Answered step by step

Verified Expert Solution

Question

1 Approved Answer

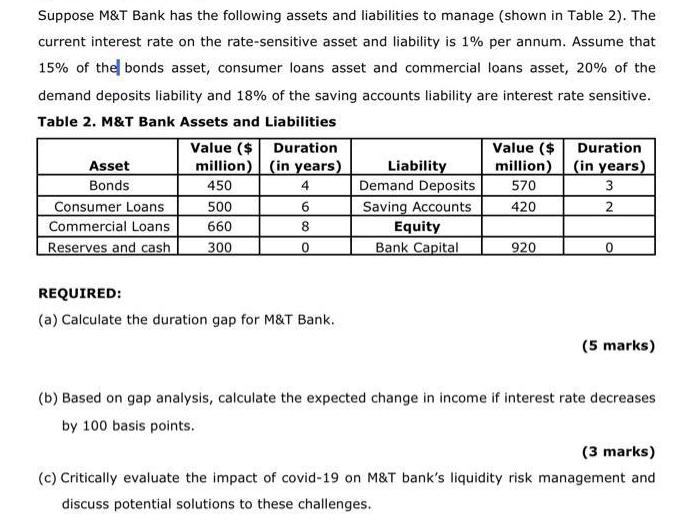

Suppose M&T Bank has the following assets and liabilities to manage (shown in Table 2). The current interest rate on the rate-sensitive asset and

Suppose M&T Bank has the following assets and liabilities to manage (shown in Table 2). The current interest rate on the rate-sensitive asset and liability is 1% per annum. Assume that 15% of the bonds asset, consumer loans asset and commercial loans asset, 20% of the demand deposits liability and 18% of the saving accounts liability are interest rate sensitive. Table 2. M&T Bank Assets and Liabilities Value ($ Asset Bonds million) Duration (in years) 450 4 Liability Demand Deposits Value ($ million) Duration (in years) 570 3 Consumer Loans 500 6 Commercial Loans 660 8 Saving Accounts Equity 420 2 Reserves and cash 300 0 Bank Capital 920 0 REQUIRED: (a) Calculate the duration gap for M&T Bank. (5 marks) (b) Based on gap analysis, calculate the expected change in income if interest rate decreases by 100 basis points. (3 marks) (c) Critically evaluate the impact of covid-19 on M&T bank's liquidity risk management and discuss potential solutions to these challenges.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started