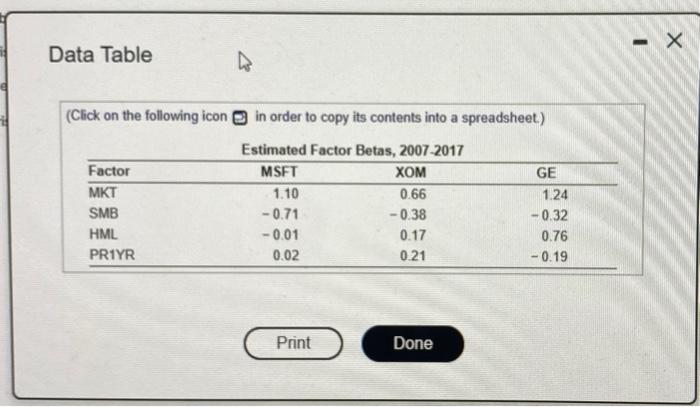

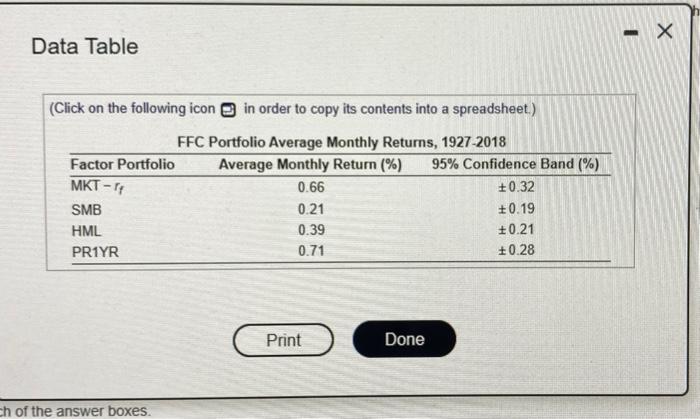

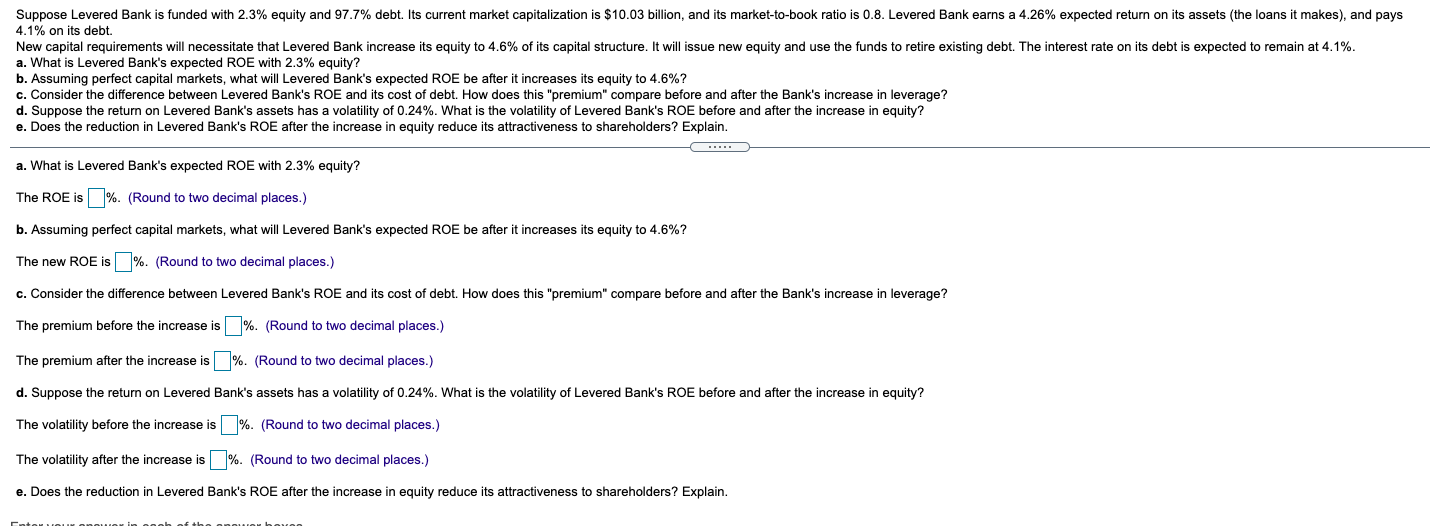

Suppose Levered Bank is funded with 2.3% equity and 97.7% debt. Its current market capitalization is $10.03 billion, and its market-to-book ratio is 0.8. Levered Bank earns a 4.26% expected return on its assets (the loans it makes), and pays 4.1% on its debt. New capital requirements will necessitate that Levered Bank increase its equity to 4.6% of its capital structure. It will issue new equity and use the funds to retire existing debt. The interest rate on its debt is expected to remain at 4.1%. a. What is Levered Bank's expected ROE with 2.3% equity? b. Assuming perfect capital markets, what will Levered Bank's expected ROE be after it increases its equity to 4.6%? c. Consider the difference between Levered Bank's ROE and its cost of debt. How does this "premium" compare before and after the Bank's increase in leverage? d. Suppose the return on Levered Bank's assets has a volatility of 0.24%. What is the volatility of Levered Bank's ROE before and after the increase in equity? e. Does the reduction in Levered Bank's ROE after the increase in equity reduce its attractiveness to shareholders? Explain. a. What is Levered Bank's expected ROE with 2.3% equity? The ROE is %. (Round to two decimal places.) b. Assuming perfect capital markets, what will Levered Bank's expected ROE be after it increases its equity to 4.6%? The new ROE is %. (Round to two decimal places.) c. Consider the difference between Levered Bank's ROE and its cost of debt. How does this "premium" compare before and after the Bank's increase in leverage? The premium before the increase is%. (Round to two decimal places.) The premium after the increase is %. (Round to two decimal places.) d. Suppose the return on Levered Bank's assets has a volatility