 per year $12,000 per year $8,000 per year 40% 15% Inflation Rate 0 1 2 3 4 5 5% $ 105,000 $110,250 $115,763 $121,551 $127,628 5% 21,000 22,050 23,153 24,310 25,526 5% 12.600 13,230 13.892 14,586 15,315 5% 8.400 8,820 9.261 9.724 10,210 Income Statement: Revenues Expenses Labour Material Overhead CCA (30%) Taxable Income Income Taxes (40%) Net Income Cash Flow Statement: Operating Activities Net Income 18.750 31.875 22.313 15.619 10,933 $ 44,250 $ 34,275 $ 47,145 $ 57,312 $ 65,644 17.700 13.710 18,858 22.925 26,258 $ 26,550 $ 20,565 $ 28,287 $ 34,387 $ 39,386 26.550 20.565 28.287 34.387 39,386 CCA 18,750 31,875 22,313 15,619 10,933 (125,000) 5% 63,814 Investment Activities Investment Salvage Disposal Tax Effect Net Cash Flow (in actual dollars) (15.321) $(125,000) $ 45,300 $ 52,440 $ 50,600 $ 50,006 $ 98,812

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started