Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose it is February 22, 2006 and you have the following data for the S&P 500 and the FTSE 100. Since the index futures

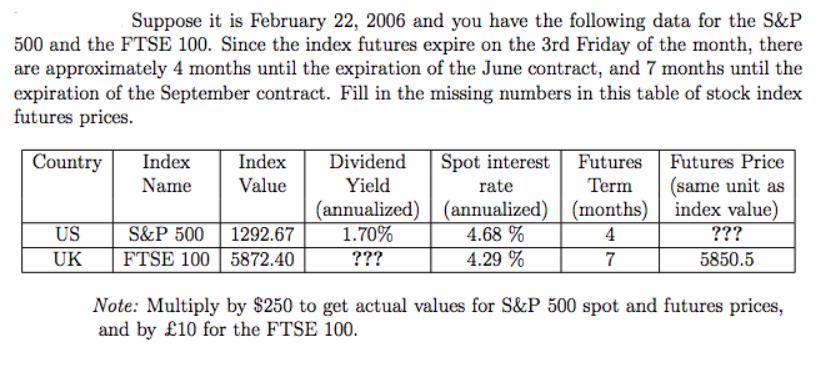

Suppose it is February 22, 2006 and you have the following data for the S&P 500 and the FTSE 100. Since the index futures expire on the 3rd Friday of the month, there are approximately 4 months until the expiration of the June contract, and 7 months until the expiration of the September contract. Fill in the missing numbers in this table of stock index futures prices. Country US UK Index Name Index Dividend Value Yield S&P 500 1292.67 FTSE 100 5872.40 (annualized) 1.70% ??? Spot interest Futures Term rate (annualized)| (months) 4.68 % 4 4.29% 7 Futures Price (same unit as index value) ??? 5850.5 Note: Multiply by $250 to get actual values for S&P 500 spot and futures prices, and by 10 for the FTSE 100.

Step by Step Solution

★★★★★

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 FTSE 100 dividend yield Based on UK dividend yields at that time b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started