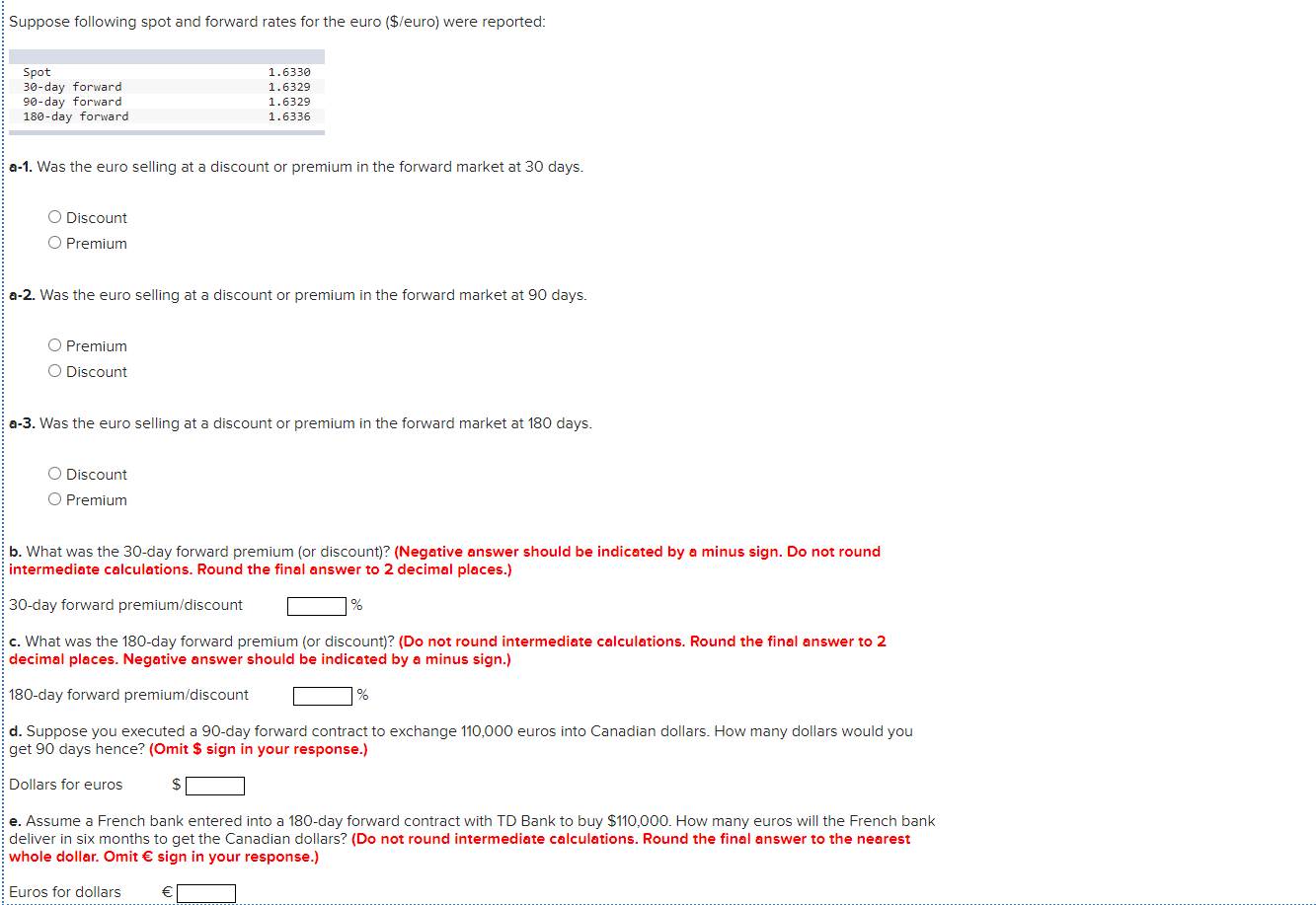

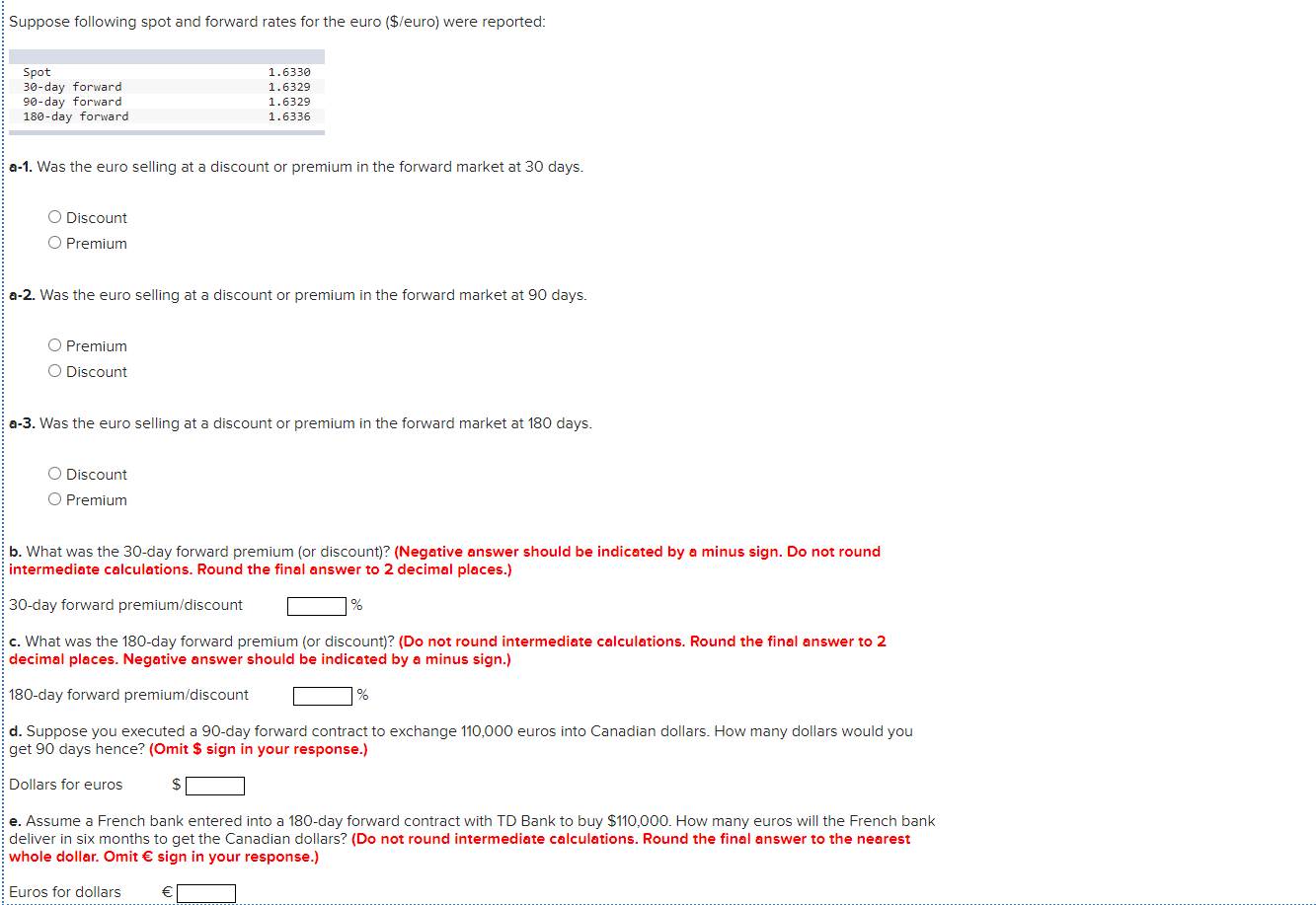

Suppose following spot and forward rates for the euro (\$/euro) were reported: a-1. Was the euro selling at a discount or premium in the forward market at 30 days. Discount Premium a-2. Was the euro selling at a discount or premium in the forward market at 90 days. Premium Discount a-3. Was the euro selling at a discount or premium in the forward market at 180 days. Discount Premium b. What was the 30-day forward premium (or discount)? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places.) 30-day forward premium/discount % c. What was the 180-day forward premium (or discount)? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answer should be indicated by a minus sign.) 180-day forward premium/discount % d. Suppose you executed a 90-day forward contract to exchange 110,000 euros into Canadian dollars. How many dollars would you get 90 days hence? (Omit \$ sign in your response.) Dollars for euros $ Suppose following spot and forward rates for the euro (\$/euro) were reported: a-1. Was the euro selling at a discount or premium in the forward market at 30 days. Discount Premium a-2. Was the euro selling at a discount or premium in the forward market at 90 days. Premium Discount a-3. Was the euro selling at a discount or premium in the forward market at 180 days. Discount Premium b. What was the 30-day forward premium (or discount)? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places.) 30-day forward premium/discount % c. What was the 180-day forward premium (or discount)? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Negative answer should be indicated by a minus sign.) 180-day forward premium/discount % d. Suppose you executed a 90-day forward contract to exchange 110,000 euros into Canadian dollars. How many dollars would you get 90 days hence? (Omit \$ sign in your response.) Dollars for euros $