Question

Suppose General Construction ltd has two investments (A and B) with the following probability distributions: (i) Expected return of Investment A [2 Marks] (ii) Standard

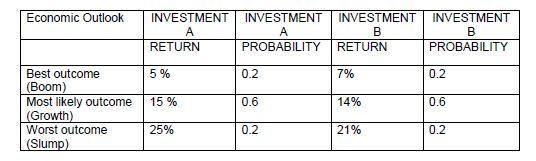

Suppose General Construction ltd has two investments (A and B) with the following probability distributions:

(i) Expected return of Investment A [2 Marks]

(ii) Standard Deviation of Investment A [3 Marks]

(iii) Expected return of Investment B [2 Marks]

(iv) Standard Deviation of Investment B [3 Marks]

(b) The portfolio of A and B has a positive correlation of 0.20 and the portfolio comprises 40 percent Investment A and 60 percent Investment B. Calculate: (i) Expected return of Portfolio AB [4 Marks] (ii) Standard Deviation of Portfolio AB[6 Marks]

(c) There are two elements of risk attached to any security: systematic (market) and unsystematic (specific). Explain the difference between these two elements of risk. [5 Marks]

Economic Outlook INVESTMENT A RETURN INVESTMENT PROBABILITY INVESTMENT B RETURN INVESTMENT B PROBABILITY 5 % 0.2 7% 0.2 15 % 0.6 14% 0.6 Best outcome (Boom) Most likely outcome (Growth) Worst outcome (Slump) 25% 0.2 21% 0.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started