Question

Suppose GM is considering expanding its operations to a new overseas market. The move will require $1,000,000,000 to build a new plant, sales center, and

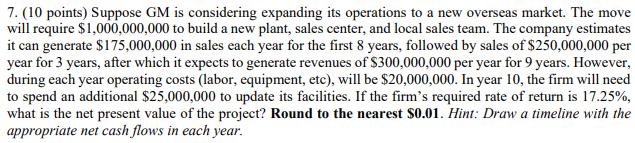

Suppose GM is considering expanding its operations to a new overseas market. The move will require $1,000,000,000 to build a new plant, sales center, and local sales team. The company estimates it can generate $175,000,000 in sales each year for the first 8 years, followed by sales of $250,000,000 per year for 3 years, after which it expects to generate revenues of $300,000,000 per year for 9 years. However, during each year operating costs (labor, equipment, etc), will be $20,000,000. In year 10, the firm will need to spend an additional $25,000,000 to update its facilities. If the firms required rate of return is 17.25%, what is the net present value of the project? Round to the nearest $0.01.

7. (10 points) Suppose GM is considering expanding its operations to a new overseas market. The move will require \\( \\$ 1,000,000,000 \\) to build a new plant, sales center, and local sales team. The company estimates it can generate \\( \\$ 175,000,000 \\) in sales each year for the first 8 years, followed by sales of \\( \\$ 250,000,000 \\) per year for 3 years, after which it expects to generate revenues of \\( \\$ 300,000,000 \\) per year for 9 years. However, during each year operating costs (labor, equipment, etc), will be \\( \\$ 20,000,000 \\). In year 10 , the firm will need to spend an additional \\( \\$ 25,000,000 \\) to update its facilities. If the firm's required rate of return is \17.25, what is the net present value of the project? Round to the nearest \\$0.01. Hint: Draw a timeline with the appropriate net cash flows in each year

7. (10 points) Suppose GM is considering expanding its operations to a new overseas market. The move will require \\( \\$ 1,000,000,000 \\) to build a new plant, sales center, and local sales team. The company estimates it can generate \\( \\$ 175,000,000 \\) in sales each year for the first 8 years, followed by sales of \\( \\$ 250,000,000 \\) per year for 3 years, after which it expects to generate revenues of \\( \\$ 300,000,000 \\) per year for 9 years. However, during each year operating costs (labor, equipment, etc), will be \\( \\$ 20,000,000 \\). In year 10 , the firm will need to spend an additional \\( \\$ 25,000,000 \\) to update its facilities. If the firm's required rate of return is \17.25, what is the net present value of the project? Round to the nearest \\$0.01. Hint: Draw a timeline with the appropriate net cash flows in each year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started