Question

Suppose it is known that 10% of all orders get returned to the store each Saturday and there are 400 orders most weeks. Let x=

Suppose it is known that

10%of all orders get returned to the store each Saturday and there are 400 orders most weeks. Let

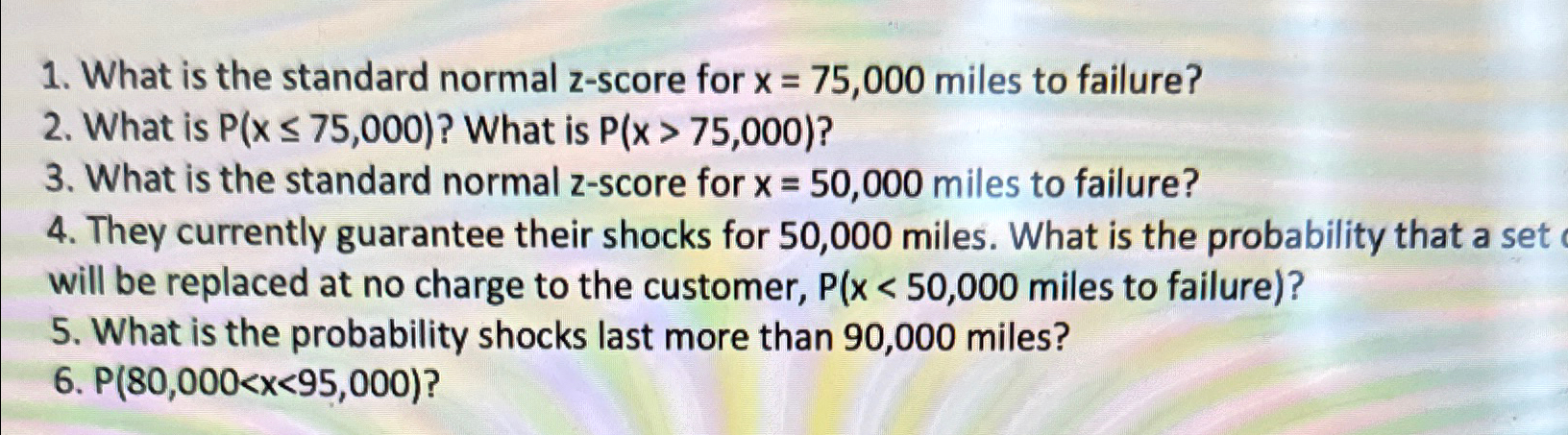

x=number of returns and a return = "success".\ What is the mean number of returns (a.k.a. expected value)?\ What is the mean number of returns \ \ Meadas company makes shocks. The distance traveled before the shocks wear out is normally distributed with population mean

=75,000miles to failure and population standard deviation

=15,000miles.\ What is the standard normal

z-score for

x=75,000miles to failure?\ What is

P(x ? What is

P(x>75,000) ?\ What is the standard normal

z-score for

x=50,000 miles to failure?\ They currently guarantee their shocks for 50,000 miles. What is the probability that a set of shocks will be replaced at no charge to the customer, miles to failure \ \ What is the standard normal

z-score for

x=75,000 miles to failure?\ What is

P(x ? What is

P(x>75,000) ?\ What is the standard normal

z-score for

x=50,000 miles to failure?\ They currently guarantee their shocks for 50,000 miles. What is the probability that a set will be replaced at no charge to the customer, miles to failure)?\ What is the probability shocks last more than 90,000 miles?\

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started