Answered step by step

Verified Expert Solution

Question

1 Approved Answer

suppose Mrs. Smith receives a gift of $10,000 from a very successful former student and automatically put it in her checking account if the interest

suppose Mrs. Smith receives a gift of $10,000 from a very successful former student and automatically put it in her checking account if the interest rate never changes how much was she having 10 years?

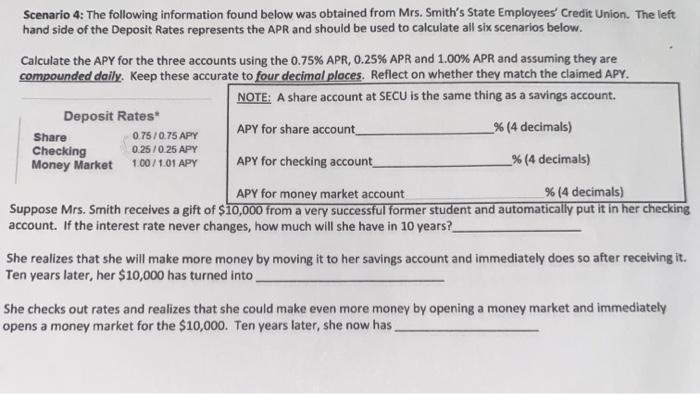

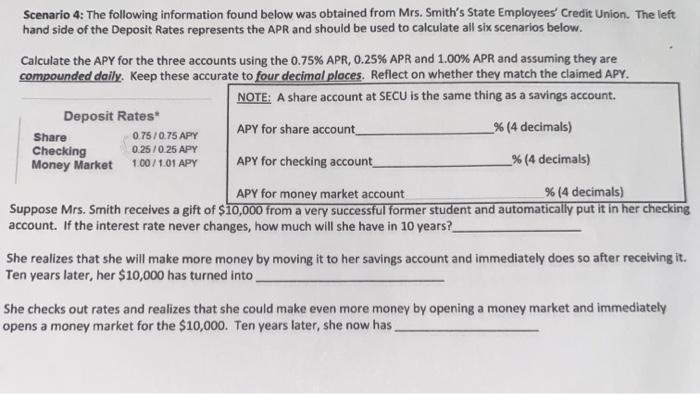

Scenario 4: The following information found below was obtained from Mrs. Smith's State Employees' Credit Union. The left hand side of the Deposit Rates represents the APR and should be used to calculate all six scenarios below. Calculate the APY for the three accounts using the 0.75% APR, 0.25% APR and 1.00% APR and assuming they are compounded daily. Keep these accurate to four decimal places. Reflect on whether they match the claimed APY. NOTE: A share account at SECU is the same thing as a savings account. Deposit Rates 0.75 0.75 APY APY for share account _% (4 decimals) Checking Money Market 100/1.01 APY APY for checking account _ % (4 decimals) APY for money market account % (4 decimals) Suppose Mrs. Smith receives a gift of $10,000 from a very successful former student and automatically put it in her checking account. If the interest rate never changes, how much will she have in 10 years? She realizes that she will make more money by moving it to her savings account and immediately does so after receiving it. Ten years later, her $10,000 has turned into Share 0.25/0.25 APY She checks out rates and realizes that she could make even more money by opening a money market and immediately opens a money market for the $10,000. Ten years later, she now has and she realizes that she will make more money by moving it to her savings account and immediately does so after receiving it.

10 years later for $10,000 has turned into how much?

she checks out rates and realizes she could make even more money by opening a money market and immediately open some money market for the $10,000. 10 years later she now has how much money?

thwre is 3 questions to this one, I even added a picture for the rates

thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started