Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose for the next three months, interest rates rise such that the average yield on RSAs increase by 40 basis point and the average yield

Suppose for the next three months, interest rates rise such that the average yield on RSAs increase by 40 basis point and the average yield on RSLs increase by 60 basis point, what is the changes in NII for the bank?

Suppose for the next three months, interest rates rise such that the average yield on RSAs increase by 40 basis point and the average yield on RSLs increase by 60 basis point, what is the changes in NII for the bank?

a. -$900,000

b. $240,000

c. -$60,000

d. $900,000

The following run-offs are expected at the end of this year: 20 million for 5-yr treasury notes, and 15 million for the 3 year floating rate mortgage. What is the one-year repricing gap?

a. 140 mil

b. 120 mil

c. 60 mil

d. 80 mil

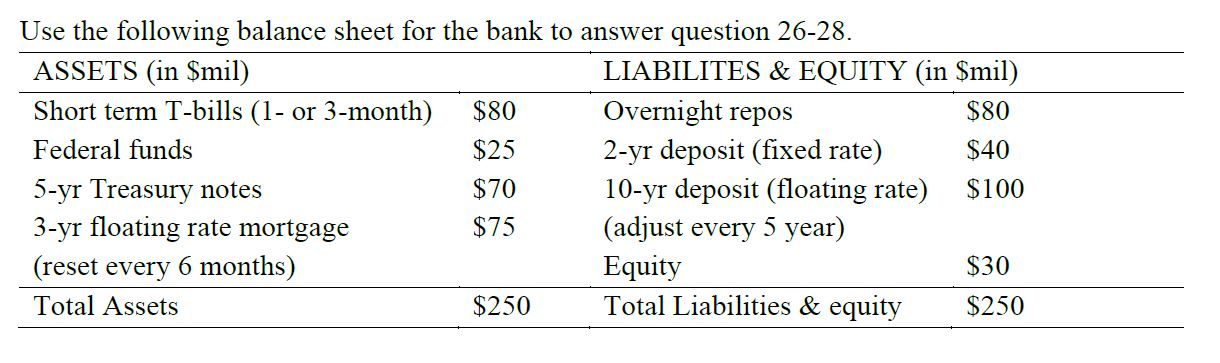

Use the following balance sheet for the bank to answer question 26-28. ASSETS (in $mil) LIABILITES & EQUITY (in $mil) Short term T-bills (1- or 3-month) $80 Overnight repos $80 Federal funds $25 2-yr deposit (fixed rate) $40 5-yr Treasury notes $70 10-yr deposit (floating rate) $100 3-yr floating rate mortgage $75 (adjust every 5 year) (reset every 6 months) Equity $30 Total Assets $250 Total Liabilities & equity $250 Use the following balance sheet for the bank to answer question 26-28. ASSETS (in $mil) LIABILITES & EQUITY (in $mil) Short term T-bills (1- or 3-month) $80 Overnight repos $80 Federal funds $25 2-yr deposit (fixed rate) $40 5-yr Treasury notes $70 10-yr deposit (floating rate) $100 3-yr floating rate mortgage $75 (adjust every 5 year) (reset every 6 months) Equity $30 Total Assets $250 Total Liabilities & equity $250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started