of 0.24%. What is the volatility of Levered Bank's ROE before and after the increase in equity? The volatility before the increase is %. (Round to two decimal places.) The volatility after the increase is %. (Round to two decimal places.) e. Does the reduction in Levered Bank's ROE after the increase in equity reduce its attractiveness to shareholders? Explain. Using the factor beta estimates in the table shown here and the monthly expected return estimates in Table 131 calculate the risk premium of General Electric stock (ticker GE) using the FFC factor specification (Annualize your result by multiplying by 12) GEs CAPM beta over the same time period was 151 How does the risk premium you would estimate from the CAPM compare? The monthly risk premium of General Electric stock is 0% (Round to three decimal places) The annual risk premium of General Electric stock is 0% (Round to two decimal places) GE'S CAPM beta over the same time period was 1.51. How does the risk premium compare with the risk premium you would estimate from the CAPM? The annual tisk premium produced by the CAPM beta is % (Round to two decimal places) How does the risk premium compare with the risk premium you would estimate from the CAPM? (Select from the drop-down menu) The annual tisk premium produced by the CAPM beta is than the annual risk premium of General Electric stock Data Table (Click on the following icon in order to copy its contents into a spreadsheet) Factor MKT SMB HML PRIYR Estimated Factor Betas, 2007-2017 MSET XOM 1.10 0.66 -0.71 -0.38 -0.01 0.17 0.21 GE 1.24 -0.32 0.76 -0.19 0.02 Print Done - Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) FFC Portfolio Average Monthly Returns, 1927-2018 Factor Portfolio Average Monthly Return (%) 95% Confidence Band (%) 0.66 +0.32 SMB +0.19 HML 0.39 +0.21 PR1YR 0.71 +0.28 MKT-T 0.21 Print Done ch of the answer boxes