Question

Suppose Gilliani Supplies paid $28,000 for inventory. By its year-end, the company had sold 60 percent of the inventory but determined that the remaining inventory

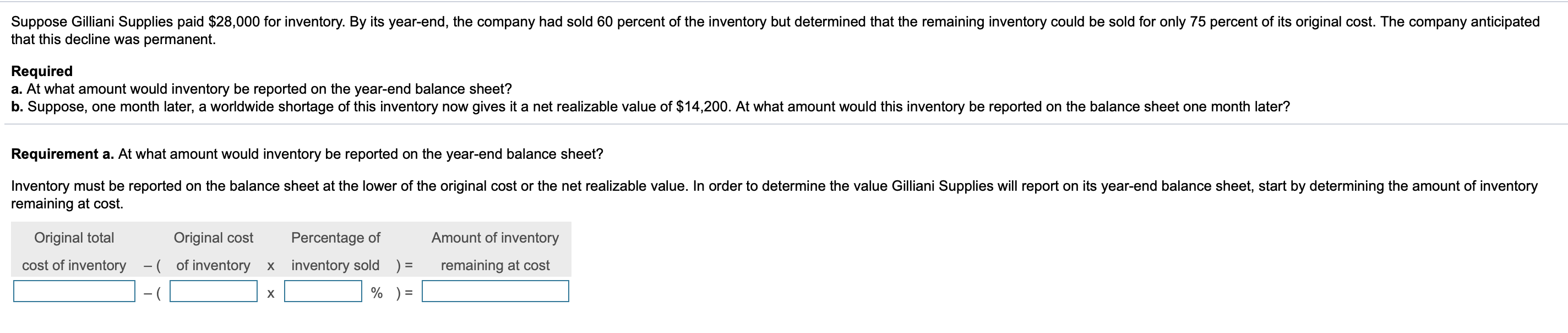

Suppose Gilliani Supplies paid $28,000 for inventory. By its year-end, the company had sold 60 percent of the inventory but determined that the remaining inventory could be sold for only 75 percent of its original cost. The company anticipated that this decline was permanent. Required a. At what amount would inventory be reported on the year-end balance sheet? b. Suppose, one month later, a worldwide shortage of this inventory now gives it a net realizable value of $14,200. At what amount would this inventory be reported on the balance sheet one month later? Requirement a. At what amount would inventory be reported on the year-end balance sheet? Inventory must be reported on the balance sheet at the lower of the original cost or the net realizable value. In order to determine the value Gilliani Supplies will report on its year-end balance sheet, start by determining the amount of inventory remaining at cost.

Suppose Gilliani Supplies paid $28,000 for inventory. By its year-end, the company had sold 60 percent of the inventory but determined that the remaining inventory could be sold for only 75 percent of its original cost. The company anticipated that this decline was permanent. Required a. At what amount would inventory be reported on the year-end balance sheet? b. Suppose, one month later, a worldwide shortage of this inventory now gives it a net realizable value of $14,200. At what amount would this inventory be reported on the balance sheet one month later? Requirement a. At what amount would inventory be reported on the year-end balance sheet? Inventory must be reported on the balance sheet at the lower of the original cost or the net realizable value. In order to determine the value Gilliani Supplies will report on its year-end balance sheet, start by determining the amount of inventory remaining at cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started