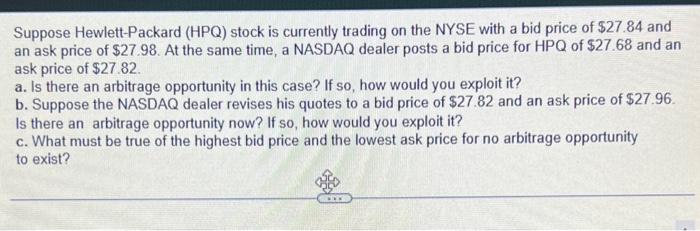

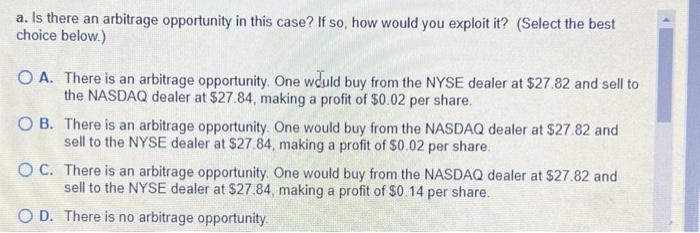

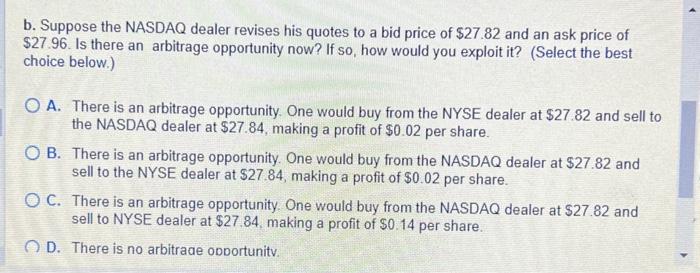

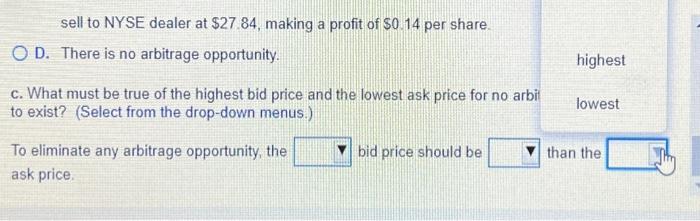

Suppose Hewlett-Packard (HPQ) stock is currently trading on the NYSE with a bid price of $27.84 and an ask price of \$27.98. At the same time, a NASDAQ dealer posts a bid price for HPQ of \$27.68 and an ask price of $27.82. a. Is there an arbitrage opportunity in this case? If so, how would you exploit it? b. Suppose the NASDAQ dealer revises his quotes to a bid price of $27.82 and an ask price of $27.96. Is there an arbitrage opportunity now? If so, how would you exploit it? c. What must be true of the highest bid price and the lowest ask price for no arbitrage opportunity to exist? sell to NYSE dealer at $27.84, making a profit of $0.14 per share. D. There is no arbitrage opportunity. highest c. What must be true of the highest bid price and the lowest ask price for no arbi to exist? (Select from the drop-down menus.) lowest To eliminate any arbitrage opportunity, the bid price should be than the ask price. b. Suppose the NASDAQ dealer revises his quotes to a bid price of $27.82 and an ask price of $27.96. Is there an arbitrage opportunity now? If so, how would you exploit it? (Select the best choice below.) A. There is an arbitrage opportunity. One would buy from the NYSE dealer at $27.82 and sell to the NASDAQ dealer at $27.84, making a profit of $0.02 per share. B. There is an arbitrage opportunity. One would buy from the NASDAQ dealer at $27.82 and sell to the NYSE dealer at $27.84, making a profit of $0.02 per share. C. There is an arbitrage opportunity. One would buy from the NASDAQ dealer at $27.82 and sell to NYSE dealer at $27.84, making a profit of $0.14 per share. D. There is no arbitrade opDortunitv. a. Is there an arbitrage opportunity in this case? If so, how would you exploit it? (Select the best choice below.) A. There is an arbitrage opportunity. One wjuld buy from the NYSE dealer at $27.82 and sell to the NASDAQ dealer at $27.84, making a profit of $0.02 per share. B. There is an arbitrage opportunity. One would buy from the NASDAQ dealer at $27.82 and sell to the NYSE dealer at $27.84, making a profit of $0.02 per share. C. There is an arbitrage opportunity. One would buy from the NASDAQ dealer at $27.82 and sell to the NYSE dealer at $27.84, making a profit of $0.14 per share. D. There is no arbitrage opportunity