Answered step by step

Verified Expert Solution

Question

1 Approved Answer

suppose if the sales of the company increase by 10%, what is the NPV of all the five projects (Gopher place, Whalen court, The Barn,

- suppose if the sales of the company increase by 10%, what is the NPV of all the five projects (Gopher place, Whalen court, The Barn, Goldie's square and Stadium remodel )

- Calculate other project evaluation criteria:

- Payback period

- Discounted payback period

- Breakeven point

- Profitability index,

- Average accounting return

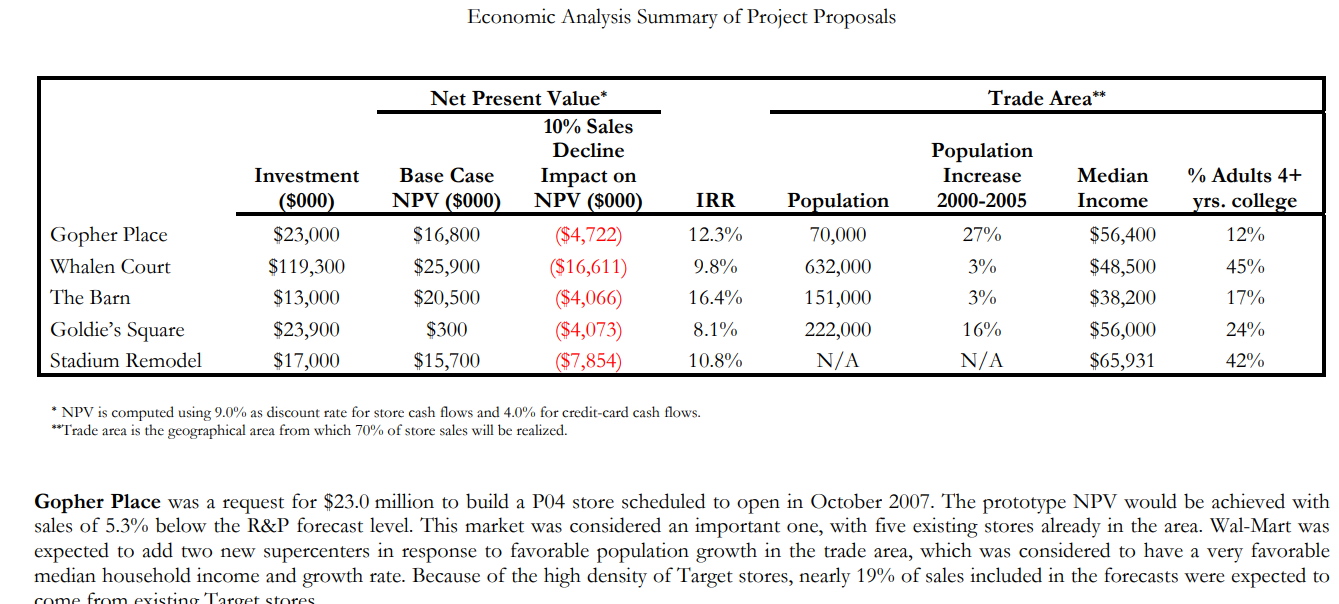

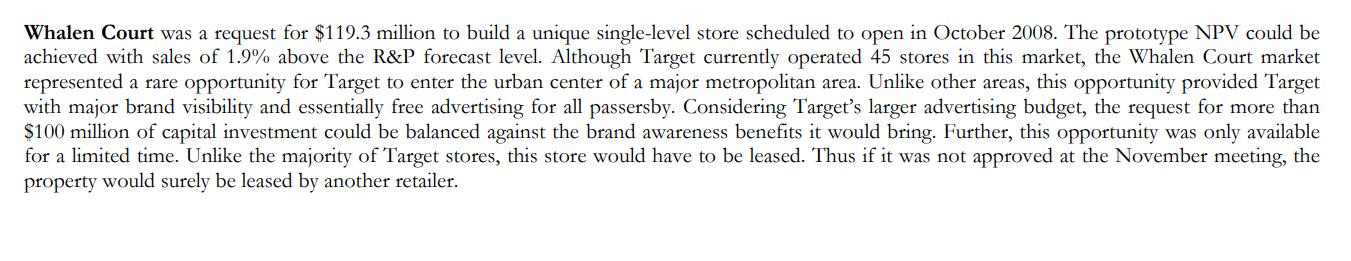

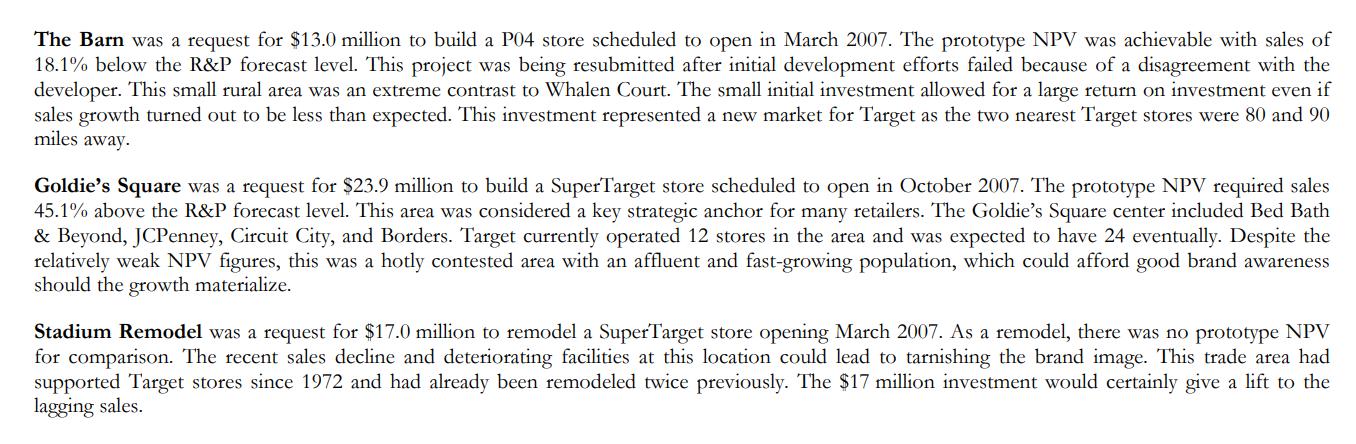

Gopher Place Whalen Court The Barn Goldie's Square Stadium Remodel Investment ($000) $23,000 $119,300 $13,000 $23,900 $17,000 Economic Analysis Summary of Project Proposals Net Present Value* Base Case NPV ($000) $16,800 $25,900 $20,500 $300 $15,700 10% Sales Decline Impact on NPV ($000) ($4,722) ($16,611) ($4,066) ($4,073) ($7,854) IRR 12.3% 9.8% 16.4% 8.1% 10.8% * NPV is computed using 9.0% as discount rate for store cash flows and 4.0% for credit-card cash flows. **Trade area is the geographical area from which 70% of store sales will be realized. Population 70,000 632,000 151,000 222,000 N/A Trade Area** Population Increase 2000-2005 27% 3% 3% 16% N/A Median Income $56,400 $48,500 $38,200 $56,000 $65,931 % Adults 4+ yrs. college 12% 45% 17% 24% 42% Gopher Place was a request for $23.0 million to build a P04 store scheduled to open in October 2007. The prototype NPV would be achieved with sales of 5.3% below the R&P forecast level. This market was considered an important one, with five existing stores already in the area. Wal-Mart was expected to add two new supercenters in response to favorable population growth in the trade area, which was considered to have a very favorable median household income and growth rate. Because of the high density of Target stores, nearly 19% of sales included in the forecasts were expected to come from existing Target stores

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets calculate the NPV of the five projects Gopher Place Whalen Court The Barn Goldies Square and Stadium Remodel if the companys sales increase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started