Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose John owns a share of stock in Columbus Research, a computer software firm. Jessica is interested in investing in the company. John and

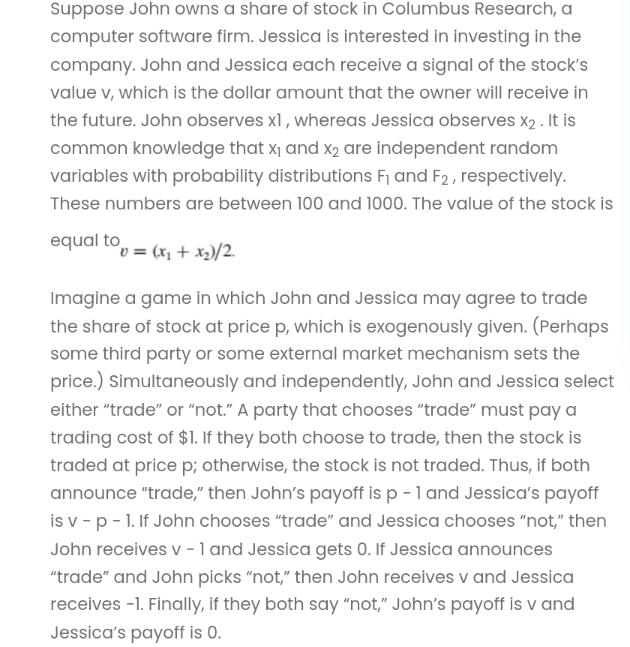

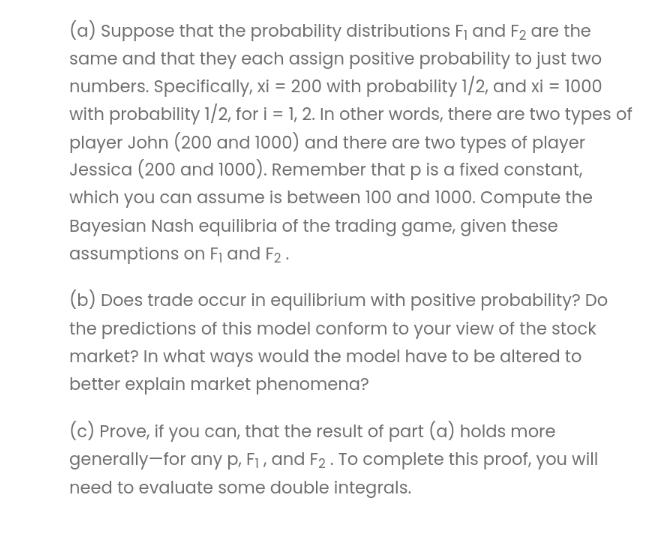

Suppose John owns a share of stock in Columbus Research, a computer software firm. Jessica is interested in investing in the company. John and Jessica each receive a signal of the stock's value v, which is the dollar amount that the owner will receive in the future. John observes x1, whereas Jessica observes X2 . It is common knowledge that x and x2 are independent random variables with probability distributions F and F, respectively. These numbers are between 100 and 1000. The value of the stock is equal to v = (x + x)/2. Imagine a game in which John and Jessica may agree to trade the share of stock at price p, which is exogenously given. (Perhaps some third party or some external market mechanism sets the price.) Simultaneously and independently, John and Jessica select either "trade" or "not." A party that chooses "trade" must pay a trading cost of $1. If they both choose to trade, then the stock is traded at price p; otherwise, the stock is not traded. Thus, if both announce "trade," then John's payoff is p - 1 and Jessica's payoff is v - p - 1. If John chooses "trade" and Jessica chooses "not," then John receives v -1 and Jessica gets 0. If Jessica announces "trade" and John picks "not," then John receives v and Jessica receives -1. Finally, if they both say "not," John's payoff is v and Jessica's payoff is 0. (a) suppose that the probability distributions F and F are the same and that they each assign positive probability to just two numbers. Specifically, xi= 200 with probability 1/2, and xi = 1000 with probability 1/2, for i=1, 2. In other words, there are two types of player John (200 and 1000) and there are two types of player Jessica (200 and 1000). Remember that p is a fixed constant, which you can assume is between 100 and 1000. Compute the Bayesian Nash equilibria of the trading game, given these assumptions on F and F. (b) Does trade occur in equilibrium with positive probability? Do the predictions of this model conform to your view of the stock market? In what ways would the model have to be altered to better explain market phenomena? (c) Prove, if you can, that the result of part (a) holds more generally-for any p, F, and F2. To complete this proof, you will need to evaluate some double integrals.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the Bayesian Nash equilibria we need to determine the strategies that maximize the expected payoff for each player given the strategies of the other player Lets consider Johns strategy fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started