Question

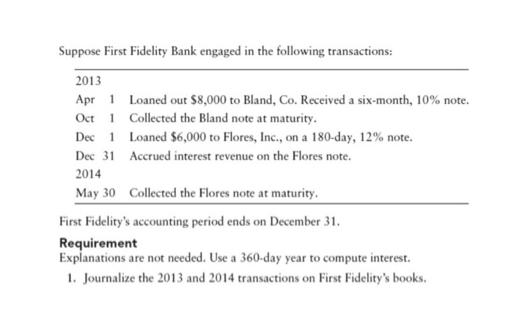

Suppose First Fidelity Bank engaged in the following transactions: 2013 Apr 1 Loaned out $8,000 to Bland, Co. Received a six-month, 10% note. Oct

Suppose First Fidelity Bank engaged in the following transactions: 2013 Apr 1 Loaned out $8,000 to Bland, Co. Received a six-month, 10% note. Oct 1 Collected the Bland note at maturity. Dec 1 Loaned $6,000 to Flores, Inc., on a 180-day, 12% note. Dec 31 Accrued interest revenue on the Flores note. 2014 May 30 Collected the Flores note at maturity. First Fidelity's accounting period ends on December 31. Requirement Explanations are not needed. Use a 360-day year to compute interest. 1. Journalize the 2013 and 2014 transactions on First Fidelity's books.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Account titles Date Explanations 2013 1Apr Note receivableBland Co c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael H. Granof, Saleha B. Khumawala

6th edition

978-1-119-4958, 9781118473047, 1118155971, 1118473043, 978-1118155974

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App